Daily performance of major economic indicators and highlights from tradings sessions and key statistics such as Treasury Bills, bonds, FX rates, inflation, oil price.

Ecobank Launches New 5-Year Eurobond at 9.75% Re-Offer

***IMF advises Nigeria, others to end fuel subsidy***

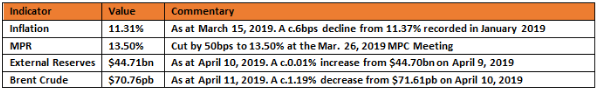

Key Indicators

Bonds

The FGN Bond market was mostly order driven in today’s session, with yields slightly lower by c.6bps following some buying interests on the 25s and 36s. We however witnessed slight selling interests persist on the 27s and 28s.

We expect yields to remain relatively stable, due to renewed buying interests witnessed on some maturities at +14.50% levels.

Treasury Bills

Trading activities in the T-bills market remained relatively muted, with some profitaking on some short and mid tenured maturities pushing yields marginally higher by c.5bps on the day.

We expect yields to maintain a slight uptrend, due to an expected system liquidity squeeze from a Retail FX auction by the CBN tomorrow.

Money Market

Rates in the money market crashed by c.6pct in today’s session, as system liquidity was bolstered by inflows from OMO maturities (N33bn) and Retail FX refunds later in the session.

We expect rates to trend upwards tomorrow, as market players fund for the Retail FX auction by the CBN, which is expected to mop up most of the existing system liquidity balance.

FX Market

At the Interbank, the Naira/USD rate was unchanged at N307.00/$ (spot) and N355.78/$ (SMIS). The NAFEX closing rate in the I&E window appreciated further by 0.05% to N360.14/$, whilst market turnover dipped slightly lower by 39% to $205m. At the parallel market, the cash rate depreciated slightly by 0.03% to N358.80/$, whilst the transfer rate remained unchanged at N364.00/$.

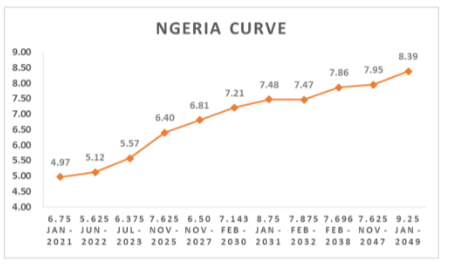

Eurobonds

The NGERIA Sovereigns remained bearish in today’s session, with yields higher by c.7bps following continued selling interests mostly on the longer end of the curve which lost c.1pct on the day.

In the NGERIA Corps, activities were relatively muted with slight selling interests witnessed on some tickers, as focus shifted to the new 9.50% 2024 ECOTRA Issue which cleared at 9.75% with a total sale of $450m from a total book size in excess of $660m. The bond was issued for refinancing of a portion of the bank’s existing debt and for General corporate purposes.

______________________________________________________________________

Contact us:

Dealing Desk: 01-6311667

Email: research@zedcrestcapital.com

Good