Not too long ago, I reported that Nigerian mutual fund asset value plunged. But that looks like history now that the mutual funds seem to have gotten their mojo back with soaring net asset value, as investors continue to dump cash into short term funds.

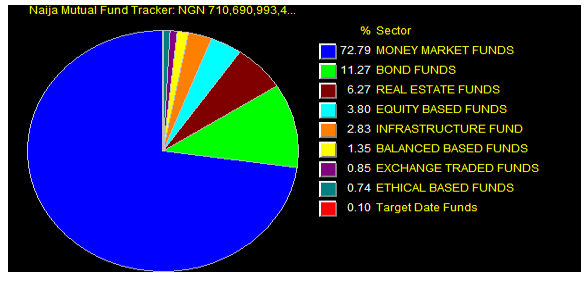

According to information contained in the latest available data from the Security and Exchange Commission, SEC, the total Asset Value of Nigerian mutual funds was about N710 billion as at March 15th, 2019. That represents 9% growth in Asset Value from the 2018 year-end value of N652 billion.

UBA Money Market Fund grew the fastest with 145% growth from N1.17 billion as at December 31, 2018, to N2.9 billion currently. CEAT Fixed Income Fund, which grew by 77% from N208 million to N369 million, recorded the second fastest growth so far this year. This is followed closely by UBA Euro Bond Fund’s 56% in Asset value from N2.5 billion to N3.9 billion.

Categorically speaking, analysts at Quantitative Financial Analytics have determined that the equity fund category grew its asset value by negative 0.89% on the average due to huge withdrawals and poor performance that out-weighed the N2.9 billion new investments that came into the category.

Bond funds recorded average asset value growth of 7.19% due largely to N11 billion inflow since the beginning of the year, while money market funds grew by 11.2% on the average as 4 money market funds recorded negative growth in asset value.

Real estate funds and Balanced/Mixed fund category recorded asset growth of 2.39% and 2.64% respectively. While Exchange traded funds grew by an average of 9.2%, Target Date funds grew by 3.08%. But Infrastructure fund category grew by negative 2.5% as a result of withdrawals.

Investors still hiding out in cash equivalents

On a fund by fund basis, the growth in asset value was mostly felt by the money market category of mutual funds, as investors continue to hide out in cash and cash equivalent investments. It is often said that cash is king. And Nigerian investors seem to be proving that by having most of their mutual fund investments allocated to money market funds.

Asset value of Money Market Funds has ballooned to N517 billion, representing about 72.9% of total mutual fund asset value. Since the beginning of 2019, money market funds had attracted an estimated N65 billion in new investments. It only suffered about N13 billion in withdrawals.

This trend underscores the conservative nature of Nigerian investors who are always wary of stock market volatility while taking advantage of whatever yield they can get from money market funds. The fear of the market has driven fund investors so far that only 3.8% of mutual fund asset is invested in equity-based funds.

The two largest money market funds, Stanbic IBTC Money Market Fund and FBN Money market fund, now account for 55% of total fund assets.

High Yield is the Reason

In keeping with the saying “keep your money where your mouth is”, it is only moral and prudent that wise investors will put their money where yield is highest. And that is in the money market funds, especially in a market where the broad stock index is struggling to stay out of the red.

As I reported recently in an article – Top 10 high yield money market funds, most money market funds are yielding a minimum of 11% on an annualised basis. That high yield, in relation to the performance of the stock market, explains the continued surge in the asset value of money market funds.

Although, investors may be aware that leaving their money in cash or cash equivalents could hurt their performance, the realization that there are not enough good stocks to buy, makes it a no brainer to remain in money market funds.

Trillion Naira Asset Value in Sight

Even though investors have not fallen in love with every type of mutual funds, if the trend of increasing assets (especially at the money market fund category) continues, it will not be long before the country’s mutual fund asset value hits the trillion Naira mark. That time may likely be before December 2019.

Mutual Fund Asset to GDP Still Low

Despite the encouraging growth in mutual fund assets, Nigeria still remains one of the countries with the lowest mutual fund asset to GDP ratio in Africa and the World at large. There is, therefore, an urgent need for investor education, increased awareness, and the creation of an enabling and motivating regulatory environment that will encourage and enthuse investors to embrace mutual fund investments the more.