New Minimum Wage: Labour issues two weeks ultimatum to FG

Bonds

The Bond market remained flat on the day, as market players continued to stay on the sidelines. We witnessed some continued interests on the mid-tenors (26s -28s) at c.15.10% – 15.15%, whilst we saw slight sell on the 2036s up to c.15.49% at the close of trading.

Market players look to be content with bond yields at these levels, but we maintain a short bias in view of the continued weakness in Emerging markets and rising interest rates in the US, with expectations of a 3rd rate hike this year by the US FED at its FOMC meeting to hold on the 25th and 26th of this month, also coinciding with the DMO’s monthly bond auction.

Treasury Bills

Yields in the T-bills space rose further by c.25bps in today’s session, as market players continued to selloff on the short end of the curve in anticipation of higher stop rates at the Primary Market Auction held today.

The DMO held rates on the 91 and 182 day bills, while it raised rates on the 364-day by c.30bps to 13.50% (15.60% eff. yield), in a bid to rollover the total maturities on the tenor.

Another OMO auction is expected by the CBN tomorrow, due to a c.N241bn OMO maturity. We consequently expect yields to remain elevated in the secondary market, with market players expected to maintain high bids at the Auction in view of clearing rates at today’s PMA.

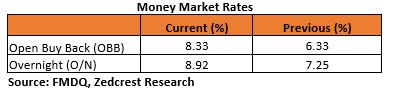

Money Market

The OBB and OVN rates inched higher in today’s session, closing at 8.33% and 8.92% respectively. This came on the back of continued interventions by the CBN to stabilize rates within the I&E FX market.

We expect continued interventions by the CBN to pressure rates higher towards weekend.

FX Market

The Naira/USD rate remained stable at the interbank, closing at N306.25/$. At the I&E FX window, a total of $341.57mn was traded in 340 deals, with rates ranging between N330.00/$ – N364.75/$. The NAFEX closing rate depreciated marginally by c.0.01% to N363.10/$ from N363.07/$ previously.

At the parallel market, the cash rates fell back by 10k to N359.40/$, while transfer rates remained unchanged at N361.50/$.

Eurobonds

The NGERIA Sovereigns remained relatively flat, with yields ticking slightly higher by c.2bps on average, as investors maintained a slightly bearish bias.

The NGERIA Corps were mostly quiet, except for some interests on the ACCESS 21s Sub and slight sell on the FBNNL 21s.