Nigeria’s Stock Market recorded a 0.66% drop on Tuesday failing to take any positives following the positive GDP numbers revealed by the National Bureau of Statistics.

Figures released today by the National Bureau of Statistics (NBS), show Nigeria’s Gross Domestic Product (GDP) grew in Q4 2017 by 1.92% (year-on-year) in real terms, maintaining its positive growth since the emergence of the economy from recession in Q2 2017.

This growth is compared to a contraction of -1.73% recorded in Q4 2016 and a growth of 1.40% recorded in Q 2017. Quarter on quarter, real GDP growth was 4.29%. The year 2017 recorded a real annual growth rate of 0.83% higher by 2.42% than -1.58% recorded in 2016.

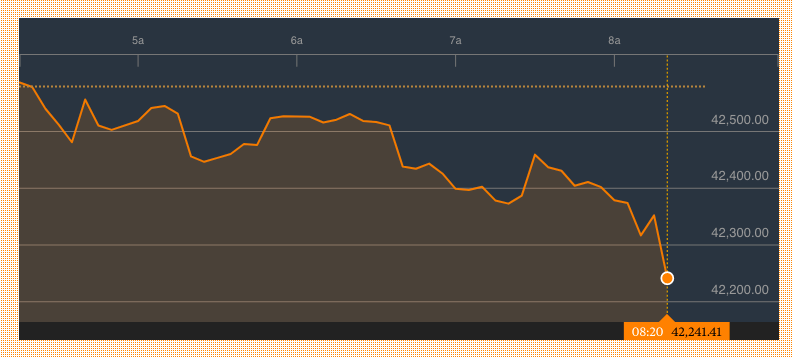

No joy with stocks as Bears ruled supreme

Stocks snapped a 5 day gaining streak losing on a day one would expect positive macro-economic data to spur investors. See chart

Gainers & Losers

They were 18 gainers and 39 losers in the market, settling the market breadth at 0.46x.

UNITYBNK (+9.82%) was the top gainer today as its price advanced by 9.82% to close at NGN1.79, according to close of business report by Meristem. Other top gainers were CONOIL (+9.81%), MAYBAKER (+8.86%), JAPAULOIL (+8.70%) and CCNN (+8.01%).

Meristem also reported that AFRIPRUD was the worst performing stock today with a 9.44% price decline which settled its price at NGN4.70. UNIC (-7.41%), MULTIVERSE (-6.06%), UCAP (-5.87%) and UBN (-5.00%) also featured on the losers chart today.

Data from the Nigerian stock exchange also showed that Tuesday’s losses were led by bears in the banking, industrial and food and beverage sectors losing NSEBNK10 (-1.29%), NSEIND (-1.14%) and NSEFBT10 (-0.15%) respectively

The Insurance and Oil & Gas sectors were the only sectors to close in the green today as the NSEOILG5 and the NSEINS10 recorded respective advancements of 0.86% and 0.29%. Conversely, the

Despite the losses recorded today, analysts at Meristem expects “a positive close to the sector this week, as more results are released and investors take position ahead of dividend payments.”