Traditionally, investors’ appetite and need for income comes from fixed income instruments like treasury bills and bonds. Until recently, 10-year Nigeria treasuries have delivered an average yield in the upwards of 15% thereby providing a high level of income to investors with a relatively minimal level of risk. However, current economic events are giving rise to low interest rates.

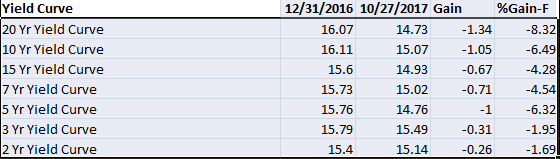

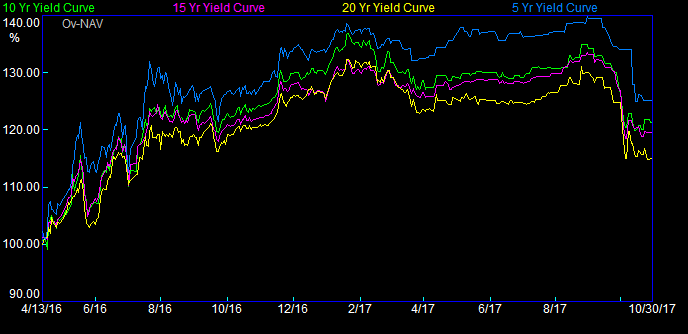

Yield curves have been falling across all tenors. The 10-year yield fell by 6% between January and October while the 20-year yield decreased by 8% to 15.07% and 14.74% respectively. Granting that yields move in the opposite direction of prices, this trend implies that the prices of fixed income instruments are trending upwards indicating that people are buying more and more of FGN and other bonds. This also implies that the government may be able to issue T-Bills or refinance maturing bonds at cheaper rates.

Credit:Quantitative Financial Analytics

One effect of the decreasing yield is that it is creating a gap between investors’ income needs and the income usually provided by traditional fixed income investments.

Source: Quantitative Financial Analytics

With bond yields trending low these days, investors could be forced to change their investment strategy away from traditional fixed income instruments to high yield dividend stocks. The advantage of such strategy change is that such strategies can deliver both the high yields required to meet their current income needs as well as the opportunities to grow their principal. Unfortunately, the Nigerian market does not boast of a sizable number of high dividend yield stocks.

Currently, only 3 stocks have dividend yields that are better than what traditional fixed income instruments provide. While Smart Products Nigeria plc and RAK Unity Pet company have dividend yield of 42% and 20% respectively, United Capital plc and Zenith International Bank plc have 16.29% and 14.7% respectively. The seeming dearth in the existence of high dividend yield stocks could be as a result of the increase in stock prices in recent months.

The relationship between stock prices and dividend yield is such that as stock prices increase, dividend yield decreases. That notwithstanding, those with keen eyes on the market may be able to uncover the stocks that could bridge the income gap being created by the falling trend in yields.

Source: Quantitative Financial Analytics