Oil price recovery positive for Nigerian Eurobonds

Oil races towards $80 on supply worries

Oil companies in Nigeria resume active exploration – Ministry of Petroleum Resources

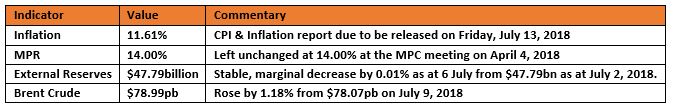

KEY INDICATORS

Bonds

The bullish trend in the Bond market turned, as market players sold off on the securities on the mid- to long-end of the curve. Sell offs witnessed by local market participants were more prominent on the 2028s (medium-term) as well as 2034s & 2036s (long-end), where yields expanded by c.10bps on average. Yields consequently expanded by c.05bps on average.

We expect mixed sentiments amidst both demand/supply support from expectation of lower inflation figures later this week as well as direction from the Q3 FGN Bond auction expected to be released by the DMO any time from now. Market participants are expected to trade the market cautiously over the coming days. We maintain a more bearish stance for bonds.

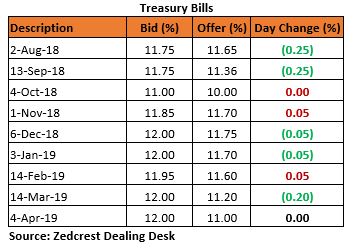

Treasury Bills

Bullish sentiment in the T-bills market slowed down, despite increased liquidity in the interbank money market as yields compressed by c.05bps on the average. Pocket of demand was witnessed on shorter-tenured securities while some market participants took opportunities for some profit taking as well as positioning against a possible OMO auction later in the week on some other maturities.

We expect yields to be relatively flat tomorrow, as expected OMO maturities of 313.56bn as well as current liquidity levels should spur the Central Bank to resume its OMO auction to manage the excess liquidity.

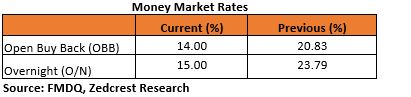

Money Market

System liquidity in the interbank market opened c.N213bn, crashing the OBB and OVN rates significantly lower by c7.81pct to 14.00% and 15.00% as funding pressures on banks were reduced. This is expected to continue with more liquidity expected via OMO maturities of N313bn later this week as the CBN gears up to resume OMO auctions to manage the excess liquidity.

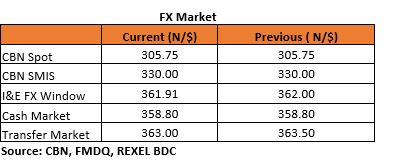

FX Market

The Interbank rate remained flat at N305.75/$. The NAFEX rate however appreciated by 0.02% to N361.91/$. In the parallel market, cash rates remained stable at N358.80/$, while the transfer market rate appreciated further to N363.00/$ from N363.50/$ the previously.

Eurobonds:

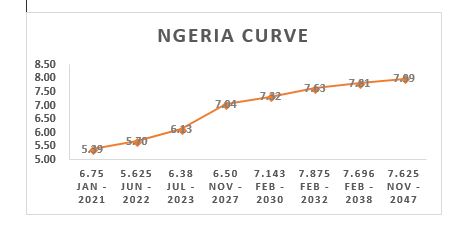

The bullish trend for the NGERIA Sovereigns continued, with yields declining further by c.05bps on average. This is coming on the back of renewed investors’ interests on the NGERIA SOVs which have now recovered by more than 5% from their YTD lows in the month of June.

The NGERIA Corps also witness continued buy interest across most of the traded tickers. We witnessed the most demand on the shorter dated tickers; GTBANK 18s and Access 21s sub, as well as FIDBANK 22s for longer dated securities.