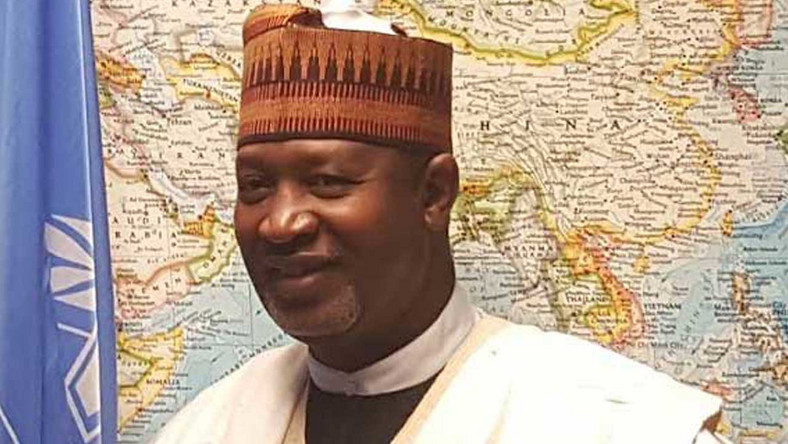

The Minister of Aviation, Hadi Sirika, has reacted to the call of Assets Management Corporation of Nigeria (AMCON) for Arik Air to be made a national carrier, that the airline does not meet the requirements of a national carrier.

Sirika explained that any airline that would operate at that level must be such that would support the national economy, with $450 million GDP for 200million people, and must be very equipped to compete favourably.

He said, “The international airlines that have dominated Africa, 80% of those airlines are non-African. In view of the AU Agenda 2063, the Single African Aviation Market, we thought that there will be an airline that will take up that challenge; that will take advantage of it and be able to provide services to our people.

“Nigeria, being the first country to kick-start the declaration in 1999, to establish a one common market in Africa; at the time, we wanted to take advantage of the Nigeria Airways which was the strongest airline on the continent, and we thought that we could take advantage of that and it would pay Nigeria very well. Tables turned, decisions were reversed and now, Nigeria was unlucky to have an airline that can participate in that manner.”

[Read Also: Elevated direct costs restrain MOBIL earnings growth]

Presently, the minister insisted that such move is not in line with the thinking of the ministry and it would not be able to give the nation the airline it needs.

Meanwhile, Nairametrics had reported that AMCON called on the Federal Government to convert Arik Airline to a national carrier to boost business opportunities in the nation’s aviation sector.

Managing Director, AMCON, Ahmed Kuru, explained in a statement that if his request is considered and approved, it would play a critical role in the development of the nation’s economy.

He said, “I call on the 9th National Assembly to reform the aviation sector, which would help local airline grow and attract many other investors that are eying Nigeria’s huge aviation business opportunity.

“I recalled how respite came the way of Arik Airlines, which was immersed in a heavy financial debt burden that threatened to permanently ground the airline when AMCON took over and restructured the operations of the airline.

“With the right support and investment, Arik has all it takes to become a massive airline given the volume of reformative and transformational work AMCON did upon intervention in 2017. But to do that, the National Assembly owes it a duty to reform the aviation sector by reducing the different layers of charges by different agencies, which makes it extremely difficult for airline to survive in the country.”

According to him, Arik has enough aircraft and facilities that can be used to set up a new airline and if the government wants to set up a national carrier to service just the domestic market, which currently has a lot of gap, it is possible with what Arik currently has.

[Read Also: Quick take: Sustained cost pressure weighs on profit]

“Today if you want to travel to Lagos from Abuja and you did not book your ticket two or three days earlier, the chances are that you may not get a seat, which tells us that there is a serious gap,” he added.