In a couple of weeks or less, the Debt Management Office of the Federal Government of Nigeria will open for subscription the December 2018 edition of the monthly FGN savings bond issues.

What are FGN Savings Bonds

The FGN Savings Bond is a retail savings product introduced by the Debt Management Office on behalf of the Federal Government to grant access to retail investors and others of all income groups. The issues which come in 2-and 3-Year maturities are aimed to encourage and motivate retail investors who could not afford the initial subscription amounts required for regular FGN bonds to participate in and benefit from investments in the various Federal Government Debt instruments. Unlike conventional FGN bonds where require a minimum subscription of N50 million, the Savings Bonds only require a minimum subscription of N5,000. The Debt management off has been issuing the FGB Savings Bonds since March 2017 and there is every indication that they are gaining in popularity.

Savings Bonds Vs Conventional FGN Bonds

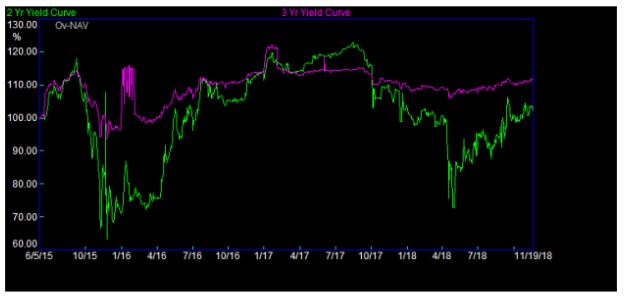

Comparatively, the interest rate or yield on the Savings Bonds are not too different from those of conventional FGN bond. For example, while the November reopened 12.75% FGN APR 2023, 13.53% (5-Yr Re-opening), FGN MAR 2025 (7-Yr Re-opening) and 13.98% FGN FEB 2028 (10-Yr Re-opening) have coupons of 12.75%,13.53% and 13.98% respectively, the November issue of FGN Savings Bonds 2-Year FGN Savings Bond due November 14, 2020: 12.390% and 3-Year FGN Savings Bond due November 14, 2021: 13.390% carry coupons of 12.39% and 13.39%. One could argue correctly that the difference in yield between the conventional FGN bonds and the FGN Savings bonds is due to difference is maturity date. Since bond with longer maturity carry additional risk, the difference in yield is the compensation for the added risk.

Why Invest in FGB Savings Bond

Generally speaking, a portfolio should have a mix of assets to be balanced and diversified. A balanced portfolio should have at least three classes of assets- Equities, Bonds and Cash or cash equivalents. Having bonds in your portfolio helps to reduce risk (mostly from the equity market). While equities are there to give you the bumper harvest in good markets, they also present with heart breaks in bad markets, so as an investor, you need a buffer, a cushion that will cool or reduce the heart breaks when they come, that is what having bonds in your portfolio does. At least, to have a balanced and diversified portfolio is a good reason to buy into the FGN Savings bond, as a retail investor.

Another reason to buy the FGN Savings bond is that you are guaranteed a 12 or 13% return if you hold it to maturity. In the current environment where the stock is yielding negative returns, it is no brainer that buying the savings bonds is a virtue. The allure to buy is even more with the tendency for interest rates to trend up and the Central Bank’s Monetary Policy Committee (MPC) may even raise rates when they meet for the last time this year. Even if they do not, upward trending interest rates, in response to market conditions, imply that buying FGN Savings bonds will not be a mistake.

You Receive more than the Coupon Rate

The good news about the FGN Savings bond and indeed about any bond analysis is that a better judgement about bonds is made not based on the coupon rates only but in addition to a look at the yield to maturity. Yield to maturity is the total return you receive on a bond if you hold the bond to maturity. Almost all Nigerian bond investors, especially the retail ones hold the bonds to maturity and as such, a good measure is the yield to maturity not just the coupon rate. Since the FGN Savings bond pays interest quarterly, the yield to maturity factors in those payments in giving a percentage return calculation.

Analysis by Quantitative Financial Analytics indicates that while FGN Savings Bonds carry coupon rates in the 12s and 13s, their yield to maturity is as high as 15%. See the YTM column below

So, in actual fact, if you hold the FGN savings Bonds to maturity, you are getting about 15% return. That is another reason to include that into your portfolio.

Use Laddering to Boost Your Return

Having seen the beauty of the FGN Savings Bond, it may not just be enough to just buy one of them. If you can afford it, the best is to use a bond investing technique called Laddering. Laddering is an investment strategy where you invest across various bond maturities. The essence of this strategy is that it enables you benefit from increasing interest rates as well as shields you from the effects of decreasing interest rates. As one set of bonds mature, you invest or roll the proceed over to the next available issue

How to build your Ladder

A bond ladder can be as long or as short as you want. Short and long being used here to refer to maturity dates. To build your ladder, let us assume that you have N600,000 to invest. You can invest N50,000 in each rung. You can put N50,000 in of the 12 2-Year maturity FGN Savings bond in the market, if you need as much as that. By next year, as they begin to mature, you invest the proceed from each maturity into the next available and newly issued bond. If interest rate is up when the new issue occurs, you get part of the increased interest rate which helps increase your overall portfolio returns. If unfortunately interest is down when the new issued is offered, you benefit from paying relatively less for the bonds and having your portfolio insulated from the effect of the low rate by the higher rate bond already in your portfolio’s bond ladder.