DMO Raises only Half of Total Bonds Offered in yet another Weak Auction

Funding Rates hit 50% as CBN Further Tightens System Liquidity

Bonds

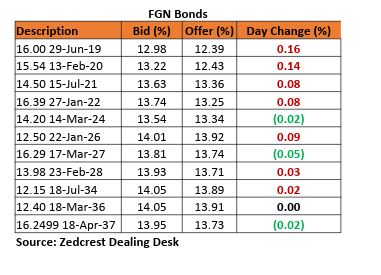

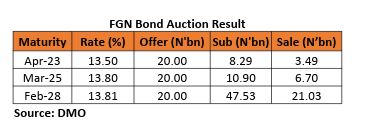

The bond market traded on a relatively flat note, as market players shifted focus to the bond auction by the DMO. We however witnessed slight sell on the 2026s which lifted yields higher by c.5bps on average. Results of the FGN Bond auction as published by the DMO confirmed the relative apathy for bonds which has been witnessed recent sessions. Rates on the 5-yr remained unchanged at 13.50% while the 7– and 10-yr bonds rose by 20 & 16bps above their previous stop rates to 13.80% and 13.81% respectively, with the DMO only able to raise about half of its total bond offering of N60bn. We expect the market to remain slightly bearish, with only slight demand expected from some lost bids on the 2028s.

Treasury Bills

The T-bills market traded on a relatively flat note, as market players remained constrained by the tight liquidity conditions in naira market. Yields consequently stayed flat c.13.00% on average. We expect a slight downtrend in yields tomorrow, as market players anticipate inflows from c.N183bn OMO maturities. This should however be moderated by a likely OMO Auction by the CBN.

Money Market

The OBB and OVN rates rose higher to 48.33% and 52.58%, as system liquidity compressed significantly down to c.N60bn from c.N200bn in the previous session. We expect rates to trend slightly lower tomorrow, with inflows from OMO maturities, expected to moderate funding pressures in the system.

FX Market

The Interbank rate appreciated by 0.02% to N305.75/$ from its previous rate of N305.80/$. The I&E FX rate also appreciated by 0.11% to N360.91/$. In the parallel market, cash and transfer rates remained stable at N360.00/$ and N364.00/$ respectively.

Eurobonds:

The NGERIA Sovereigns traded on a relatively flat note, with yields ticking slightly higher by c.1bp, following slight sell mostly on the 2023s and 2038s. We however witnessed slight buys on the 2047s which gained c.0.15pt.

The NGERIA Corps were mostly bearish, with the most sell off witnessed on the ACCESS 21s, EOTRA 21s and UBANL 22s. We however witnessed some buying interest on the GRTBNL 18s and ZENITH 19s.