Nigeria’s President Muhammadu Buhari was sworn in for a second term of four years on May 29th, 2019. As Nigerians brace up for what is widely termed “next level” in line with the ruling party’s slogan, the focus will be on the performance of the economy; particularly government finance.

One particular aspect of the government’s finance that will be closely watched is the public debt profile. Nigeria’s public debt had risen considerably under President Buhari’s initial four-year term and could rise further as he continues with his expansionist programmes.

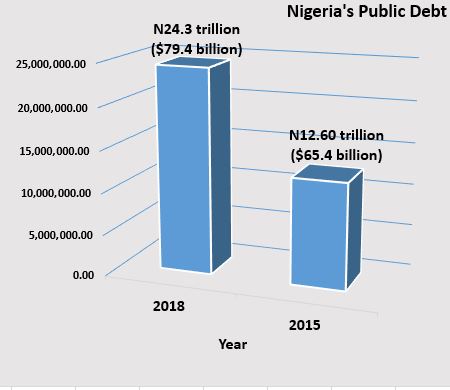

Buhari’s debt profile: As of the last full quarter under former President Goodluck Jonathan, Nigeria had a public debt profile of $65.4 billion and N12.6 trillion for foreign and local debts respectively. By December 2018 (March official numbers not yet published), the Debt Management Office placed Nigeria’s public debt at $79.4 billion and N24.3 trillion for foreign and local debts respectively. This suggests the Government adds about $14 billion and N11 trillion to the foreign and local debt profile annually. During Buhari’s first four-year term alone, Nigeria’s debt profile increased by almost double in naira value (93%).

Interpretation: Under Buhari, Nigeria doubled its local debts which are mostly denominated in naira. Interest rates paid for the debts ranged from 12% to 17% over the last four years in line with the rate of inflation. Local borrowing, though less risky compared to foreign borrowing, is significantly more expensive and take years to pay off.

With the government borrowing more from the economy than the private sector, interest rates for Nigerians and businesses operating in Nigeria have remained high and unsustainable. The effect is that most businesses cannot borrow at such high rates, further depressing economic growth.

More debt: This government is likely to continue borrowing as its revenue profile continues to worsen. The government has for years collected less than 50% of its budgeted revenues (see page 35) while paying as high as 79% of its revenue for debt servicing (foreign and local).

Nigeria is projected to borrow about N1.9 trillion in 2019 via a mixture of foreign and local debts. This will further add to the current debt pile. Going by an average annual net debt increase of $3.5 billion and N2.4 trillion (public and local debt respectively) for this government in the past four years, Nigeria could be saddled with a debt profile of $100 billion and N35 trillion respectively in the next four years. This could surely make the President Baba Gbese (father of debt in Nigeria’s local Yoruba dialect).

Data never lie

I wonder how we reason here in Nigeria….

Why will the debt profile not go up…?

You wanted to embark on developmental activities while you focus on maintaining Stabilised Foreign reserve and still keep all this expensive legislators….? while we remain import dependent Nation with low productive capacity…..!

The president just signed the budget and you could see his frustration at the hands of these legislooters packaging severance package into the budget before they vacate their offices this week or next

Haaa.. That is not how they taught me Developmental Economics….

We are not joking…..!

We should stop blaming Buhari….