Recently, the Minister of Finance and Budget & National Planning, Mrs Zainab Ahmed disclosed that the sum of N650 billion had been released for capital projects in 2019, adding that the finance ministry plans to release up to N900 billion for capital projects by the end of 2019.

Furthermore, she stated that Ministry of Works & Housing, Ministry of Power and Ministry of Transportation have been the biggest beneficiaries of the funds released this year.

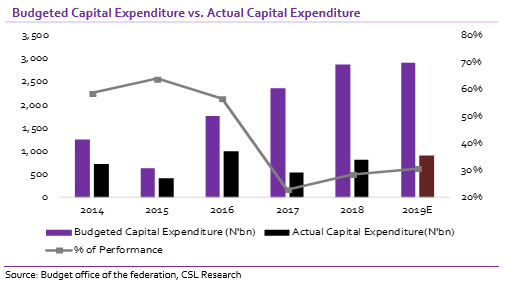

Juxtaposing the capital release announced by the minister with the budgeted sum for 2019 (N2.93 trillion), this translates to a performance ratio of 22% while the projected spending of N900 billion by year-end stands at 31% of budgeted spend.

We also note that if the ministry successfully releases its projected sum, it would represent the highest capital spend in 3 years and 9.7% y/y increase over CAPEX spending in 2018.

Nigeria’s huge infrastructural deficit remains a topical discourse and poses a major hindrance to the growth of businesses and economic prosperity. From poor port infrastructure, dilapidated transport networks, epileptic power supply, huge housing deficit, Nigeria’s infrastructure gap cannot be overemphasized.

[READ MORE: Nigeria’s business environment; Survival of the fittest]

Recently, the Minister of Finance stated Nigeria needs an estimated N36 trillion annually for the next 30 years to solve Nigeria’s infrastructure problem. Clearly, the sum spent by the government annually on capital projects is significantly short of the sum needed to tackle Nigeria’s infrastructure problems.

______________________________________________________________________

CSL STOCKBROKERS LIMITED CSL Stockbrokers,

Member of the Nigerian Stock Exchange,

First City Plaza, 44 Marina,

PO Box 9117,

Lagos State,

NIGERIA.