Daily performance of major economic indicators and highlights from tradings sessions and key statistics such as Treasury Bills, bonds, FX rates, inflation, oil price.

Bond Market Turns Bearish as Selloffs Persist

***DMO to Issue 30-Year Naira Bonds This Quarter *** – Oniha

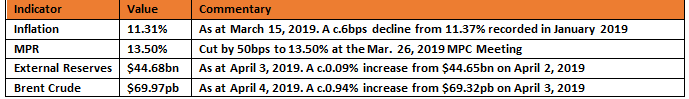

Key Indicators

Bonds

The FGN Bond market turned significantly bearish in today’s session, with yields trending higher by c.23bps on the day and consequently breaking above the 14.50% resistance point to close at an average of 14.68% on the bid. The most selloff remained on the 2028s which traded at a high of 14.65%.

The bearish sentiments could be largely linked to relatively weak demand interests and the news on the issuance of a new 30-year bond this quarter by the DMO.

We expect yields to remain slightly pressured, but with some bargain hunting expected at current levels.

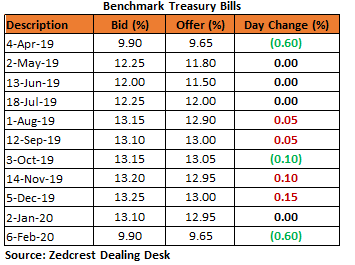

Treasury Bills

The T-bills market traded on a relatively flat note, as the CBN intervened in the market via a further OMO sale (c.N200bn) across the 203 and 364-day tenors offered. Stop rates were maintained at 13.04% on the longer tenor, whilst they compressed by 5bps to 12.95% on the medium tenor.

We expect yields to remain elevated in the secondary market, owing to the relatively tight system liquidity level from the significant OMO sale today and the anticipated retail FX funding for tomorrow.

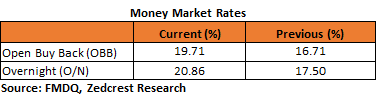

Money Market

Rates in the money market rose higher by c.3pct, as the CBN drained system liquidity via a significant OMO sale today. The OBB and OVN rates consequently ended the session at 19.71% and 20.86% respectively.

We expect rates to remain elevated tomorrow, as banks provide funding for the CBN’s bi-weekly retail FX auction.

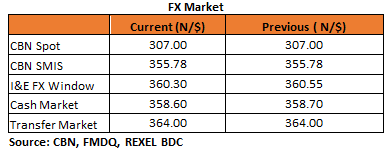

FX Market

At the Interbank, the Naira/USD rate was unchanged at N307.00/$ (spot) and N355.78/$ (SMIS). The NAFEX closing rate in the I&E window however appreciated by 0.07% to N360.30/$, whilst market turnover remained slightly lower at $119m. At the parallel market, the cash rate appreciated by 0.03% to N358.60/$ whilst the transfer rate remained unchanged at N364.00/$.

Eurobonds

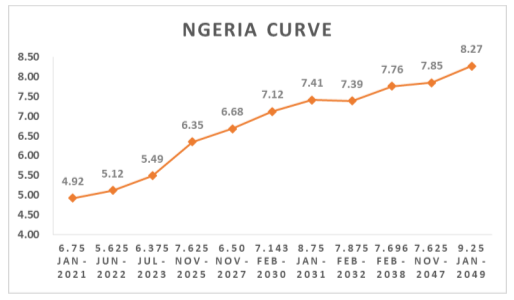

The NGERIA Sovereigns were slightly bearish, with yields marginally higher by c.4bps on the day, on the back of some more profit taking, especially on the long end of the curve.

In the Nigeria Corps, Investors remained slightly bullish on the 2022 maturities.

____________________________________________________________________

Contact us:

Dealing Desk: 01-6311667

Email: research@zedcrestcapital.com