Few days after the inauguration of the next level cabinet, the newly appointed Minister of Finance and Budget & National Planning, Mrs Zainab Ahmed in a meeting with her team members described Nigeria’s precarious fiscal situation as a revenue problem rather than a debt problem.

The comments made by the finance minister represents a U-turn from the perceived stance of her predecessors who often supported the notion that Nigeria has the capacity to take on more debt. Nevertheless, the minister has been criticized for justifying Nigeria’s endless borrowings on the basis of not facing a debt problem.

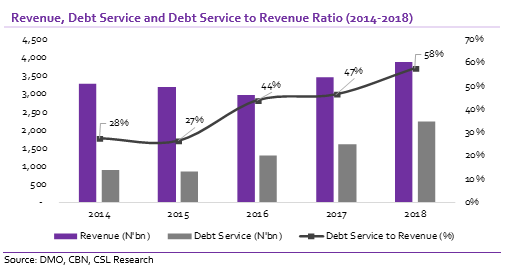

In the past, several debates on the appropriate measure of the nation’s solvency have divided opinions. While the proponents in support of Nigeria’s “healthy debt situation” cite the country’s low and compliant debt to GDP ratio, those against have pointed fingers at a precariously deteriorating debt service to revenue ratio.

In our opinion, we maintain the stand that Nigeria’s solvency is best assessed on debt service to revenue ratio. In light of this, despite our government’s debt to GDP ratio (Nigeria – 27.4%) being lower than our peers (South Africa – 55.7%, Kenya – 56.9%, Morocco – 62.4%, Ghana – 65.9%) as well as in compliance with the IMF/World Bank Debt Sustainability Framework for low income countries (55.0%), we remain concerned about our elevated debt service to revenue ratio of 58% as at 2018.

[READ ALSO: Updated: FG’s VAT charges on online transactions to commence]

Furthermore, while we support the minister’s view that Nigeria faces a revenue problem rather than a debt problem, we disagree that it justifies taking on more debt. While the size of our economy justifies taking additional debt, inability of the fiscal authorities to capture a significant portion of the economy into the tax net will continue to undermine efforts to build revenue base and ultimately keep the nation in a precarious solvency situation. Thus, unless the fiscal authorities can solve Nigeria’s revenue problem, the country must stay off more debt, otherwise, just as the minister said, we may be heading towards a fiscal crisis.

[READ ALSO:Major causes of low capacity utilization at Lagos ports –stakeholders]

CSL STOCKBROKERS LIMITED CSL Stockbrokers

Member of the Nigerian Stock Exchange

First City Plaza, 44 Marina

PO Box 9117

Lagos State

NIGERIA