Recently, the National Palm Produce association of Nigeria (NPPAN) revealed that importation and illegal smuggling of Palm Oil are biting really hard on producers. NIPPAN specifically disclosed that local producers lose about $500 million annually as a result of the problem.

Report shows that in Q1 2019, Nigeria imported a total of 112,480 metric tonnes of palm oil. Note that Nigeria’s annual consumption of palm oil is estimated at 2.4m metric tonnes annually. However, statistics from the United States Department of Agriculture (USDA) shows that the country currently produces 1.1m metric tonnes.

What this implies, therefore, is that palm oil importers source for products from other countries such as Thailand, Malaysia, and Indonesia in a bid to meet the supply gap.

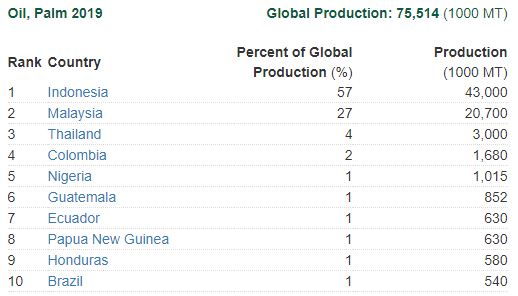

Leading producers: Recent statistics have shown that Indonesia and Malaysia are leading the global Oil palm market. Specifically, Indonesia produces 41.5m metric tonnes, while Malaysia produces 20.5m. This is why Nigerian stakeholders are calling for a revamp of the industry. According to them, the thriving Oil palm sector is fundamental to Nigeria’s diversification agenda.

Nigeria used to be a major producer of palm oil when agriculture was still the mainstay of the economy. However, ever since the discovery of oil, the country’s power oil production has been underwhelming. This is despite the Government’s recent efforts and policies to revamp Oil palm production, a recent report indicates smuggling of Palm produce is biting hard on exporters, as they exporters are now reportedly slashing prices to make sales.

Global trends and Nigeria’s Oilseeds: In 2014, USDA reported that the Production of oilseeds and products is trending upwards in Nigeria, contributing 70 percent to total domestic vegetable oil. However, domestic supply still lags behind the growing demand.

Fast forward to 2019, Nigeria’s oil palm production has not made much progress. Regrettably, the USDA global ranking shows that countries like Indonesia, Malaysia, Thailand, and Colombia are all ahead of Nigeria. Statistically speaking, Indonesia and Malaysia are sole Oil palm producers in the world.

As of today, Malaysia is regarded as one of the powerhouses of palm oil producers. The country earns significant foreign exchange from the commodity. The story has often been recounted about how the Malaysians visited Nigeria and went back with some seed samples of the country’s oil palm. Today, Malaysia is the second highest producer of palm oil, earning significant foreign exchange from the commodity.

Importation despite ban: Oil palm products are one of the 41 items banned/prohibited by the Federal Government of Nigeria as ineligible for foreign exchange. Despite this, smuggling and importation have surged in recent times.

Data from the Malaysian Palm oil Board revealed that Nigeria imported a total o 112,480 tonnes between January and April 2019. Back in March 2019, the CBN Governor, Mr. Godwin Emefiele dsclosed that Nigeria still expends close to $500 million on Oil palm importation annually. He, however, expressed optimism that will soon be a change in the narrative.

“WE INTEND TO SUPPORT IMPROVED PRODUCTION OF PALM OIL TO MEET NOT ONLY THE DOMESTIC NEEDS OF THE MARKET, BUT TO ALSO INCREASE OUR EXPORTS IN ORDER TO IMPROVE OUR FOREX EARNINGS.” -Emefiele

Stakeholders Concern: Stakeholders in the industry are lamenting the influx of banned adulterated Crude Palm Oil (CPO) into the Nigerian market, claiming that it is adversely affecting indigenous companies, with colossal revenue loss to the government. For instance, the Managing Director of Okomu Oil Palm Company Plc, Dr. Graham Hefer, recently stated the following:

” We are very disappointed to observe in the last four months that there’s been lots of adulterated illegal importation of crude palm oil and Ole into Nigerian markets.

“We are now trying to ask Customs to see where the oil landed from or if Customs actually get duties or followed due process.”

Upshots: In recent years, Nigeria’s total import has been rising, standing at N13.16 trillion at the end of 2018. While efforts are being made to downsize imports, a sectoral approach to revamp becomes inevitable. Statistics from the National Bureau of Statistics (NBS) shows that 5 out of 15 top imported items in 2018 are agricultural products, while Oil products constitute over 90% in monetary value.

Although, the government has been meeting stakeholders to draw strategies in reviving the sector, and the CBN Governor recently declared a single digit interest rate loan, stating that the country targets of becoming the third largest producer of palm oil in the world.

To structurally resuscitate the Oil palm industry, the current administration must realise that this will be a huge step in its diversification agenda. The success recorded in the Oil Pam industry has the potential to spill over to other industries in the sector and eventually help in the effort to salvage the country’s oil-trapped economic quagmire.