Bank Chief Executive Officers (CEOs) in Nigeria have been advised to acquire the necessary knowledge that will help them to effectively address the persistent issue of cybersecurity in the country’s financial sector.

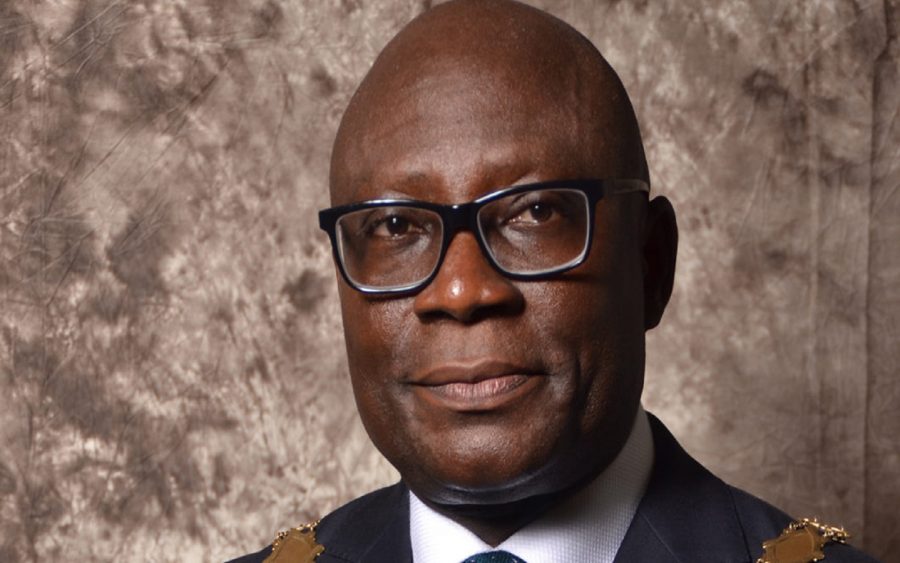

Speaking recently at a roundtable event on the topic: Cyber resilience in organisations, the President of the Chartered Institute of Bankers of Nigeria (CIBN), Dr Uche Olowu, emphasised that the bank CEOs must equip themselves with the necessary cybersecurity concepts as well as leverage their leadership capabilities as they map out workable strategies for managing security risks.

Mr Olowu, however, clarified that this does not mean that the CEOs are mandated to become cybersecurity experts.

“For financial sector institutions, cybersecurity has become an issue from the top down. Board of directors, chief executive officers and senior executives must ensure that they are making the right decisions about cybersecurity for their institutions.

“CEOs need to be able to answer tough questions and prove that they are working with the senior leadership team to develop a cybersecurity strategy, and that they understand the cybersecurity landscape and how it can affect key business functions in the company.” – Olowu

Why this has become imperative

According to the CIBN President, both the shareholders and board members of many companies are now beginning to ask a lot of questions “about companies’ approach to cybersecurity and the readiness to face an attack.” For this reason, it is important that the CEOs equip themselves with some level of cybersecurity knowledge which will enable them to answer such questions when they come.

Cybercrime has become a source of headache

Speaking further, Mr Olowu acknowledged that technological advancements in the financial services sector have made progress possible. But at the same time, it has also exposed financial institutions to “criminal activities such as credit card fraud, phishing, Automated Teller Machine fraud and identity theft have increasingly become infamous in banking operations.”

Mr Olowu also cited statistics showing that Nigeria loses as much as N198 billion every year to cybercrime.

Note that the Central Bank of Nigeria has made several commitments in the past to resolve the problem but all to no avail.