Following the release of its UNAUDITED financial report, Stanbic recently published its AUDITED report where we observed no differences in the Consolidated statement of profit or loss and the Consolidated statementfinancial position, suggesting credibility in its financial reporting. A final dividend of N2.o was declared, bringing the total dividend for FY 2019 to N3.0. Based on todayís closing price of N35.7, the final dividend translates to a dividend yield of 5.6%.

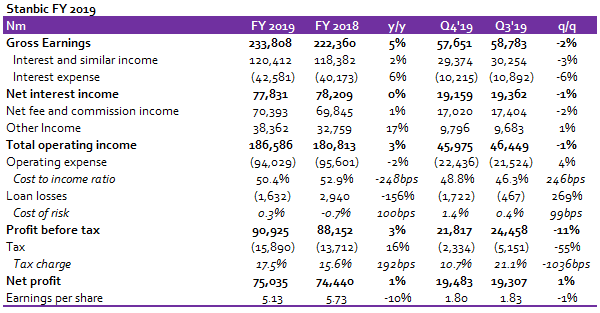

See below the major highlights of its financial performance as we initially published;

Stanbicís Gross Earnings grew 5% y/y growth to N233.8 billion, slightly below our 2019 estimate of N234.2 billion. Profit before tax also increased 3% y/y to N90.9bn, slightly ahead of our FY 2019 estimate of N90.4 billion. On a q/q basis however, Gross Earnings declined marginally, down 2% q/q to N57.7 billion while Profit before tax fell 11% q/q to N21.8 billion. We highlight that the Q4 performance was affected by weakness in Interest Income (down 3% q/q), Net Fee and Commission Income (down 2% q/q) alongside the rise in OPEX (up 4% q/q).

Interest Income grew marginally 2% y/y to N120.4bn in FY 2019 but declined 3% q/q to N29.4 billion. The growth in Interest Income was driven by higher Interest on loans and advances to customers (up 4% y/y), reflecting the growth in the loan book (Net loans to Customers grew 23% y/y in 2019). We highlight that the growth in the bankís loan book is the highest since 2014; 40.6%. Accordingly, we believe the strong growth was on the back of CBNís guideline which mandated banks to maintain an LDR of 65% by December 2019. As of 9M 2019, the bankís Loan to funding ratio stood at 62.9%.

[READ MORE: UBA: Modest growth in FY 2019 profit despite a disappointing Q4 performance)

Interest Expense, however, rose by 6% y/y to N42.3 billion in FY2019 but declined 6% q/q to N10.9 billion. The increase in Interest Expense was driven by increase in other borrowings (new real sector support fund taken from the CBN, disbursement from Development Bank of Nigeria), as well as debt securities issued (Senior unsecured bond of N30bn raised in December 2018). The rise in Interest expense ensured Net Interest Income remain flat, both on a y/y basis and q/q basis.

Non-Interest Income grew 6% y/y to N108.8 billion but declined marginally by 1% q/q to N26.8bn. The y/y growth was driven largely by the increase in Trading Income (up 16% y/y) amidst the flattish growth in Net Fee and Commission Income (up 1% y/y). However, the quarterly decline was due to weaker Net Fee and Commission Income (down 2% q/q) as well as lower Trading Income (down 5% q/q)- we attribute this to lower yields on risk-free instruments during the quarter.

Unlike in 2018 when the bank recorded writebacks of N2.9bn, the bank had Impairment Charge assets of N1.6 billion. However, we are still comfortable with the cost of risk of 0.3% in FY 2019.

Operating income grew modestly, up 3% y/y to N186.6bn but was slightly pressured in Q4 (down 1% y/y)- Again, we suspect this was due to the lower yield environment.

Cost efficiencies, however, remained firm as Operating Expenses declined by 2% y/y but grew sub-inflation in Q4; 4% q/q. The decline in OPEX coupled with a single-digit growth in Operating Income (+3% y/y) led to the 248bps improvement in Cost to Income Ratio (CIR ex provisions) to 50.4%.

READ MORE: Buhari proposes sweeping changes to tax laws in 2019 Finance Bill

Pre-tax Profit grew 3% y/y to N90.9 billion, largely on account of stronger Trading Income and the moderation in OPEX. On a quarterly basis, however, Pre-tax Profit fell 11% q/q to N21.8bn. Profit after tax grew marginally 1% y/y to N75.0 billion, owing to higher effective tax rate of 17.5% compared to 15.6% in FY 2018. RoAE stood at 27.3% in FY 2019 compared to 34.5% in FY 2018.

We have a target price of N55.01/s for Stanbic (current price: N35.7) with a BUY recommendation.

_______________________________________________________________________

CSL STOCKBROKERS LIMITED CSL Stockbrokers,

Member of the Nigerian Stock Exchange,

First City Plaza, 44 Marina,

PO Box 9117,

Lagos State,

NIGERIA.