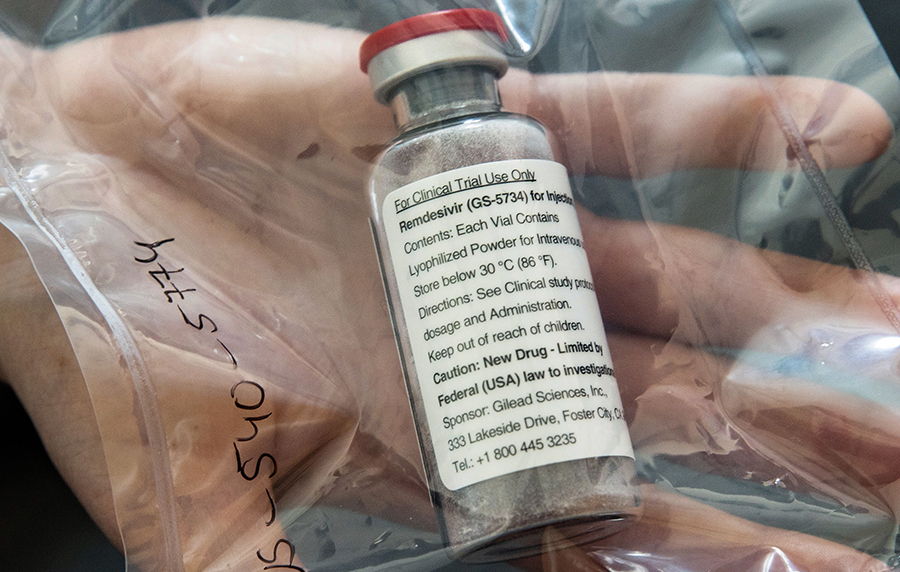

After weeks of debate of how Topline Gilead Sciences would develop pricing that balances social responsibility with its profits, the company has announced the pricing plan for Remdesivir, its coronavirus treatment drug.

According to the plan announced, countries in the developing world will pay much less for the drugs, than their counterparts in the developed world.

Forbes reports that the company said in its Monday statement, that the government of developed countries, including programs like Medicare in the U.S., will pay $2,340 for a typical five-day treatment course, or $390 per vial for six vials.

Though no figure was given, the company stated that developing countries, where the drug has been licensed to generic manufacturers, will pay significantly less.

On the other hand, private insurance companies in the United States will pay a lot more, $3,120 for a five-day course of treatment, or $520 per vial.

According to the company, the pricing plan announced is “well below” the drug’s value and showed responsibility on the part of the company.

“Remdesivir, our investigational treatment, is the first antiviral to have demonstrated patient improvement in clinical trials for COVID-19 and there is no playbook for how to price a new medicine in a pandemic,” Gilead CEO Daniel O’Day wrote in an open letter on Monday.

READ MORE: UK scientists discover cheap drug (just N2.5k) that can combat Covid-19

The company estimates that it will reduce hospital costs by $12,000 per patient, as data shows that COVID-19 patients taking Remdesivir were discharged from the hospital four days earlier than those undergoing a standard treatment plan.

After donating its 1.5 million doses of Remdesivir to the U.S. government to allocate on an as-needed basis through the end of June, the company also announced that it will begin charging for the drug from July 1, 2020.

After making the announcement on Monday, Gilead’s share price jumped up 2.7% to in premarket trading.

The Food and Drug Administration authorized Remdesivir for emergency use in May after the drug showed promising results in early clinical trials, although the FDA has not given official approval to the drug as this normally takes years.