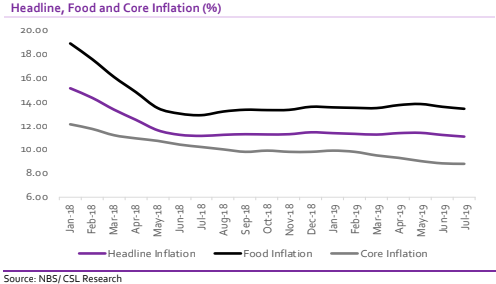

According to the inflation report released by the National Bureau of Statistics (NBS),

headline inflation extended its downtrend to the second consecutive month, as it declined

by 14bps to 11.08% y/y in July (June; 11.22%). July’s inflation is the lowest since January

2016 when the Consumer Price Index (CPI) stood at 9.62%.

Like the headline inflation, core inflation and food inflation both trended southwards in July

with the core inflation falling to its lowest level since Dec 2015 (8.7%) while the food

inflation extended its decline to the second consecutive month. Core inflation fell by 8bps to 8.80% while food inflation declined 17bps to 13.39%. On a month on month basis, there was a synchronized movement in all of the three major indices as headline inflation, core

inflation and food inflation moderated 6bps, 8bps and 11bps respectively to 1.01%, 0.77%

and 1.26% in July.

[READ ALSO:You can buy this listed company for less N100 million ]

In our view, the synchronized deceleration in all of the three indices in the month of July

does not signify the absence of inflationary pressures rather its suggests that the rate of

increase in prices in July was slower compared to June. We attribute the decline in headline

inflation to high base effect and moderation in food inflation, on the back early harvests.

Additionally, we believe the single-digit core inflation has been supported by the relative

stability in the exchange rate, owing to the continued intervention of the CBN across all

segments of the FX market. Decrease in oil prices over lower global demand and rising US

production has supported the downtrend in core inflation as energy and petrol prices have

remained stable.

In the absence of any major adjustments to energy and petrol prices, we envisage further

decline in headline inflation in the coming months as we move closer to the harvest season and this will increase the likelihood for monetary policy easing in the near term.That said,

we think the possible implementation of FX restrictions on food imports remains a major

upside risk to inflationary pressures from food prices.

[READ ALSO:Leaked Memo: Chief of Staff queries Fowler for failing to meet tax budget.]