Welcome to Nairametrics‘ summary of the daily performance of major economic indicators and highlights from trading sessions and key statistics such as Treasury Bills and Bonds. This is brought to you by Zedcrest.

This report is dated May 18th, 2019.

***ECB President signals rate cuts with dovish tones, the market looks to US FED meeting on Thursday

Key Indicators

Bonds: Bullish sentiments returned to the FGN Bonds Market, as investors cherry-picked yields across the mid-end of the benchmark bond curve, most notably the 2027 & 2028 maturities. Consequently, yields compressed by c.7bps on the average across the benchmark bond curve.

The DMO released the offer circular for this month’s FGN Bond auction today. Whilst maintaining the overall offer amount, the DMO has shifted its attention to the 10-year bond by increasing the amount on offer to N40bn.

We expect the positive sentiments to remain in the near term, as optimism for rate cuts by global central banks as well as a resolution to global trade tensions support the carry trade environment for foreign portfolio investors.

Treasury Bills: We witnessed sustained demand for short- to mid-dated maturities in the Treasury Bills market during the day’s session, most notably on the December and February maturities. Yields across the Benchmark NTB curve compressed further by c.4bps on the average.

As system liquidity holds at healthy levels, barring any OMO auction, we expect the market to remain bullish in the near term. We see rates at the primary auctions closing lower than the previous auction, a reflection of the low offer amounts as well as current market levels.

Money Market: OBB and OVN rates closed the session lower at 7.21% and 7.71% respectively. Updated financial market figures show system liquidity estimated to close the day at c.N202bn positive.

We expect rates to keep steady in light of reduced funding pressures for market participants, barring an OMO auction by the CBN.

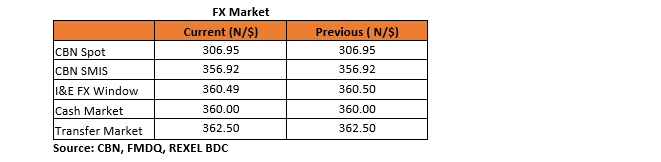

FX Market: At the interbank, the Naira/USD rate remained stable to close at N306.95/$ (spot) and N356.92/$ (SMIS), with no change either at the I&E window which closed at N360.50/$.

The Naira also held steady at the parallel market, as both cash and transfer rates closed unchanged at N360.00/$ and N362.50/$ respectively.

Eurobonds: The NIGERIA Sovereigns saw a late positive run in the trading session following tweets from the US president signaling a possible end to trade tensions with China at the forthcoming G-20 summit. The sovereign papers posted their biggest gains in recent times, adding to advances sparked by expectations for further monetary easing sparked by a dovish tone from European Central Bank President Mario Draghi. Yields compressed by c.18bps on the average across the sovereign curve, with gains across the curve.

Positive sentiments also spread to some of the NIGERIA Corps tickers, as investor demand remained most notably on the ETINL 2024 paper which gained +18bps on the day.

Contact us: Dealing Desk: 01-6311667 Email: research@zedcrestcapital.com

Disclaimer: Whilst proper and reasonable care has been taken in the preparation and accuracy of the facts and figures presented in this report, no responsibility or liability is accepted by Zedcrest Capital or its employees for any error, omission or opinion expressed herein. This report is not an investment advice or a research recommendation and should not be regarded as such. The information provided herein is by no means intended to provide a sufficient basis on which to make an investment decision.