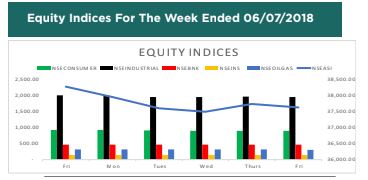

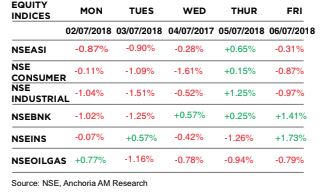

The performance of the Nigerian Equity Market returned bearish last week with the index (NSE ASI) down by 1.71% WTD to close at an index level of 37,625.59 and market capitalization of N13.63 trillion.

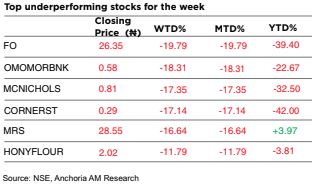

The sectoral performance was negative as bearish sentiments were witnessed in all sectors with the exception of Insurance index that rose by 0.53%. The Consumer Goods sector recorded the highest decline amongst NSE indices with the NSE Consumer Goods index

down by 2.83% WTD, owing to significant price depreciation in HONYFLOUR (-11.79%) and NESTLE (-4.76%).

The market activities were characterised by profit taking on 4 out of 5 trading sessions last week despite the implementation of the new equity market structure which allows market participants to enter imbalance orders to address Imbalance for auction sessions (where

bids exceed offer and vice versa).

In the global space, mixed sentiments were witnessed in equity markets last week as investors ignored the trade war between the United States and China following the release of strong Job statistics, the US Dow Jones was up by 0.76% last week to close at 24,456.48 while the China CSI 300 slipped by 4.15%. The US strong Job data is an indication that the economy remains on its expansionary path.

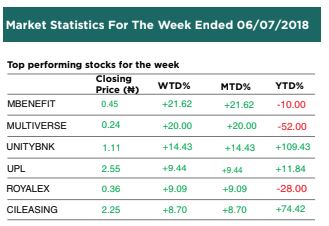

Stock Watch:

Over the last five trading sessions:

ZENITHBNK (Zenith Bank) fell by 2.80% to close at N24.30.

Recommendation: We place a buy rating on this stock.

UBA (United Bank of Africa) fell by 1.43% to close at N10.35.

Recommendation: We maintain a buy rating on this stock.

ACCESS (Access Bank) rose by 0.48% to close at N10.40.

Recommendation: We maintain a buy rating on this stock.

Contact Anchoria Asset Management Limited for more information

Email: research@anchoriaam.com

www.anchoriaam.com