NAICOM introduces a new guideline on the recapitalisation of Insurance sector which will become effective on 1st January 2019 with a stipulated deadline of 14th September 2018 for Insurers to notify NAICOM on their choice of Tier level.

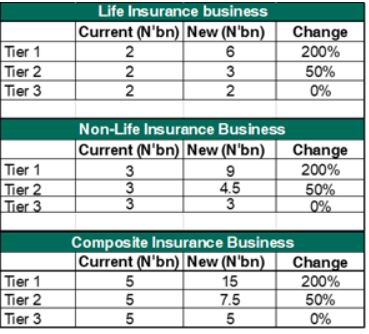

Shift of focus to solvency capital rather than shareholders’ fund: The current minimum required capital for Life Insurance Business is N2billion, Non-Life Insurance Business is N3billion while Composite Insurance business is N5billion with the introduction of Tier Based Minimum Solvency Capital, there is a shift of focus from the shareholders’ Fund to Solvency Capital as the basis for the minimum required capital. Life, Non-Life and Composite Insurance businesses now have different tiers. However, the present review does not extend to Reinsurance Companies, the Minimum Base Capital remains N10billion.

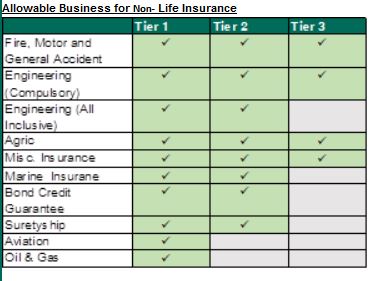

Allowable Business per Tier – a distinguishing factor: The New Tier-Based Minimum Solvency Capital stipulates different kinds of insurance businesses allowable for different Tier, this is to prohibit insurance companies from taking too much risk with their capital and ensure that the capital to support the nature, scale and complexity of the businesses conducted by insurance Companies is sufficient.

Corporate Actions (Right Issue, M&A, IPO, Public Offer) unavoidable for some Insurers: Based on the new solvency capital and introduction of control levels, corporate actions such as Merger & Acquisition (M&A); Right Issues; Initial Public Offer; Public Offer, become unavoidable for some insurance companies.

Composite Insurance Business:

- Based on our coverage, the following insurance companies operate within the composite insurance business: Leadway, AXA Mansard; AIICO; Cornerstone; Great Nigeria; LASACO and Niger Insurance.

- Leadway Assurance can operate within the Tier 1 space as a result of its high Solvency capital and a post implementation solvency margin of 282%. However, despite a high shareholders’ fund of N16.6billion for AXA Mansard which is above the proposed regulatory requirement for Tier 1 Minimum Solvency Capital, the firm can only play within Tier 3 space due to a low Solvency capital of N6.2billion as at 31st December 2017.

- Meanwhile Cornerstone Insurance and Great Nigerian Insurance Plc will have to inject additional capital to enhance its capital base regardless of the Tier they decide to operate. Their Solvency margin as at 31st December 2017 is 104% and 111% respectively.

- AIICO, Lasaco Assurance and Niger Insurance Company fall within the control level of 1, hence no special action is required. However, in order not to lose big transactions in the Oil & Gas, Aviation and Annuity space the company may decide to shore up their capital in order to play in the Tier 1.

Non-Life Insurance Business:

- Regardless of the Tier the following Non-life insurance businesses would have to shore up their capital based due to low solvency margin: Royal Exchange (103%); Equity Assurance Plc (108%); and Guinea Insurance Plc (116%).

- Based our anticipation, NEM Insurance Co.; Wapic Insurance; Custodian Investment Plc; and Zenith General Insurance will play within the Tier 1 space. NEM has to shore up its capital to operate in Tier 1 due to a low solvency margin of 101%.

- Top insurance firms like Law Union & Rock Insurance; Prestige Assurance Company; Linkage Assurance; Sovereign Trust Insurance; Veritas Kapital Assurance; Mutual Benefit Assurance and Regency Alliance Insurance Company might need to play within the Tier 2 space hence losing big transactions in Oil & Gas and Aviation business.

Life Insurance Business:

- ARM Life; United Metropolitan Life Insurance and Mutual Benefit Assurance Plc may have to play within the Tier 2 space. ARM Life has a post implementation solvency margin of 108%, hence would have to shore up its capital base.

With a lot of insurers having low solvency capital or ratio, we anticipate several corporate actions within the insurance space. Corporate Actions ranging from Mergers & Acquisitions (M&A); Rights Issues; Initial Public Offer; Public Offers; Introductions to the Exchange.

Contact Anchoria Asset Management Limited for more information

Email: research@anchoriaam.com

www.anchoriaam.com