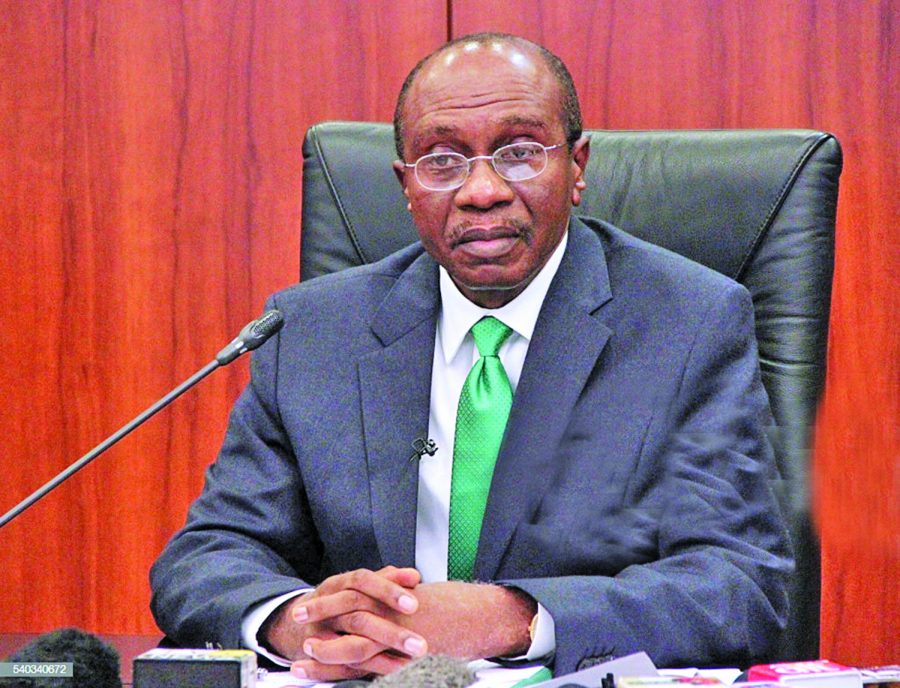

Expectations are high as the Central Bank of Nigeria (CBN) commences its 268th Monetary Policy Committee (MPC) meeting. Note that the MPC meeting is the first to be held since the Central Bank’s Governor, Godwin Emefiele officially began another five-year term in the office.

The recent events (domestic and global) are expected to guide the decisions of the MPC. At its last meeting, the CBN’s highest monetary policy decision-making body (MPC) decided to hold all rates, citing certain headwinds for its decisions.

Highlights of the last meeting: At the last meeting, all the key rates were left unchanged. Basically, the MPR was kept at 13.50%, while other parameters were held as follows:

- the asymmetric corridor of +200/-500 basis points around the MPR was retained;

- CRR was held at 22.5%; and

- the Liquidity Ratio was also kept at 30%.

While explaining the reasons for holding rates, the MPC noted that lowering rates would aggressively restart the capital activities, and stimulate growth. On the other hand, MPC noted there was a need to restrain from loosening in order not to exacerbate inflationary pressures.

[READ: EFG Herms thinks CBN’s directives could be damaging to Nigerian banks]

What MPR, CRR and Liquidity ratios mean: MPR is the interest rate at which CBN lends to commercial banks.

- The MPR is the benchmark against which other lending rates in the economy are pegged and is usually used as an instrument to moderate inflation in the economy.

- CRR simply refers to the ratio of customers’ deposits (i.e. your money in the bank) which banks are expected to hold as cash or keep with the CBN.

- Liquidity ratio refers to the amount of highly liquid assets that banks should hold in order to meet their financial obligations to customers.

Will the CBN alter rates this time? Financial experts have argued that the recent move by the CBN, ordering all banks to maintain a minimum loan-to-deposit ratio of 60% by September 2019, may not be an important factor in the MPC’s decision for now.

Since the apex bank held all rates in the last meeting, most experts expect the same thing to happen, while others project that the CBN will cut rates by 50 points.

- Financial expert and CEO, AfriSwiss Capital Assets Management Limited, Kalu Aja, expects CBN to hold rates.

“Inflation came unexpectedly down last month. CBN has been pushing banks to lend, but still needs to keep MPR high to attract foreign Portfolio Inflow. I project CBN will keep rates. Minor cuts in MPR won’t stimulate lending. The problem is more than interest rates.”

- Similarly, the Chief Economist for Businessday, Nonso Obikili, expects CBN to hold rates.

“I expect CBN to hold rates. There is room to cut, given the action by other global central banks but I don’t think they will cut anyway. The policy of the Central Bank encouraging commercial banks to lend to the real sector is not credible to alter rates. I suspect the CBN will continue to try and use other non-interest rate measures.”

- Also weighing in, financial expert and Founder of Nairametrics, Ugodre Obi-Chukwu, expects a hold of rates and further stresses that the economy needs more than the CBN just encouraging commercial banks to loan to the real sector, but instead a “push” is required.

“Concerning the CBN policy on encouraging commercial banks to loan to the real sector, it’s not encouragement we need, a big push is required. I expect CBN to hold rates.”

- Financial market expert, Onome Ohwovoriole, states that in the event of inflation dropping again in July, the CBN may consider rates cut in its next MPC meeting. He, however, expects a hold.

“If inflation drops in July, the MPC may consider cutting rates. On the CBN policy to encourage lending to the real sector, I don’t think it will influence the decision. They need a few months to see how effective that would be, then decide on cutting in response.”

On the other hand, FSDH expects a rate cut: The Financial Security Deposit Housing (FSDH) anticipates a-50 basis point reduction in the Monetary Policy Rate (MPR), as well as a possible adjustment to the asymmetric rates around the MPR.

According to the FSDH in its policy options report, the development in the global economy also favours an interest rate cut in the short term.

“While considering FSDH Research notes, there are a number of structural challenges in the economy at the moment that can reduce the effectiveness of the monetary policy. There are strong indications that the MPC members may vote to reduce the MPR to 13%.

The market should not be surprised if the MPC also announces a reduction in the rate of the Standing Deposit Facility (SDF) of the banks with the CBN. It is possible that the MPC will maintain the Liquidity Ratio and CRR at the current level.“

Nairametrics Research in the meantime expects the MPC to leave all rates unchanged. While the June inflation report shows a slowdown, we expect the CBN to observe the inflationary pressure to ease off further into the third quarter to consider another rate cut.

[READ FURTHER: CBN issues new circular that could force banks to lend to nearly everyone]