United Bank for Africa Plc saw a rise in funding cost in 2018, which, according to the bank, was due to the tight liquidity situation within the sector. And with yields on interest earning assets remaining relatively flat, Net Interest Margin (NIM) was pressured. The bank reported NIMs of 6.2% in FY 2018 compared to 7.0% in 2017. We estimate NIMs will close 2019e at 6.3%.

UBA reports healthy asset quality ratios with Cost of Risk (COR) of 0.3% reported for FY 2018 and NPL ratio of 6.5%, which is expected to decline to 5.2% post reclassification of its 9Mobile exposure from stage 3 to stage 2. The bank’s capital ratios are comfortably above regulatory limits. CAR of 20% was reported for UBA Nigeria in FY 2018, comfortably about the 16% minimum for systemically important banks. As such, we do not believe the bank will be raising debt or equity in the near to medium term.

Growing contribution from its Pan African subsidiaries (contributed 40% of group earnings in 2018) also gives some versatility to the business and valuations remain compelling (PE 3.5x, PBV 0.54x). Consequently, we maintain our Buy recommendation on the stock with a revised price target of N12.44/s from N12.49/s previously.

Loan growth: UBA’s Net Loans and Advances to customers were up 3.9% and the bank guides to 12% net loan growth in 2019. The group has 37% of its loan book is in foreign currency. The group sees more loan growth opportunities from its other African subsidiaries such as Uganda and Kenya and anticipates they will come from the following sectors; general commerce, retail, oil and gas, and agriculture. Considering the low risk appetite for loans in Nigeria, both from the demand and supply side, we have estimated a 10% net loan growth to customers in 2019.

Deposit growth: Deposits to customers were up 22.5% y/y on the back of a strong drive to build its retail deposit base. The group grew retail deposits by 48% and estimates deposit growth of 18% for 2019e compared to our forecast of 15%. The group’s deposit book is made of c.20 FCY deposits.

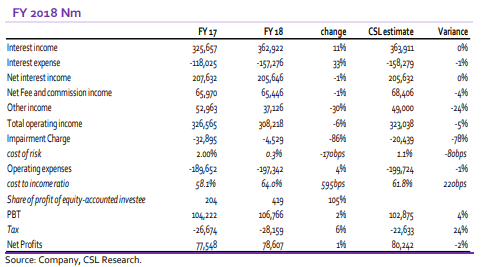

Profitability: UBA’s Interest Income was up 11% y/y mainly on the back on growth in

Interest Income on Treasury Bills. On the flip side, Interest Expense also grew significantly, up 33% y/y. Higher growth in Interest Expense relative to Income resulted in a 1% y/y marginal decline in Net Interest Income, causing NIMs to decline to 6.2% in 2018 from 7.0% in 2017. UBA saw an increase in funding costs in 2018 to 4.2% from 3.7% in 2017. This was attributed to the tight system liquidity.

We have assumed cost of funds will decline by a marginal 10bpbs in 2019e, given that yields are expected to remain relatively attractive despite expectations of a slight

moderation. We forecast a 15% y/y growth in the group’s Net Interest Income and forecast NIMs will close 2019e at 6.3%.

Fee and Commission Income: Net Fee and Commission Income declined marginally. Though Fee and Commission Income was up 13.3% y/y, Fee and Commission expense grew more significantly, mainly on the back of a significant growth in E-banking expense. While income lines like trade transaction income and e-banking income showed significant growth, credit related fees remained pressured. Management noted that credit fees for loans booked late were yet to hit the books and the impact will be seen in 2019. We forecast a 13% growth in Net Fees and Commissions in 2019.

Other Income: Other Income (Net trading/FX Income and Other Operating Income)

was down 30% y/y, mainly due to FX revaluation loss of N31.5bn. The Group CEO noted that the derivate book was at c.US$850m dollars at the end of the year while the Net open position is c.US$200m. We forecast a 7.1% decline in Other Income in 2019.

Update on asset quality: Impairment charge was down 86% y/y to N4.5bn from

N32.9bn in 2017, bringing Cost of Risk (COR) down to 0.3% in FY 2018 compared to

2.0% in 2017 and significantly below our previous forecast of 1.1%. On its 9Mobile

exposure, the Managing Director noted that it is the single largest NPL of the group

and has been resolved. The bank took 35% provision on the exposure and the amount

outstanding is N22bn.

The exposure is expected to be reclassified as a stage 2 loan

from stage 3 previously and this should bring down the group’s NPL ratio from 6.5% reported for 2018 to 5.2%. NPL ratio for Nigeria alone was 4.2% inclusive of the 9Mobile exposure. The group took N48bn in additional Impairment Charge as expected under IFRS 9 and this was passed through equity.

The oil and gas sector accounted for 43% of the group’s NPL ratio. According to the group, this relates mainly to an exposure to a Ghanaian company. Provision coverage on the exposure is c.85% while provision coverage on the group’s NPL inclusive of regulatory risk reserves comes to 79%. We forecast FY 2019 COR of 1.1%.

Capital Adequacy Ratio (CAR): The bank’s capital ratios are comfortably above

regulatory limits. CAR of 20% was reported for UBA Nigeria in FY 2018, comfortably

about the 16% minimum for systemically important banks

Pan African business: The subsidiaries contributed 40% of the group’s earnings in

2018 and the managing director was of the view that the subsidiaries can contribute

about c.50% of group profit.

The bank proposed a final dividend of N0.65/s, bringing total dividend to N0.85/s and

implying a dividend yield of 11.0% based on yesterday’s closing price of N7.70/s.

Overall, Pre and Post tax profits grew marginally by 2% and 1% y/y respectively. The

bank’s Return on Average Equity (ROAE) of 15.3% compares with 16% in FY 2017.

Valuation: We retain a Buy recommendation on UBA with a revised price target of

N12.44/s (current price: N7.70/s) from N12.49/s previously. UBA rates well based on

capital adequacy and stable asset quality and valuations remain compelling. Key

inputs to our valuation include risk free rate of 15.0%, long term sustainable ROE of

17.8% and a cost of equity of 21.9%.

CSL STOCKBROKERS LIMITED CSL Stockbrokers,

Member of the Nigerian Stock Exchange,

First City Plaza, 44 Marina,

PO Box 9117,

Lagos State,

NIGERIA.