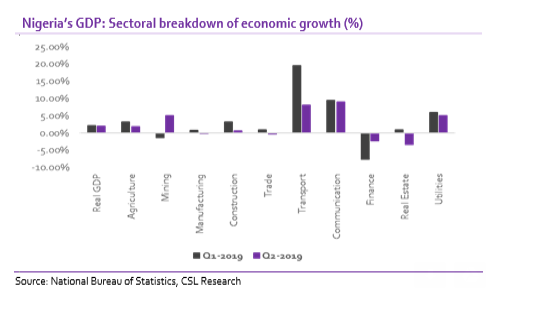

Economic activity in Nigeria’s economy decelerated in the second quarter of the year. Data from the National Bureau of Statistics (NBS) revealed that the country’s GDP slowed to 1.94% y/y from a revised growth rate of 2.10% y/y in Q1 2019. On a half-year basis, real growth in H1 2019 stood at 2.02% y/y, higher than 1.69% for H1 2018.

Despite a daily oil production decline of 10,000bpd between the first two quarters, the oil sector halted its four consecutive quarters of contraction as it posted a growth of 5.15% y/y. However, the non-oil sector remained sluggish, growing by 1.64% y/y in Q2 against 2.47%y/y in Q1.

[READ MORE: NNPC spends estimated N33.60/litre on petrol subsidy]

The non-oil sector continued to be impacted by weak output in the real sectors. Growth in the real sectors (i.e. Agriculture, Mining & Quarrying, Manufacturing and Construction) stagnated at 2% y/y. Growth in the agriculture sector (constitutes 22.8% of GDP) slowed to 1.79% y/y from 3.17% y/y in Q1 2019.

We associate this with more farmers leaving their farmlands as talks about the government’s RUGA settlement scheme prevailed in the quarter. Like the agriculture sector, growth in the construction sector slowed to 0.67% y/y in Q2 2019 from 3.18% y/y in Q1 2019.

The manufacturing sector contracted 0.13% y/y, driven by a yearly contraction in its main sub-sector (oil refining: -23.8%) while oil and gas expansion (+5.15% y/y) buoyed mining & quarrying sector (+5.02% y/y).

Growth in trade contracted 0.25% y/y from an expansion of 0.85% y/y recorded in Q1 2019. Output from the utilities sector (electricity, gas, water & sewerage) slowed to 5% y/y in the review period compared to 6% y/y recorded in Q1 2019, while growth in the transportation and communication sectors also slowed to 8.02% y/y and 9.01% y/y respectively (Q1 2019: 19.50% y/y and 9.48% y/y respectively).

The financial and insurance sector contracted for the fourth consecutive quarter (-2.24% y/y) and the real estate sector -which we perceived to be out of the woods in Q1 2019 with a growth of 0.93% y/y- resumed contraction in Q2 (-3.34% y/y).

[READ ALSO: Nigerian telecoms industry shows improving fundamentals]

We expect oil production cuts to subsist amid depressed oil demand and lower oil price and this will likely further moderate the economy’s expansion trajectory. Although domestic demand will support a modest expansion in manufacturing and services, structural fault lines of over-burdened infrastructure and weak ease of doing business metrics will continue to constrain activities in industry, trade and agriculture in the medium-term, weighing on the non-oil sector.

______________________________________________________________________

CSL STOCKBROKERS LIMITED CSL Stockbrokers,

Member of the Nigerian Stock Exchange,

First City Plaza, 44 Marina,

PO Box 9117,

Lagos State,

NIGERIA.