Crude oil price gained some ground on Wednesday morning, with oil traders’ positive sentiments heightened after the world’s largest consumer of oil reported a significant decline in its crude oil inventories, yesterday.

The American Petroleum Institute (API) estimated an 8.322 million-barrel draw for the week ended July 10. The draw was bigger than analysts’ forecasts of a 2.1 million-barrel draw, and reversed the previous week’s 2 million-barrel build.

Brent crude gained about 0.42% to $43.08 at 5.30 am local time. Also, the other international benchmark for oil, the West Texas Intermediate, gained 0.45% to trade at $40.47.

READ ALSO: Nigeria only hit 56% of its target revenue in first five of months of 2020

Amid the worsening COVID-19 situation globally, OPEC+ is expected to further step up oil production cuts beyond the July expiry date.

Stephen Innes, Chief Global Market Strategist at AxiCorp, in a note to Nairametrics, spoke about efforts being made by the Saudis to ensure a smooth OPEC+ meeting scheduled for today. He said:

“However positive for oil prices is that Saudi Arabia is laying the foundations for a relatively smooth OPEC+ meeting on Wednesday with a joint statement released from the Saudi Arabian and Iraqi Energy Ministries, complementing Iraq for progress implementing production cuts.

READ ALSO: Global oil prices drop after reports of unexpected inventory build

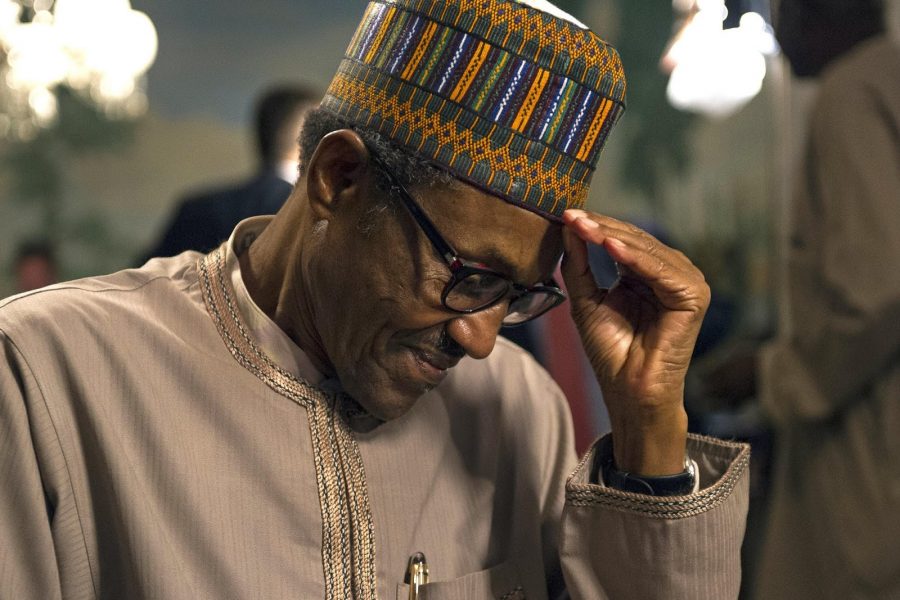

“At the same time, Saudi Arabia’s energy minister has also had a discussion with his Nigerian counterpart, following which Nigeria said it would compensate through September for producing over its agreed quota in May and June.”

READ MORE: What is holding oil price?

OPEC+ is scheduled to meet later today to discuss the future level of production in crude oil. The meeting will decide whether to extend output cuts of 9.7 million barrels per day (bpd) due to end in July, or decrease the cuts to 7.7 million barrels per day.