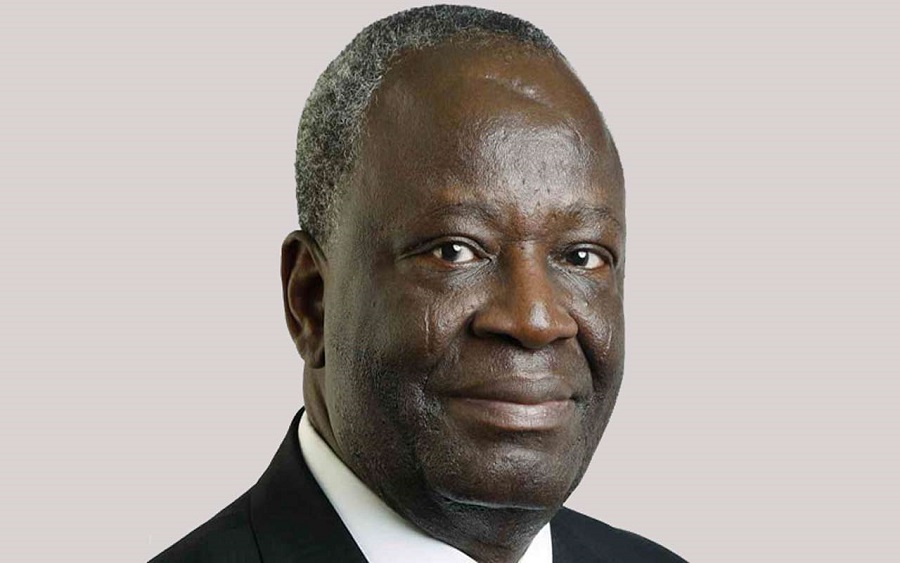

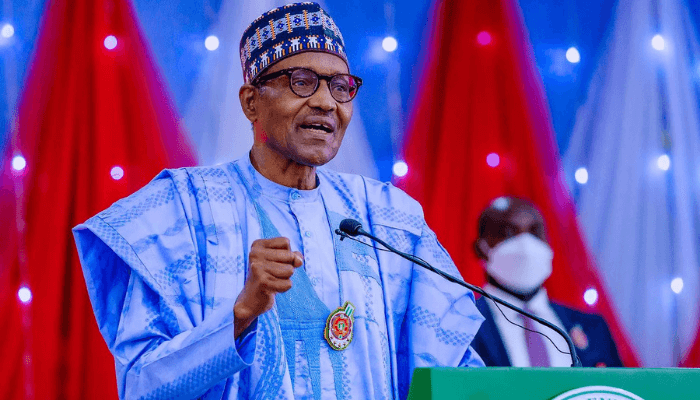

Exactly 25 days after the burial of former Chief of Staff, Mallam Abba Kyari who died of complications from COVID-19, President Muhammadu Buhari has appointed his replacement – Professor Ibrahim Agboola Gambari.

The formal announcement was made Wednesday afternoon during the Federal Executive Council Meeting. This is according to a Personal Assistant to President Muhammadu Buhari, Bashir Ahmad, who announced the development on Twitter.

President @MBuhari has appointed Professor Ibrahim Gambari, as his Chief of Staff, Boss Mustapha, Secretary to the Government of the Federation, announced the appointment today at the virtual Federal Executive Council (FEC) Meeting.

— Bashir Ahmad (@BashirAhmaad) May 13, 2020

While the flurry of encomiums and congratulatory messages continue to pour in, it is expedient to briefly look at Gambari’s pedigree. He has held numerous leadership positions (both national and international) and garnered experiences that validate his competencies. He was appointed Chairman of the United Nations Special Committee Against Apartheid in 1990, a position he held till 1994. He became Ambassador and Permanent Representative of Nigeria to the United Nations in 1990 and served there for 9 years.

Between 1999 and 2005, he served with the United Nations as the first Under-Secretary-General and Special Adviser to the Secretary-General in Africa. At about the same time, he was the Resident Special Representative of the Secretary-General and Head of the United Nations Mission to Angola. He was also the head of the UN Department of Political Affairs between 2005 and 2007. The professor is also a one-time Minister for External Affairs (1984-1985), joining the African Union at the time as a national delegate.

(READ MORE: Abba Kyari’s last letter to President Buhari(Opens in a new browser tab)

He once served as the Joint African Union-United Nations Special Representative for Darfur. He also served as the Special Adviser on the International Compact with Iraq and Other Issues for the Secretary-General of the United Nations.

Ambassador Gambari was also a Research Fellow at the Brookings Institution, Washington, D.C., as well as a Resident Scholar with the Rockefeller Foundation Centre in Bellagio, Italy. He was also a visiting Professor at the School of Advanced International Studies (SAIS) of the Johns Hopkins University, Georgetown University, and Howard University in Washington, D.C. for three years, starting from 1986.

A man of the letters, Gambari has earned and been decorated with several honours and awards, including the third-highest honour in Nigeria, the Commander of the Federal Republic (CFR). He has also received South Africa’s highest national honour, the Order of the Companions of O. R. Tambo, which was conferred on him personally by President Jacob Zuma in October 2012.

(READ MORE: Trump speaks with President Buhari on telephone over COVID-19)

He was awarded a Doctor of Humane Letters (honoris causa) from The University of Bridgeport, Connecticut (2002) and Farleigh Dickinson University, New Jersey (2006). Also in 2002, Professor Gambari was elected to the Johns Hopkins University Society of Scholars. In 2005, he was appointed to serve as a member of the International Advisory Board of the Institute of Peace, Leadership, and Governance at Africa University, Zimbabwe. In 2013, he was appointed pioneer Chancellor of the Kwara State University.

An indigene of Kwara state Nigeria. Gambari bagged his first degree from the London School of Economics, specialising in International Relations. He obtained his Masters and Doctoral degree in Political Science/International Relations from Columbia University, New York, USA.

Thank you for listing Prof Ibrahim Gambari’s educational and political background. However what exactly are his achievements when he occupied these privileged positions. How did he move Nigeria forward and how did he unify Nigeria? He is 75 years for God’s sake! Are there no better read and experienced younger Nigerians? Do you not think that the appointment of this 75 year old is a confirmation of what President Buhari believes and broadcasts about Nigerian youths , that they are good for nothings? Please do us another article detailing the Achievements of Prof Ibrahim Gambari. Brilliance is not about who occupied a position and when they occupied the position: Just take a look at “President” Mohamadu Buhari!

print friendly version would of been nice