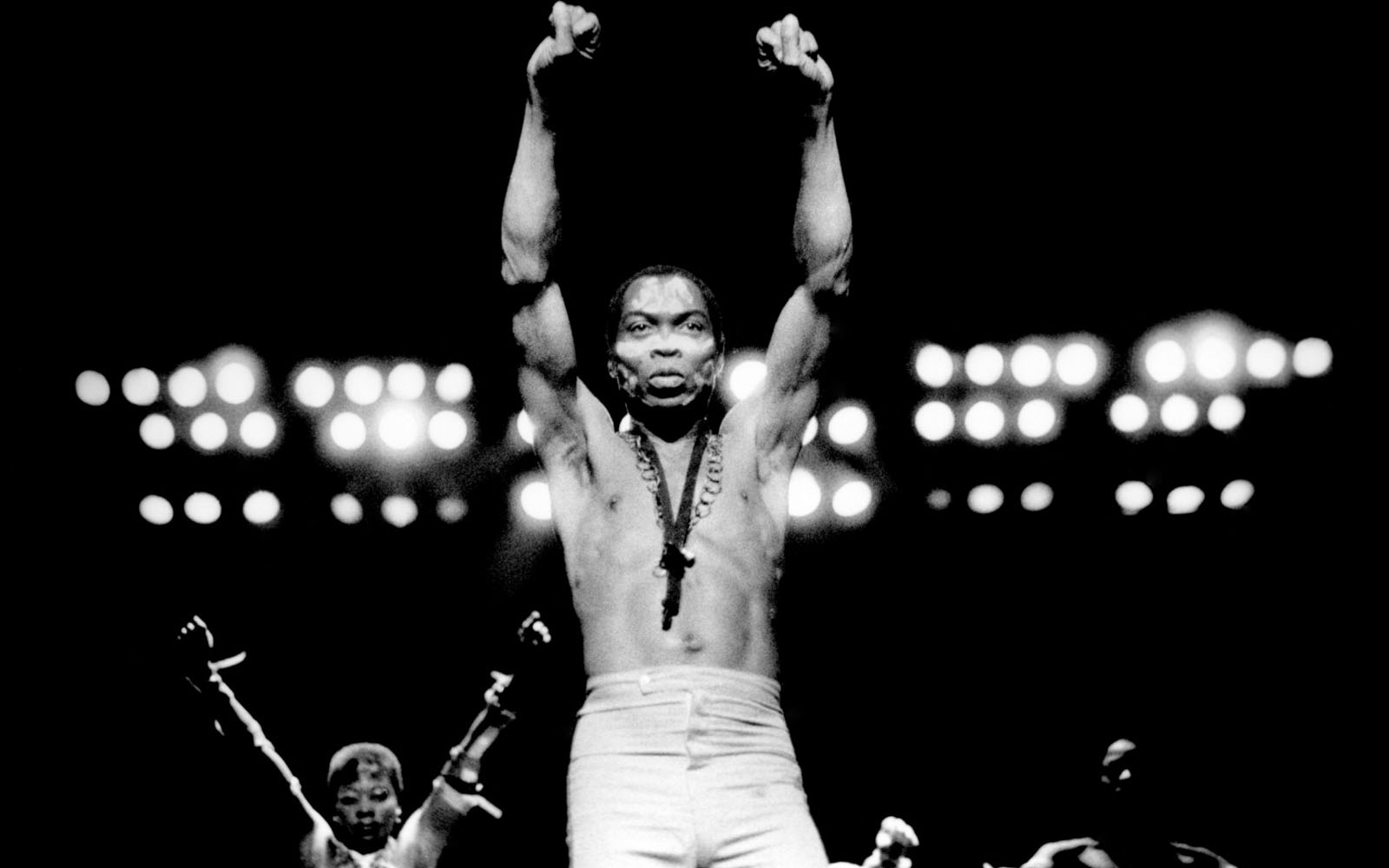

Nigerian Music Legend, Fela Anikulapo Kuti, has a catalogue of legendary hits that will remain with us for generations to come. He always had this uncanny way of using wordplay to expose bad governance and in the same vein, leave everyone awed by the awesome magic that was his music. Talking about magic, Unknown Soldier is one Fela song I really like.

In one of his many memorable word plays in that song, he expresses how magical government can be when they want to get things done. With the government on your side, all things are possible. And when they are not? Well, you just learn to survive till their favour comes your way again.

Recently, Wolfgang Goetsch, the Managing Director of Julius Berger, was in the news boasting of a 45 percent jump in 2018 revenue as the country recovers from a 2016 contraction and as the foreign exchange market stabilises. The company expects revenue to grow to ₦210 billion, to be spurred by government contracts valued at ₦500 billion ($1.4 billion). In his words:

“The government will raise bonds and these bonds will be given to the contractors and we can sell the bonds and generate cash.” – Government magic.

Fundamentals

Julius Berger has had a rough two to three years, especially since President Muhammadu Buhari came into power. Just like everyone else, they have been at the receiving end of the crushing economic recession, seeing margins evaporate within one year.

First was the 43% drop in profits recorded in 2015 compared to 2014. From a profit after tax of N2.43 billion in 2015, the company closed 2016 with a ghastly loss of N2.39 billion. They essentially lost everything that they earned in 2015 in one year.

So what went wrong? Just like magic, Julius Berger’s revenues have been plummeting since 2013. From a revenue of about N212 billion in 2013, the company’s revenue dropped to as low as N133 billion in 2015, before rising to N138 billion in 2016. JBerger’s revenue segment is divided into Civil Works and Building Works. Both segments suffered significant drops.

Another major challenge for the group was the significant N14 billion in foreign exchange loss incurred in 2016. This essentially wiped out profits, stopping the company from paying dividends.

Make JB Great again

With the support and experience of the Chairman of the board, Mutiu Sunmonu, the company announced plans to test the hot waters of the upstream sector. Recently, they also have the financial muscle of Dr Mike Adenuga behind them and can raise significant capital whenever the need arises.

Despite these positives, the key to a reversal of fortune for JBerger is an increase in government contracts and their ability to mitigate against an unlikely crash in exchange rate. They need to win back some of the market share lost to Chinese heavyweight, CCECC. Fortunately, they are doing this already.

Last September, the company announced that it had signed a N120 billion tripartite agreement with the Federal Government and the Nigeria Liquified Natural Gas (NLNG) for the construction of Bonny-Bode Road and for the part-funding of N60 billion by NLNG. Construction of the Lagos-Ibadan Expressway is also back on track so this might unlock some of the cash currently tied in trade receivables (over N120 billon). And in the first quarter of 2018, they declared a profit after tax of about N1.49 billion.

Share Price Valuation

At N26, JBerger is trading at an earnings multiple of 7.35x based on trailing twelve months (TTM) earnings. If you consider the fact that the last four quarters include two quarters of losses, then perhaps the multiple could be in the region of 3x, assuming that it maintains the current profitability trend which we expect. Julius Berger is also not doing badly with other multiples. Price to free cash flow is 1.25 and price to book is 1.22.

In terms of returns, its TTM returns on average equity is around 16% higher than the 5-year average and higher than inflation rate. Also, relative to prior years, its EPS for the most recent quarter vs Qtr. 1 Yr. ago is 441.76%,just as EPS (TTM) vs TTM 1 Yr. ago is 218.85%.

These all point to value and I can spot a cheap stock here. With a little bit of government help or magic, this stock could rise above N40 by the end of the year. Sing along with me:

“Them go turn green into white”

“Them go turn red into blue”

“Water dey go, water dey come”

“Water dey go, water dey come”

“Them go turn electric to candle”

“Them go turn electric to candle”

“Government magic”

“Government magic”

Did you know that as a Nairametrics subscriber you would have had the opportunity to read this article two weeks ago? Yes, and that is because Nairametrics Newsletter subscribers get to read some of our investing related articles before it is published on this site. Maybe it is a coincidence that Jberger share price is up N1.50k since we first sent out this article.

To subscribe, just follow this link.