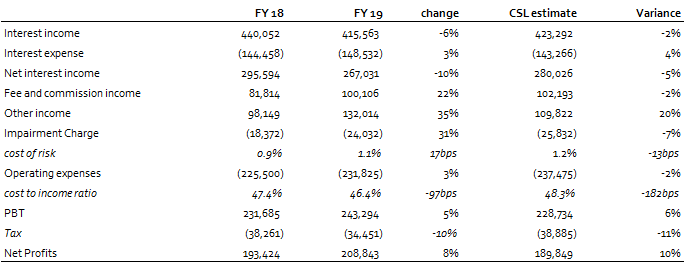

Zenith Bank recently released its FY 2019 AUDITED report wherein Interest Income declined 6% y/y to N415.6 billion, owing largely to lower Interest earned on Loans and advances to Customers (down 15% y/y) and Treasury bills (down 19% y/y)- we attribute the decline in both line items to the lower yield environment in 2019 compared to the prior year. Despite the weakness in Interest Income, the strong growth in Non-Interest Income (up 29% y/y) ensured Pre-tax profit grew 5% y/y to N243.3 billion in FY 2019.

We observed that like most tier-two banks under our coverage who have published their UNAUDITED numbers, the bank recorded strong double-digit growth in its loan book-Net Loans to customers grew 26% y/y in FY 2019. We believe this was driven by the regulatory guideline from the CBN mandating banks to maintain a Loan to Deposit ratio (LDR) of 65% by December 2019 (an upward revision from the initial threshold of 60% to be met by September 2019).

Interest Expense, however, grew 3% y/y despite a 5% y/y growth in Interest Bearing Liabilities. Overall, Net Interest Income declined 10% y/y to N267.0 billion in FY 2019 compared to N295.6 billion in FY 2018.

Net Fee and Commission Income grew 22% y/y to N100.1 billion, on the back of the 1.08x increase in Fees on electronic products, growth in Credit-related fees (13% y/y) and Account maintenance fees (up 9% y/y).

The bank reported Trading gains of N117.8 billion in FY 2019 compared to N80.2 billion in FY 2018-this was driven by the significant increase in T-bills trading income (up 21% y/y to N114.3 billion), further supported by lower Derivative loss (N7.4bn in FY 2019 compared to N16.8 billion in FY 2018).

[READ MORE: UACN grows revenue by 10% to N83.9 billion)

Other Income (Dividend income from equity investments, Gain on disposal of property and equipment, Foreign currency revaluation gain) however declined 21% y/y owing largely to lower FX revaluation gain (N11.5bn in FY 2019 vs N15.3bn in FY 2018).

Impairment charge was up 31% y/y to N24.0 billion in FY 2019- we believe this was driven by the significant growth in the bank’s loan book particularly in Q3 and Q4 following the apex bank’s regulatory guideline on LDR. The bank’s Cost of Risk (COR) came in at 1.1%, higher than 0.9% in FY 2018 albeit in line with our estimate of 1.2%.

The bank was able to keep a lid on Operating Expenses, reporting a sub-inflationary growth of 3% y/y. This positive, coupled with a marginal increase in Operating Income (up 5% y/y) led to a 97bps moderation in Cost to Income Ratio (ex-provisions) to 46.4% in FY 2019 which is also below our FY 2019e of 48.3%. We applaud the bank’s efforts in containing costs despite the presence of cost pressures in the operating environment.

Overall, PBT grew 5% y/y to N243.3 billion in FY 2019. A lower effective tax rate of 14% in FY 2019 compared to 17% in FY 2018 supported the higher growth in Net profit (up 8% y/y to N208.8 billion in FY 2019). The bankís Return on Average Equity (ROAE) stood at 23.8% same as in FY 2018.

In line with historical precedence, the bank declared a final dividend of N2.50 (same as in the prior year), bringing the total dividend for FY 2019 to N2.8o. Based on the last closing price of N19.4/s on 20 February, the final dividend translates to a dividend yield of 12.9%.

We have a Buy rating on Zenith Bank as Valuations remain compelling.

_______________________________________________________________________

CSL STOCKBROKERS LIMITED CSL Stockbrokers,

Member of the Nigerian Stock Exchange,

First City Plaza, 44 Marina,

PO Box 9117,

Lagos State,

NIGERIA.