NASS pass 2018 budget, raise spending to N9.1 trillion, oil benchmark to $51

KEY INDICATORS

| Inflation | 12.48% | Declined by 0.86% in April from 13.34% in March 2018 |

| MPR | 14.00% | Left unchanged at 14.00% at the MPC meeting 0n 4th April 2018 |

| External Reserves | $47.79billion | Decline by0.10% as at 14 May from $47.84bn as at 11th May 2018 |

| Brent Crude | $78.09pb | Fell by0.98% from $78.86pb on 11th May 2018 |

Bonds

The bond market traded on a relatively quiet note, with yields ticking slightly higher by c.1bp due to slight sell on the 2036s and 2027s towards close of trading. We expect some price recovery in the near term, as the yield premium on inflation is relatively attractive especially to the local institutional clients.

This view would be strengthened by a further moderation in T-bill yields, especially if the CBN decides to relax its current liquidity tightening posture.

| FGN Bonds | |||

| Description | Bid (%) | Offer (%) | Day Change (%) |

| 16.00 29-Jun-19 | 11.45 | 11.07 | (0.01) |

| 15.54 13-Feb-20 | 13.18 | 12.61 | (0.04) |

| 14.50 15-Jul-21 | 13.50 | 13.40 | 0.02 |

| 16.39 27-Jan-22 | 13.43 | 13.31 | 0.04 |

| 14.20 14-Mar-24 | 13.34 | 13.18 | 0.01 |

| 12.50 22-Jan-26 | 13.46 | 13.27 | 0.03 |

| 16.29 17-Mar-27 | 13.37 | 13.34 | 0.01 |

| 12.15 18-Jul-34 | 13.30 | 13.28 | (0.03) |

| 12.40 18-Mar-36 | 13.32 | 13.22 | (0.01) |

| 16.25 18-Apr-37 | 13.28 | 13.24 | 0.05 |

Source: Zedcrest Dealing Desk

Treasury Bills

Yields in the T-bills Space moderated further downwards by c.10bps as market players began to price in their OMO auction expectations for tomorrow, with the auction largely expected to clear at +5bps (11.10/12.20) based on prior trends. The PMA auction by the CBN was fairly subscribed, mostly from non-competitive client bids.

The auction stop rates consequently cleared at about 150bps below their secondary market levels. We expect a relatively quiet trading session tomorrow, as market players shift focus to the OMO T-bill auction, which we do not expect to be heavily subscribed due to the liquidity strain in the market.

| Treasury Bills | |||

| Description | Bid (%) | Offer (%) | Day Change (%) |

| 14-Jun-18 | 12.50 | 11.75 | 0.00 |

| 5-Jul-18 | 13.50 | 11.75 | 0.00 |

| 2-Aug-18 | 13.00 | 12.00 | (0.50) |

| 13-Sep-18 | 13.50 | 12.50 | 0.00 |

| 4-Oct-18 | 13.50 | 12.50 | 0.00 |

| 1-Nov-18 | 13.00 | 12.00 | 0.00 |

| 6-Dec-18 | 12.60 | 12.35 | (0.20) |

| 3-Jan-19 | 12.65 | 12.40 | (0.05) |

| 14-Feb-19 | 12.50 | 11.50 | 0.00 |

| 14-Mar-19 | 12.50 | 11.00 | 0.00 |

| 4-Apr-19 | 12.50 | 11.00 | 0.00 |

Source: Zedcrest Dealing Desk

| NTB PMA Result | ||||

| Tenor | Rate (%) | Offer (N’bn) | Sub (N’bn) | Sale (N’bn) |

| 91 days | 10.00 | 3.38 | 3.71 | 3.38 |

| 182 days | 10.50 | 16.92 | 20.90 | 16.92 |

| 364 days | 10.70 | 13.54 | 48.60 | 13.54 |

Source: CBN

Money Market

The OBB and OVN rates rose to 23.33% and 24.67%, as system liquidity still remained tight at c.N63bn negative. We expect rates to decline slightly tomorrow on the back of expected inflows OMO T-bill and net PMA repayments (N296bn). This is however baring a significant OMO T-bill sale by the CBN.

| Money Market Rates | ||

| Current (%) | Previous (%) | |

| Open Buy Back (OBB) | 23.33 | 15.33 |

| Overnight (O/N) | 24.67 | 16.42 |

Source: FMDQ, Zedcrest Research

FX Market

The Interbank rate depreciated by 0.02% to N305.85/$ from its previous rate of N305.80/$. This was just as the CBN’s external reserves posted a 2-day decretion of $72m down to $47.79bn as at 14-May. The NAFEX closing rate appreciated by 0.23% to N360.77/$, while rates in the Unofficial market remained stable at N362.00/ $.

| FX Rates | |||||||||||

| Current (N/$) | Previous ( N/$) | ||||||||||

| CBN Spot | 305.85 | 305.80 | |||||||||

| CBN SMIS | 330.00 | 330.00 | |||||||||

| I&E FX Window | 360.77 | 361.61 | |||||||||

| Parallel Market | 362.00 | 362.00 | |||||||||

Source: CBN, FMDQ, REXEL BDC

Eurobonds:

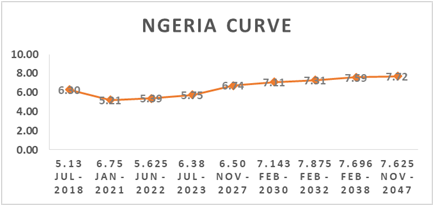

The NGERIA Sovereigns remained slightly bearish with yields inching slightly higher by c.3bps on average. The 27s and 47s were the most traded and lost about –0.15pt on average.

The NGERIA Corps were also bearish across all traded tickers except for the ACCESS 21s Snr which posted a marginal gain of +0.10pt. The Zenith 19s and 22s recorded the highest loses of about -0.15pt.