In recent times, Nairametrics has received a whole lot of emails pertaining to Sterling Bank’s I-invest app. Lots of people want to know if it is legit, dependable and can be truly trusted to carry out their treasury bills investments and transactions. After carrying out investigations and trying it out ourselves, we are able to say this.

At this point in the Nigerian money market, there are a lot of possibilities, albeit, business wise. There is little or nothing not to be expected in the Nigerian Market. The Nigerian market and trading as we know is quite volatile. Most times to make it, you have to be at the top of your game. This, Sterling Bank has done by introducing the I-invest app in conjunction with Parthian Partners in April of this year, 2018.

I do not think it is much news anymore about the authenticity of investing in treasury bills to secure and increase one’s funds and investment. In fact, ranging from astute working-class people to retiring people and of course pensioners, they are advised to place their money into Treasury bills investment.

Now, this is where the I-invest mobile App comes in. A huge feat. Most of the mobile banking apps in Nigeria we are familiar with literally deal with funds transfer, airtime top-up, payment of utility bills and a host of related features. Let me also stress that prior to this time, though a lot of financial experts were talking about it and encouraging participation, it was not easy to embark upon investing in treasury bills. You would have to spend hours in the banking hall much to one’s chagrin. Now, with the I-invest app, that difficulty, delay, and uncertainty have been dispensed with. Unless you’re set in your ways which you should not be.

All about I-invest App

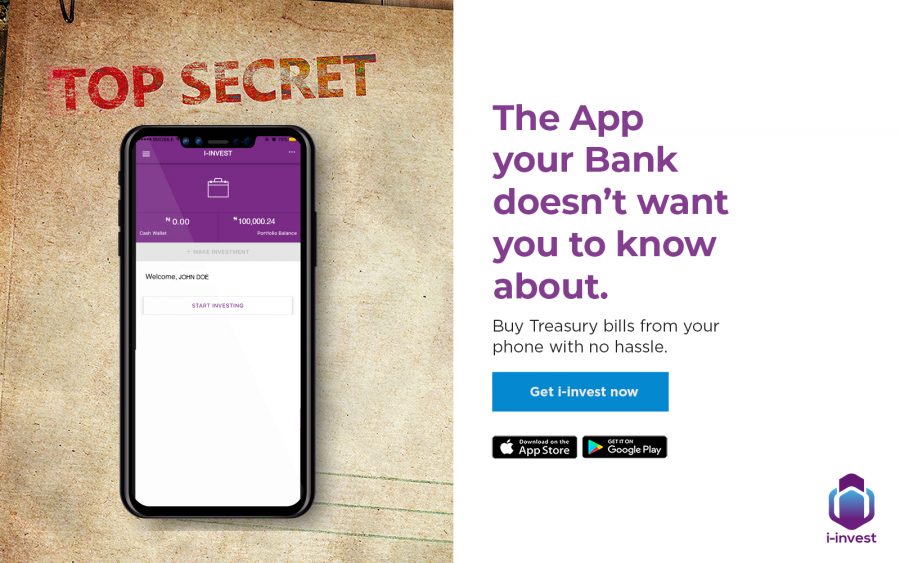

- The I-invest app was launched by Sterling Bank in partnership with Parthian Partners and can be found and downloaded free on Google Play and Apple Store.

- The sole aim for which this app was created was to enhance the participation in investing in Treasury bills and to bridge the gap between the per-conception of this method of investment and potential investors.

- The I-invest app has also brought treasury bills investment to the doorstep of everyone who is interested in it. You do not need banking officials, no documents or forms to fill and no spending of valuable time in the bank anymore. It is as simple as that; when you think investing in Treasury bills, simply think I-invest app.

- For every app, you must be registered to enjoy the features inherent in the app. This is not the case with the I-invest app. I am pleased to inform you that you do not need to register or become an account holder with Sterling Bank to enjoy this app or its service. All you need are your identification card, BVN and a valid phone number and you would be registered.

- It is so easy to use that in a little over five (5) minutes, you are all set up and ready to start investing. All of this is done from the comfort of wherever you are through your mobile phone without stress. It accords you the wherewithal to learn and see what you are doing first hand.

- Your money is secure and if at any time you feel overwhelmed, you have the choice of simply withdrawing your funds.

Risks?

- Basically, there is no venture without risks but with the I-invest app and investment in Treasury bills, you can almost get rid of any apprehension arising therein.

- The I-invest mobile app is secure and is directly regulated by the Nigerian Securities and Exchange Commission (SEC). Furthermore, this forestalls any fraudulent act, the initial BVN details and Bank account details provided during the onset of registration are those that will only be recognised during any transaction that will be undertaken.

- You can also monitor your funds or investments in real time to ensure your money does not get lost.

- What’s more? Normally, it is quite difficult for funds invested in treasury bills to get missing. Getting your funds back is guaranteed and more often than not, your interest rates keep multiplying at every stage.

- It should be noted that during registration, a secret question is provided which acts as a buffer for investors.

- That is not to say that there are mobile thefts and/or loss or malfunction of one’s mobile device. This does not in any way impede or jeopardise the security and functionality of the I-invest app.

Universality

- Gone are the days when the idea of investing in treasury bills meant owning millions in order to invest. With I-invest, just about anyone with a minimum of a hundred thousand Naira (N100,000) can go into the Treasury business.

- Irrespective of one’s knowledge of financial investment, I-invest makes it so easy for a novice to use. The interface is user-friendly and pretty self-explanatory.

The I-invest app is in a league of its own. A pacesetter and more is obviously being expected. The days are still early with people cautiously trusting their mobile phones and apps with millions of Naira. Be that as it may, the creation of I-invest app is welcome development in the world of financial techs and it has definitely made the language and mystery shrouded around treasury bills extinct. The future is here, and we are making the most of it.

I-invest is also hoping to have other investment instruments on the app.

Fantastic information provided on this platform. The I invest App is a nice innovation. More coming with the advent of this.

I decided to try out the app and i’m quite satisfied with the rates offered. The only downside I observed however, is that unlike the treasury bill investment made at the bank, the interest on your investment is not paid upfront. A fraction of the interest is reflected on the invested amount every day until the maturity of the investment. I didn’t like that because, I may have planned to use the interest earned upfront for something else. The app would be perfect for me if that drawback is looked into.

I am interested in it

Regulated by NSE and SEC but without CBN; any explanation?

It’s great information. My question is what is the interest like monthly, quarterly or yearly

I am so much interested

I am very much interesting to know the profit or interest per the minimum amount deposited

What is the profit if i adeniyi temitope invest with 100,000 on i~investment ,,,,,monthly or daily

who has invest and get both his capital and interest,? also without CBN security I don’t thing is 100% served