The Nigerian mutual fund industry added an estimated N40 billion in the month of May to push its AUM above N600 billion for the first time in the history of the industry. May was not particularly a good month for the industry.

Analysis of available data indicates that mutual funds generated an estimated loss of N1.7 billon in the month of May due largely to poor equity market performance during the month. All the Equity and Ethical mutual funds made loses totaling about N1.5 billion. Among the Exchange traded funds, only Stanbic IBTC ETF 40 and Stanbic IBTC ETF 30 ended the month with some gains, the rest saw red.

The story was much different for the Bond funds where 17 of the 23 funds made gains while money market funds held their ground. This is quite understandable given the inverse relationship between bond prices and interest rate.

Since yields started falling, prices of bond funds have been trending upwards. Only 3 of the 10 funds in the Balanced funds category reported gains while the Real Estate category ended in the black. At the end of the day, the greatest gain went to UPDC Real Estate Investment Fund while the fund that lost most is the Stanbic IBTC Dollar Fund.

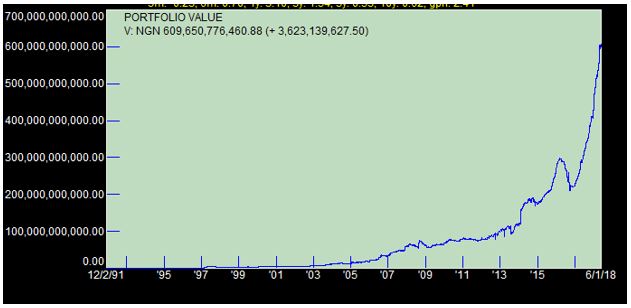

Inspite of the losses, asset under management grew by 6.58% from N571 billion reported on April 30th to N609 billion as at May ending. Within the month under review, mutual funds saw an estimated N46.7 billion in-flow while outflow is estimated to be about N7.3 billion, resulting in a net positive inflow of N39.4 billion, N3.6 billion of which was added in the week ending June 1, 2018. Mutual fund assets under management have been on the increase since September 21, 2016, according to analysis by Quantitative Financial Analytics.

As usual and in line with the risk dispositions of most mutual fund investors in Nigeria, money market funds got a chunk of the inflows. An estimated net inflow of N36 billion went to money market funds while about N3.8 billion went to bonds funds with the rest of the categories suffering net outflows.

This trend underscores the risk profile of Nigerian investors, who for one reason or the other, have fallen in love with safe haven investments like money market and fixed income funds despite their seemingly low yields. These investors are not to blame as many of them are still reeling from the wounds of poor investment returns of the 2008/2009 financial crisis as well as losses made from investments in Ponzi schemes.

The continued growth in mutual fund asset value can be attributed to increasing interest in mutual funds as well as an increase in awareness arising from a rise in availability of information and news about mutual funds. Social media has also helped, as investors can now easily exchange ideas about available investment products and their attendant returns or rates of interest on most discussion forums or chat rooms.

As awareness continues ,with fund managers building confidence among investors by streamlining and making their processes easier, more and more people will buy into more and more mutual funds, and the Assets Under Management will have no where else to go but up.

How safe are Money Market Funds?

No investment is safe in the strictest sense or as relates to the possibility of losing ones principal investment , however, probability of loss differs from investment type to investment type. Money market funds are low risk low return funds.