This Corporate News Compilation for the week ended March 24th, 2018 is brought to you by Bluechip Technology Ltd Nigeria.

1. We begin this week’s roundup with a slew of corporate promos. StarTimes, one of Nigeria’s leading Value Cable TV companies said it is offering its customers “a free upgrade on all of its bouquets for subscribers on the antenna and dish platform from March to April.

The promo basically involves a two weeks free viewing on a higher bouquet when you pay for the immediate next lower bouquet.

For example, subscribers who pay N1,300 for one month on the basic bouquet will get to enjoy all classic bouquet channels free for another 2 weeks and customers who pay one month on the classic and unique bouquets would get an extra week free of charge.”

Star Times is basically using the same concept Netflix uses to woo subscribers. An indirect form of marketing where they hope that by giving subscribers two weeks free viewing for a higher bouquet they are drawn to the value of the content available and they pay for subsequent months.

2. SWIFT4Glte Network, one of Nigeria’s Internet Broadband Companies, also announced a free broadband Wi-Fi service, in Lagos which is named “Red Cheetah.” So, what’s Red Cheetah?

According to the CEO of Swift, Charles Anudu, Red Cheetah is a service that provides free internet for Nigerians in exchange for advertising. Users who access the internet using Red Cheetah will not pay a dime but in exchange, they will be served ads.

In fact, in his words, “this means that to keep browsing free, users are OBLIGED to watch ads during their session.” Anudu also mentioned that it took them over two years to bring this project live and it involves them working with brands.

The project will initially be served in Lagos and in 500 locations that include public spots, BRT buses, and taxis. Plan according to him is to target 10,000 locations in 6 months. They plan to go beyond Lagos and will offer this service in other states and African countries. Is this the future of internet browsing in Nigeria?

The critical path to success for this product will be balancing user experience with display ads. Swift also struggles with the same network patches other ISPs suffer, so they could further alienate customers if this goes wrong. Security is also a major concern but they claim it will be served via a VPN.

In case you are interested in using this service, you are restricted to 1GB per day and will need to download the app on the Android Play Store and register. Windows and iOS versions of the app will be available in the next 3 months. Critics will suggest this was rushed. Should be on all platforms at launch.

3. Ah yes, TStv . Not to be left out, the ever-promising Cable TV company announced that it is slashing the price of its Sassy decoders from N5k to N3.5k. So what’s in this Sassy Decoder?

N2 per day PAYG subscription, over 70 channels, Pause Subscription function and PVR. I guess the most important function required here is the Pause Subscription Function.

If this works as promised then I can with time DStv won’t have a choice but to offer something similar. The future for content is on demand. On Demand content is typically associated with consumer-centric products such as Pause Subscriptions, Automatic Cancellations, Pay Per Views, Binging etc.

4. A Malaysian Financial Technology Company, Belfrics Global Technology launched its operations in Nigeria under an entity named Belfrics Nigeria PVT Limited.

These guys claim to offer a wide range of services including digital currency industry, including a wallet, a trading platform, a payment gateway and others. Last July, the company announced that it will be launching Bitcoin exchanges across Africa, starting with Kenya.

With its Nigerian launch, they will be competing directly with Nairaex. Recall we mentioned a few weeks back that the CBN had warned Nigerians against using Nairaex so it is interesting to see how Belfrics operates freely in Nigeria.

In its press release, I noticed the company avoided the use of Bitcoins and focused a lot on Blockchain technology and how it plans it to solve a myriad of Nigeria’s problems including corruption, health, law, finance, tax management etc.

5. Dun & Bradstreet Nigeria, announced last week that it will launch a procurement portal, Vend-R, which is a centralised vendor registration and pre-qualification system.

According to the company, Vend-R is a portal that will allow all procurement managers in Nigeria to have a centralised registration system. The Director of Business Development, Dun & Bradstreet Nigeria, Mr. Abayomi Olomu explained further that Nigerian businesses that aspired to be vendors to large private and government clients could choose any one or multiple clients to register on the portal.

He also claims that Vend-R is designed for seamless integration to any ERP system that a procurement team works on, including Oracle and SAP.

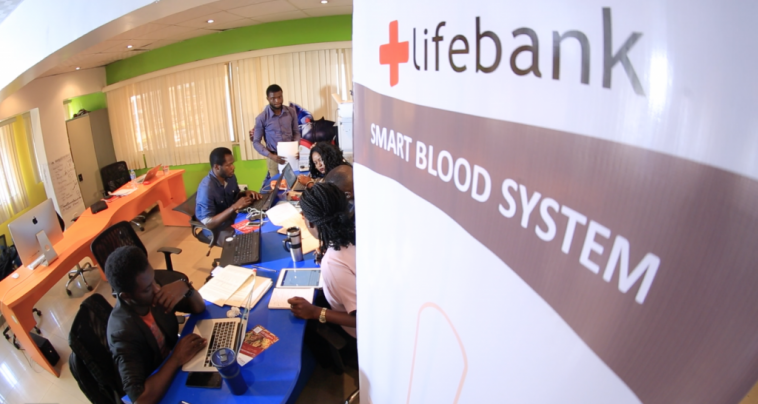

6. LifeBank, a Nigerian Startup in the blood distribution value chain, was one of the 10 startups shortlisted for the 6th round of the Merck Accelerator programme in Germany. Lifebank recently raised $200k in seed funding which it plans to use for its nationwide expansion.

In a recent Nairametrics show on Classic FM, Temie Giwa-Tubosun, the Founder/CEO of Lifebank informed us that they were stepping up their expansion plans across Nigeria and signing up more hospitals on their network. She also told us that beyond blood they were also opening other verticals such as Vaccines, Oxygens etc.

Lifebank will be receiving a €50k support. Lifebank started with a $35k seed funding from CCHUB. This is one company to watch in the next 3 -5 years as what they can do with their model seems limitless.

7. Flutterwave announced last week that it had agreed to collaborate with Flywire to enable payment of school fees and other academic related transactions.

Flywire is one of the leading providers of global payment and receivables solutions for education and healthcare sectors.

According to the press release seen by Nairametrics, Flywire will integrate Flutterwave’s Race payment solution on its platform enabling parents, students, and patients to make payments using local debit cards and bank accounts.

Reports indicate Nigeria has about 15k Nigerians studying in the UK and another 10k in the US, so the partnership gives Flutterwave access to service these Nigerians who find it difficult making payments.

If you imagine that over $1b is spent on Medical tourism annually (according to World Bank, which I don’t really believe), this is a major milestone for Flutterwave as it expands its service offering in an increasingly competitive space.

8. Teleology finally met ithe $50m non-refundable cash deposit to the acquisition of 9Mobile last Thursday.

Payment was made via a Keystone Bank account (of all banks) to a UBA account in favour of United Capital Trustees Ltd. After paying, the laid out a 10 point agenda for 9 mobile, which will be implemented after it pays the balance $500m within 90 days.

Here are some of them (as culled from a Thisday article); Double the 9mobile network with new 3G/4G specific cell sites as well as several thousands of kilometers of fiber optic cable across the country. Special program of rural internet coverage, focusing on 4G with broadband access planned for all of Nigeria’s 774 Local govt areas.

Youth engagement and employment programs are also planned with all build contractors, distributors and consultants, investment in broadband internet access technologies optimised for high speed and high capacity data including imaging, video, games, music, IPTV and more.

An increase of 50 percent in direct employment in the new 9mobile. There is also an active plan to introduce within the first year, several million 4G-capable premium quality smartphones, at exceedingly affordable pricing. We dey wait..

9. A Consumer Goods Company, Sweet Nutrition Ltd last week introduced “Choco Love” a malt drink into the market.

Interesting to note that Sweet Nutrition Ltd was formerly known as Bayswater Industries Ltd and is located in Ogun State. Never heard of them before now.

10. Chairman of Dangote Group, Aliko Dangote was in the news for all the good reasons last week as he hosted world’s richest man, Bill Gates as well as several other dignitaries for his daughter’s wedding ceremony.

However, as part of his tour with Bill Gates he implored private companies to donate 1% of their annual profits to the health sector. It wasn’t clear if he was recommending this in the form of another tax. Nigerian companies currently pay a 2% Education tax to the government yet, our Education system as all but worsened over the years.

Maybe it’s time we ask that the tax be scrapped (wishful thinking). TBH what is the use of Educational Tax? Meanwhile, Dangote Cement spent about N474 million in donations to about 57 organisations in 2016. Thought none of this amount went to Healthcare.

11. Still, on Aliko Dangote , the Mercurial Businessman and Africa’s richest man stands to make over N100 billion in dividends alone from his various companies listed on the Nigerian Stock Exchange.

For example, Dangote Cement Plc, the largest company in the group announced a final dividend of ₦10.50 per share amounting to about ₦152 billion. The company has an issued share capital of 17,040,507,405 shares.

The majority shareholder in the firm is Dangote Industries Limited (DIL) (owned by Aliko) with an 85.06% stake amounting to 14,484,431,294 shares. DIL thus made about ₦152 billion from its holding in Dangote Cement.

12. Not done with Dangote, Dangote Cement’s multi-billion-dollar company announced plans to sell N300 billion in bonds which will be used for its African Expansion.

The bonds will be sold in Naira and will also be used to refinance its debts. The bond will be issued in tranches of N50 billion over a three-year period. The company also said it is planning a Eurobond offering which it wants to use for capital projects, including the building of export facilities at Nigeria’s seaports, which will see it begin shipments of clinker and cement to neighboring West African countries.

Dangote Cement has about N372 billion in external debts out of which about N200 billion are intercompany loans. I was a bit surprised about this considering that Dangote Cement external loans are priced well below market rates. Its expensive debts are the intercompany ones which go for MPR+1% (MPR is 14%).

I guess Dangote is relying on its “triple A” status to attract single-digit rates. The cheapest Corporate Bond per FMDQ data is from @UBAGroup at a coupon of 14%pa. In 2016, rival LafargeHolcim accessed the Corporate Bond market at a coupon of 14.75%.

13. Talking about Lafarge, its majority shareholders, LafargeHolcim, confirmed that it has now injected about N96 billion via a rights issue which was concluded last November.

LafargeHolcim, as well as other foreign shareholder, owned entities in Nigeria contributed to the over $5 billion in Capital Importation received in the final quarter of 2017.

14. Cars45 announced a partnership with Kia last week. According to the company, it has extended its used car and car trade-in partnership with Kia Motors to the Federal Capital Territory, Abuja.

So basically, Kia owners in Abuja can now drive into the Kia Motors Nigeria’s office at Utako, Abuja to trade in their used car for a new Kia vehicle or a fairly used one or any other car owned by Cars45. Cars 45 business model interest me a lot and I think I should do a Deepdive on these guys pretty soon.

15. Those interested in the Sanitary Wares business will be interested to know that the West African Ceramics Company has ramped up its expansion plans after it nveiled two tiles and sanitary ware exclusive showrooms in Kaduna State and Abuja.

From what we gather, this is the 7th and 8th showroom it has launched across locations in Kano, Port Harcourt, Nasarawa, Jos, Osogbo, and Enugu. This company started operations in Nigeria in 1995 and is run by Indians. It’s one of the biggest indigenous ceramic makers in Nigeria.

16. We hear a lot about Vehicle recalls around the world but nothing in Nigeria. However, last week, the Consumer Protection Council, CPC, advised Nigerians who own Ford Cars 2014-2018 models of Ford Fusion and Lincoln MKZ to immediately contact it.

Specifically, the models are fusion S, SE, hybrid S, SE, hybrid titanium, fusion energi SE, energi titanium, fusion sport, fusion platinum, fusion hybrid platinum and fusion energi platinum. We understand some models have steering wheel bolts which could become loose and cause the steering wheel to potentially detach, potentially leading to fatal accidents.

17. A Real Estate Firm, Sparklight Property Development Company Limited launched a N1 billion debenture issuance.

The company claimed it was part of its expansion plans. The debenture (debt) will offer a 16% interest rate and a tenor of 3 years. Anchoria Investment and Securities Limited will be handling the bond issuance. This is an interesting offer especially from a Real Estate Company that isn’t such a household name.

The company’s track record includes several housing units in Lekki and Lagos Ibadan Expressway. They also manage Real Estate properties and render advisory services. Rental yields in Lagos from my limited assessment less than 8% so it will be interesting to see how they plan to repay the debentures. Though, the model suggests it will be via sale of units.

18. Another property development company Knightstone Properties said it has completed a 20 no 3 bedroom terrace duplexes.

This story made this roundup because it is for Addax Petroleum Cooperative. The units are also first part of a 56 housing units they agreed to deliver. Real Estate developers make a substantial amount of their money developing properties for Cooperatives.

The model serves a mutually beneficial purpose as the cooperatives provides developers a ready market while the cooperatives do not have to take on all the development risk until at the early stages of development.

19. Hotel Operators, BON Hotels International West Africa, revealed last week that it has begun a launch of 11 new hotels across Nigeria.

The first of the hotels is the BON Hotel Maitama in Abuja. Bon now has 25 hotels in Nigeria. Bon Hotel is a South African franchise and has Mr. Otto Stehlik as its executive chairman. Otto was also the former Chairman of Protea Hotels.

Nigeria still doesn’t have a notable hotel operating entity. The last was Nigerian Hotels Ltd which owned, Ikoyi Hotels, Jos Hilton, Kano Central Hotels, Bristol Hotels to name a few. The hotels were eventually privatized by the government while Nigerian Hotels was wound down.

20. Sahel Capital announced that it has executed a definitive agreement for a significant investment in Coscharis Farms Limited.

Reports indicate Coscharis Farms is developing a 2,500ha rice cultivation scheme with an irrigation system to enable multi-cycle rice cultivation, and is in the process of installing a 40,000 MT per year rice mill.

By the way, Sahel Capital Agribusiness Managers Limited is a private equity firm focused exclusively on the Nigerian agribusiness sector. Sahel first Private Equity fund is Fund for Agricultural Finance in Nigeria (“FAFIN”). It has a fund size of about $65.9m. Their average investment size is between $3m to $6.59 and target SME’s with over 250 employees, revenues of between N500m & N5b.

21. Not to forget Milost. They were in the news last week again. After a Bloomberg article suggested that they were investing $1b in Unity Bank, the bank denied that it had agreed any major deal with the Milost and that it was still talking to other investors.

It appears the folks at Unity Bank decided to react fast to avoid any potential fallout from a scenario in which the Milost deal fall through. In what seems like a cat and mouse, Milost may have also made this announcement as a subtle message to any potential entity interested in the Unity Bank deal.

On a flipside, Unity Bank also doesn’t want to shut its doors to potential investors and made a counter-announcement to strengthen its hand on the negotiation table. What I still don’t get is why Unity Bank is embroiled in all of this. For a bank that has proxies two of Nigeria’s most influential living ex-presidents, IBB and OBJ, things don’t just add up.

22. Still on Milost, they issued a press release last week defending its planned investment into Nigeria.

The company said it uses MESA (Milost Equity Subscription Agreement) its strategy for investing in Nigeria. We described MESA in this article 23.Japaul, reeling from a Businessday article that crashed its share price also issued a press statement from its founder, chiding the newspaper for what it termed unfair reporting.

Businessday had accused the Milost/Japaul deal as a pump and dump scheme. It appears their press release worked as the stock gained 9.5% on Friday to close the week at a positive note. I still will not touch this stock with a ten-foot pole (My opinion).