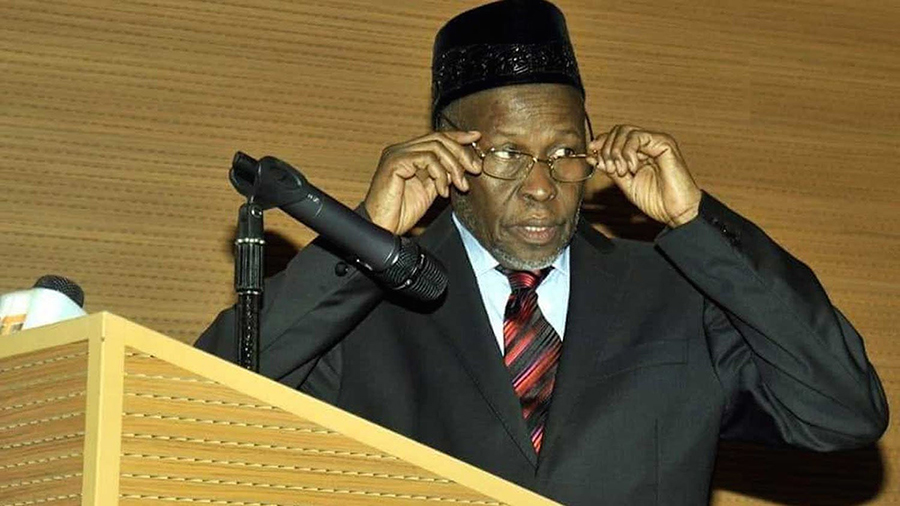

The Chief Justice of Nigeria (CJN), Ibrahim Tanko Muhammad has ordered all courts in the country to suspend judicial activities immediately, in order to prevent the spread of the Coronavirus.

Earlier last Friday, the Chief Justice had issued a circular directing that all staff and court visitors including lawyers, litigants, men of the press and orderlies, undergo screening at the entrance before entering the court premises.

The memo insisted that, “Anyone who refuses to undergo temperature screening at the entrance should be sent back.”

However, developments over the weekend prompted the Chief Justice to issue a new directive on Monday ordering all of the courts to close for at least two weeks, with immediate effect.

[READ MORE: COVID-19: FG to deploy police, army for enforcement)

The circular, however, stated that matters which are time-sensitive would not be affected by this shutdown, but would still be treated.

The directive reads, “Further to my earlier circular Ref. No. NJC/CIR/HOC/II/629 dated 20th March 2020, on the above subject matter. In view of the reality of the COVID-19 in the country and in order to take further preventive steps, all heads of courts are, from tomorrow, the 24th day of March 2020, directed to suspend court sittings for an initial period of two weeks at the first instance, except in matters that are urgent, essential or time bound according to our extant laws.

“Your Lordships are hereby directed to bring the content of this circular to the notice of all stakeholders in justice administration, please.”

The Federal Government had on Thursday ordered an immediate closure of all educational institutions in the country, from primary to tertiary levels, in a bid to reduce the incidence of large gatherings and curb the spread of the Coronavirus disease.

As of Monday evening, the total number of confirmed cases of COVID-19 had risen to 40, with 2 discharged and 1 dead.