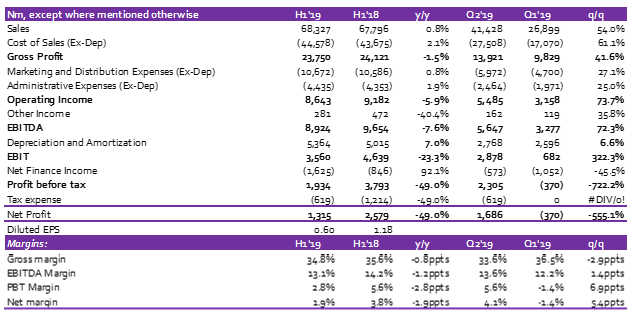

On Thursday, Guinness Nigeria Plc released its H1 2020 financial report announcing 0.8% y/y increase in Revenue to N68.3bn in H1 2020 from N67.8bn in H1 2019. On a q/q basis, Revenue grew significantly, up 54.0% q/q due to increased activities associated with the festive period.

Reported H1 2020 Revenue was ahead of our H1 2020 estimate of N63.5bn by 7.5%. We believe the company’s Revenue growth was driven by supportive volumes as well as the impact of the price increase in November.

Cost of Sales (adjusted for depreciation) grew faster than Revenue in H1 2020, up 2.1% y/y to N44.6bn from N43.7bn in H1 2019 on the back of stronger volumes in Q2 2020 which resulted in a 61.1% increase in Cost of Sales in Q2 2020. We have always expressed concerns on cost pressures for Guinness and this seems to be unabating despite the increase in price to distributors. As a result, Gross margins edged lower by 0.8ppt y/y to 34.8% in H1 2020 while Gross Profit declined 1.5% y/y to N23.8bn in H1 2020 from N24.1bn in H1 2019.

Operating Expenses (adjusted for depreciation) grew marginally in H1 2020, up 1.1% y/y to N15.1bn from N14.9bn in H1 2019. The growth in Opex was driven by higher Marketing & Distribution Expenses adjusted for depreciation (+0.8% y/y to N10.7bn) and Administrative Expenses adjusted for depreciation (+1.9% y/y to N4.4bn).

Decline in Gross Profit and Opex pressures pushed EBITDA lower by 7.6% y/y to N8.9bn in H1 2020 from N9.7bn in H1 2019. Depreciation & Amortisation grew 7.0% placing further pressure on operating performance as EBIT declined 23.3% y/y to N3.6bn in H1 2020 from N4.6bn in H1 2019.

[READ MORE: Stanbic FY 2019: Modest earnings despite frail Q4 performance)

Net Finance Expense was up 92.1% y/y to N1.6bn in H1 2020 from N0.8bn in H1 2019 driven by Lower Finance Income (down 58.3% y/y) as well as higher Finance Cost (up 24.1% y/y). The increase in Finance cost was on the back of higher short-term loans (up 87.0% YTD). Against the backdrop of a weak Operating performance, Guinness reported a 49.0% decline in Net Income to N1.3bn for H1 2020 from N2.6bn in H1 2019, bring Earnings Per Share to N0.60, down from N1.18/s in H1 2019.

_______________________________________________________________________

CSL STOCKBROKERS LIMITED CSL Stockbrokers,

Member of the Nigerian Stock Exchange,

First City Plaza, 44 Marina,

PO Box 9117,

Lagos State,

NIGERIA.