Daily performance of major economic indicators and highlights from tradings sessions and key statistics such as T-bills, bonds, FX rates, inflation, oil price.

- Crude Oil prices hit 1-year lows, investor sell-offs hit Eurobonds

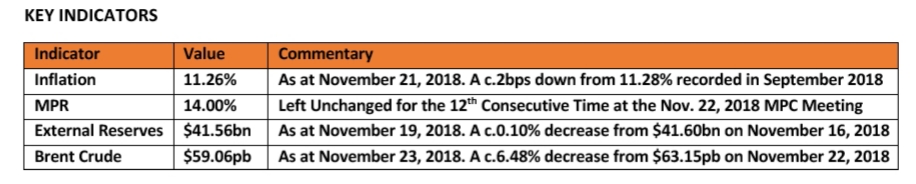

- Brent crosses below national budget benchmark, increases pressure on reserves

KEY INDICATORS

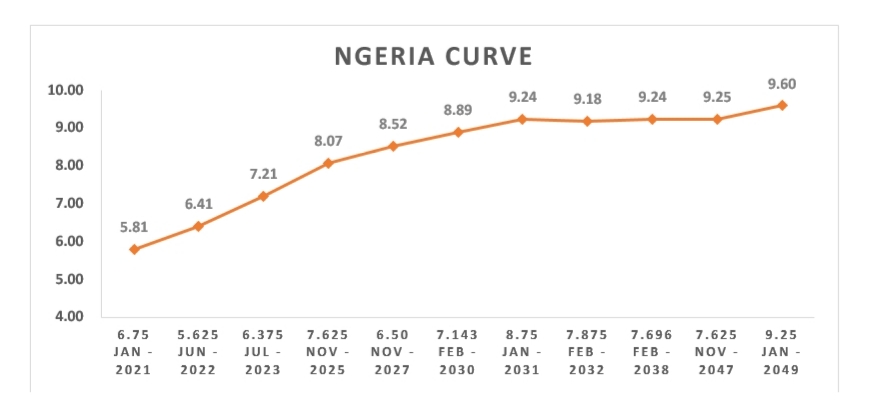

Bonds

The Bond market closed the week on a relatively quiet note, as yields traded flat across the curve. Market participants continue to trade cautiously in the interim as most investors expect yields to trend up as election activities begin to kick in.

In the coming week, our expectations for a weaker market remain in the light of subdued oil prices and general risk off sentiment on FGN bonds.

Treasury Bills

The T-bills market closed the week on a bullish note supported by a very liquid Money Market. Yields across the T-bills curve compressed further by c.2bps to close the week at c.13.43% on the average.

We expect the bullish sentiments to continue into next week with most trading activities skewed towards the short and long end of the curve.

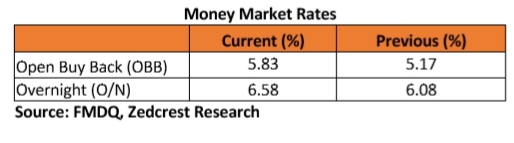

Money Market

The OBB and OVN rates ticked higher today to close at 5.83% and 6.58% as liquidity remained robust despite the expected outflows via CBN FX Retail Intervention and Bond auction debit. System liquidity is estimated to close today at c.N500bn

We expect rates to open the coming week higher as market participants provide funding for FX Wholesale interventions by the CBN.

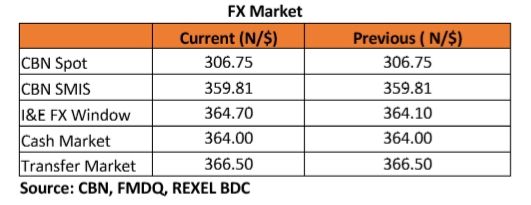

FX Market

At the Interbank, the Naira/USD rate remained unchanged to close at N306.75/$ (spot) and N359.81/$ (SMIS). At the I&E FX window a total of $249.28bn was traded in 354 deals, with rates ranging between N358.00/$ – N365.60/$. The NAFEX closing rate depreciated by c.0.16% to N364.70/$ from N364.10/$ previously.

At the parallel market segment, the cash and transfer rates both remained unchanged to close N364.00/$ and N366.50/$ respectively.

Eurobonds

Bad news for Sub-Saharan Africa’s government debt, especially the NGERIA Sovereigns, as investors sold off oil related sovereign debt notes in reaction to the continuous decline in Oil prices. Oil prices today crossed the $60pb mark, trading at $59.06pb, the lowest level seen since October 2017.

Consequently, Yields on the NGERIA Sovereigns inched up further by c.16bps on the average across the curve. Major losers include NIGERIA 27s losing c.30bps on the day while the 30s & 31s both closed the session c.19bps higher.

NGERIA Corps tickers also showed weakness across most tracked tickers. Yields expanded the most on the DIAMBK 19s, Zenith 19s and 22s papers by c.129bps, c.64bps and c.41bps respectively.

Disclaimer:

Whilst proper and reasonable care has been taken in the preparation and accuracy of the facts and figures presented in this report, no responsibility or liability is accepted by Zedcrest Capital or its employees for any error, omission or opinion expressed herein. This report is not an investment research or a research recommendation and should not be regarded as such. The information provided herein is by no means intended to provide a sufficient basis on which to make an investment decision.

Thanks so much. Quite educative.