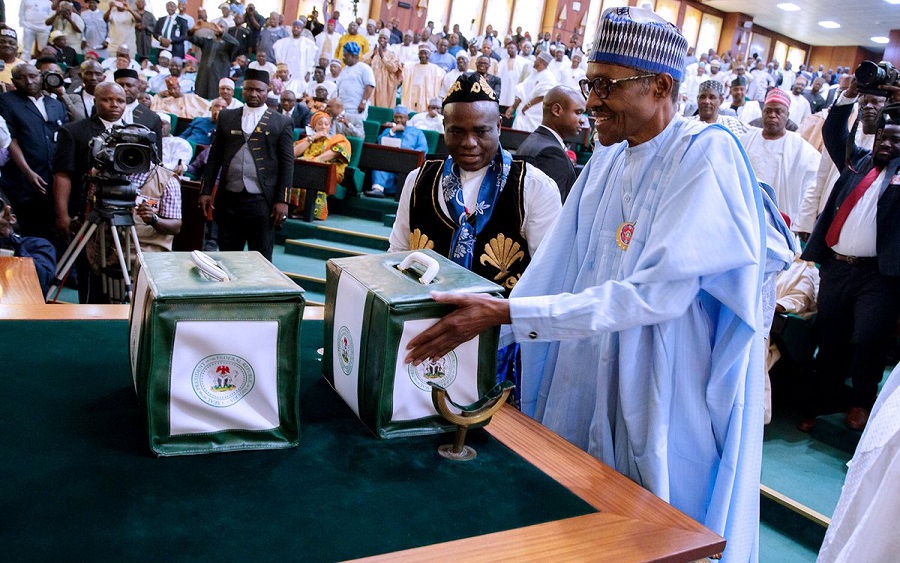

In what can be regarded as a move that may put an end to Nigeria’s budget cycle conundrum, the Senate and the House of Representatives in a joint session passed the 2020 Appropriation Bill that was presented by the President on 8 October. The passage followed the consideration and unanimous adoption of the reports on the bill by the Senate and House Committees on Appropriation.

Notably, the National Assembly raised the total estimates from the proposed N10.33 trillion presented by the President to N10.6 trillion. Interestingly, the National Assembly also put a clause in the bill that it runs from January 1, 2020, raising hopes that the nation’s budget can be restored back to a January-December budget cycle.

Historically, the nation’s budget has never fit into the fabled January – December fiscal year referred to as an organic budget calendar. Since 2014, the gap between the presentation and the final assent to the budget averaged five months. The impact of this trend has been that funds meant to be released for key capital projects are usually rolled over into subsequent fiscal years.

In the case of the 2019 budget, the conduct of the general elections and the supposed power tussle between the Executive and the Legislature delayed the passage and by extension the implementation of the budget. Asides availability of finance, we believe the time lag between the presentation and assent to the budget contributed to the sub-optimal 22% budget performance as at November (based on N650 billion released for capital projects thus far in 2019 compared to budgeted sum of N2.93 trillion), according to the Minister of Finance.

[READ MORE: Banking sector NPLs down, loans up]

With the passage of the appropriation bill by the National Assembly, attention will now be directed towards the executive. Thus, the fundamental question is- Will the President give assent to the budget before the end of the year?

________________________________________________________________________

CSL STOCKBROKERS LIMITED CSL Stockbrokers,

Member of the Nigerian Stock Exchange,

First City Plaza, 44 Marina,

PO Box 9117,

Lagos State,

NIGERIA.

Beautiful development