Bond Yields Tick Higher Ahead of Auction Tomorrow

W’Bank, Others Raise $1.57bn for TCN to Expand Grid to 20,000MW in 4 Years

Bonds

The bond market traded remained bearish, with yields ticking slightly higher by c.2bps on average. This was following continued selloffs on the medium to long end of the curve ahead of the auction tomorrow. We however witnessed some local client demand on the short end of the curve which slightly moderated the overall market bearishness. We expect the market to be relatively quiet tomorrow, as market players focus on the bond auction which we expect to clear at c.10 – 20bps above the previous stop rate.

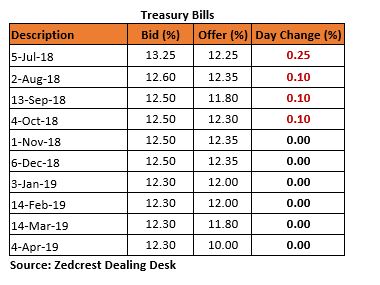

Treasury Bills

The T-bill market traded on a bearish note with some selloff, mostly on the shorter end of the curve (Jul – Nov) which rose by c.30bps on average. This was following a squeeze in system liquidity coming from the OMO and FX sale in the previous session. Yields consequently rose by c.13bps to 13.00% avg. We expect yields to be relatively flat tomorrow as market players await inflows from OMO maturities and possible FAAC payments later in the week to moderate funding pressures in the system.

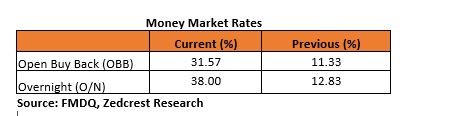

Money Market

The OBB and OVN rates rose significantly higher by c.20pct to 31.57% and 38.00%, with system liquidity (estimated at c.N200bn positive) skewed towards a fewer number of banks. We expect rates to be relatively flat tomorrow, but to trend slightly lower in subsequent sessions, due to expected inflows from FAAC and OMO maturities (Thursday/Friday).

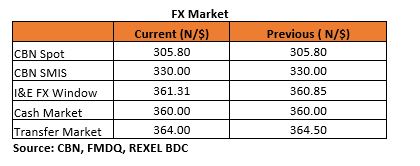

FX Market

The Interbank rate remained stable at its previous rate of N305.80/$. The I&E FX rate depreciated by 0.13% to N361.31/$. In the parallel market, cash rates remained stable at N360.00/$, while the transfer rate appreciated by 50k to N364.00/$.

Eurobonds:

The NGERIA Sovereigns traded on a bearish note with yields ticking higher by c.10bps on average. We witnessed the most selloff on the 27s and 47s which lost –0.75pt and –1.30pt respectively.

The NGERIA Corps were slightly bullish, with gains recorded on most of the traded tickers except for the UBANL 22s and Zenith 19s. We witnessed the most gains on the FBNNL 20s and ECOTRA 21s which rose by +0.70pt and +0.40pt respectively.