Nairametrics| The controversy surrounding the Malabu Oil and Gas deal has been one interesting case keeping Nigerians entertained, as the constant twists and turns in the case remind one of a well-scripted television drama series. However, to those involved in this web of corruption, deception and theft, this is no drama, as billions of dollars are at stake.

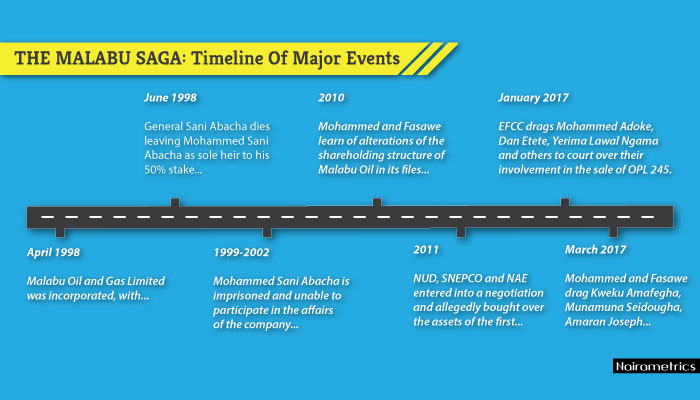

For those having difficulty keeping up with developments surrounding the case, we bring you a timeline of major events most of which were sourced from media reports.

[read more=”Get timeline” less=”Read Less”]

What is OPL 245

- OPL 245 is an oil prospecting license issued by the Federal Government. It gives owners of the license the rights to prospect oil in a potentially valuable oil field.

- The license is issued for the period 2011 and expired 20131

- Reserves – 726mmboe (Oil 580 mmbbl, Gas 146 mmboe)

- Acreage – 1958m2

- OPL 245 is located directly between the two major commercial oil discoveries of Agbami (OPL 216/217) and Akpo (OPL 246)

April 2017

- Shell finally admits to knowing that Etete will receive part of the money it paid for OPL 245. This is after several denials by the company.

- BBC releases emails and phone conversations confirming that Shell knew that Etete would use a major part of the money.

- BBC also alleges that hundreds of millions would end up in the pockets of Nigerian politicians including the former President Goodluck Jonathan.

- The BBC report also reveals that Italian prosecutors allege that $466m were laundered through a network of Nigerian bureaux de change to facilitate payments to President Jonathan and other politicians.

- A spokesperson for Goodluck Jonathan tells the BBC that no charges or indictments have been brought or secured against the former president relating to this transaction and described the allegations as a “false narrative”.

March 2017

- Mohammed and Fasawe drag Kweku Amafegha, Munamuna Seidougha, Amaran Joseph, Corporate Affairs Commission (CAC), Shell, Agip, Federal Government of Nigeria (FGN), AGF, and the Petroleum Minister over the sale of OPL 245.

January 2017

- EFCC drags Mohammed Adoke, Dan Etete, Yerima Lawal Ngama and others to court over their involvement in the sale of OPL 245.

2016

- Panama papers, a leak of about 11.5m files from the database of the world’s fourth biggest offshore law firm, Mossack Fonseca is released

- Included is an allegation that Etete and the company, Malabu Oil & Gas Limited, signed a consultancy agreement with an offshore company created by Mossack Fonseca to negotiate the sale of oil blocks to China, a deal that never proceeded.

- It also reveals others documents appeared under Etete’s reported alias, Omoni Amafegha. Amafegha’s company, Pentrade Securities Inc., featured the signature of Richard Granier-Deferre, a French oil trader who was fined approximately $200,000 in 2007 by a Paris court as an accessory to Etete’s money laundering.

- Etete denied using Amafegha as an alias and said he had never heard of Pentrade Securities Inc. or Henkel Investments. He is also reported as denying owning or having owned Malabu. “It’s all just enemies that created this misinformation,” said Etete.

- Prominent Nigerians are accused as allegedly conspiring to undermine Italian Prime Minister, Matteo Renzi, and the leadership of the giant state-owned oil major ENI.

2015

- Dan Etete takes the CPS to court in London asking that the seized $85 million be returned to him

- In December 2015, Justice Edis of the Southwark Crown Court, London British, refuses to grant Dan Etete his request to have the seized $85 million of the OPL 245 payment returned to him. Judge says then-President, Goodluck Jonathan may be in on the fraudulent deal.

2013 – 2014

- In July 2013, a British High Court rules that Dan Etete was indeed the owner of Malabu Oil & Gas

- In 2014, Italy and UK begin investigating Shell and ENI for their participation in the deal

- Italian prosecutors ask the UK’s CPS to freeze $85m in assets related to Malabu Oil & Gas, a request granted by the CPS.

2011

- NUD, SNEPCO and NAE entered into a negotiation and allegedly bought over the assets of the first plaintiff, OPL 245, through Munamuna Seidougha, Amaran Joseph and Chief Dan Etete acting as the two directors and consultant respectively for Malabu Oil, for a consideration of about $1.3 billion with the Federal Republic of Nigeria acting as an obligor.

- $1.1 billion is paid to the FG’s Domiciliary Escrow Account, from where the sum of $801,540,000 is transferred to 2 different accounts, one in First Bank and the other in Keystone Bank, upon the instruction of Adoke. Etete is the sole signatory to both accounts.

- The $400 million in Keystone Bank is distributed to several unnamed individuals while $60,000,000 is transferred to another account for forex trading.

- The $401,540,000 paid into the First Bank account, was distributed to several individuals among who were Abubakar Aliyu, AVM Nura Imam, Bashir Galandashi, Adesegah Moses, Abubakar Aliyu, Adeyemi Tunji and Suleiman Ibrahim, none of whom were known to render any service to Malabu Oil.

- Emeka Obi of Energy Venture Partners sues Malabu Oil & Gas in a British High Court for failing to pay him for work he had done in obtaining a buyer for OPL245. Shell and Eni were not part of these proceedings.

2010

- Mohammed and Fasawe learn of alterations of the shareholding structure of Malabu Oil in its files with the CAC, purporting to divest the three original shareholders of their investments in Malabu Oil and allegedly making Munamuna Seidougha and Amaran Joseph the only shareholders and directors with 10 million shares each.

- They petitioned the then Attorney-General to the Federation, Mr. Mohammed Adoke, asking him to stop the conclusion of the transaction in respect of OPL 245.

2006

- FG agrees out of court settlement with Malabu handing over OPL 245 back to the company

- The signature fee of $210 million is maintained

- Shell fights back and takes the Federal Government before the International Centre for the Settlement of Investment Disputes (ICSID), an arm of the World Bank in Washington DC.

- The case drags throughout the tenure of President Umaru Musa Yar’Adua

2001 – 2002

- Shell is offered 40% ownership in Malabu Oil Ltd and would also be made technical partners

- Processing fee of $10 million is paid while only $2.04 million was paid as signature bonus.

- In July 2011, FG , via the instruction of President Obasanjo annuls the sale of OPL 245 to Malabu Oil and Gas.

- Government thereafter, puts the license on sale and Shell turns from Technical Partner to owner and operator of OPL 245

- Shell will however now need to pay $210 million in signature bonus.

- Dan Etete will have none of this and sought legal action.

- FG annuls the sale of OPL 245 to Malabu Oil and Gas

1999 – 2000

- In 1999, the entire documents for Malabu got missing at the CAC and a new one surfaced

- The new documents had Munamuna Siedougha and Fasawe Oyewole as shareholders. Munamuna Sidougha, 10,000,000 and Pecos Energy Limited, 10,000,000.

- Mohammed Sani Abacha is imprisoned and unable to participate in the affairs of the company.

- Chief Dan Etete, consultant to Malabu Oil, took over Mohammed Sani Abacha’s books, documents and records in Mohammed’s absence and without his mandate.

- Hindu’s 20 per cent was bought by Fasawe through his company, Pecos Energy Ltd.

- The corporate status and shareholding structure of Malabu Oil were altered severally through forged board resolutions, which eventually divested Mohammed Sani of his shares while new shareholders and directors were appointed fraudulently

1998

- Malabu Oil and Gas Limited was incorporated, with an ordinary share capital of N20 million divided into 20 million units.

- The shareholders were, Mohammed Sani (fronting for the late Gen. Sani Abacha), Kwekwu Amafegha (representing Dan Etete, then Minister of Petroleum Resources) and Hassan Hindu (on behalf of Ambassador Hassan Adamu.) as shareholders. The equity was shared 50%, 30% and 20% respectively

- Ministry of Petroleum, Dan Etete, offers Malabu Oil the deepwater oil block processing license OPL 245.

- On 29th April 1998, Malabu Oil and Gas Limited had been directed to pay N50,000 application fee, $10 million bid processing fee and $20 million for signature bonus, all within a period of one month as stipulated by law.

- By June, General Sani Abacha dies leaving Mohammed Sani Abacha as sole heir to his 50% stake

Further reads

[/read]

All this story about this malabu scandal clear,even by nairametric.I THOUGHT THE GOVT WOULD HAVE DETAIN OR PUT CHIEF ETETE IN PRISON BY NOW IF HE IS STILL ALIVE OR IN NIGERIA.on what basis is mahammed abacha issuing a law suit against anybody.Mohammed abacha should be ashamed of himself.he have the audacity and proud to show his face any where in Nigeria.

” A man cannot have something he does not have”,and there is a latin word in legal term,and this,the English word,i have just said,and that applied to mohammed abacha and chief etete,govt do not go to court,to take procession of this oil,field.let mohammed abacha,chief etete,mohammed adoke,shell and eni go to court,if they acquired this oil field legally and lawfully according Nigerian laws..and I feels they will not go court,as they will take cover and run for their lives,as the govt would have charged to go to cout,a long time ago,smelling rod in kirikiri.What the f–ck is this ?

we are reading that EFFCC is going to court,for govt to take what is lawful govt property,to be hold on trust on behalf of the Nigerian people.WHAT THE HELL IS THIS THIS ?.WE THOUGHT THE EFFCC SHOULD HAVE TAKEN THOSE CRIMINALS TO COURT,ON MULTIPLE CHARGES,E.G DEFRAUDING THE NIGERIAN GOVT.now it looks some sections in this govt are shielding some powerful people in Nigeria.all man are created equal in the eyes of God.now look at the sum of money allocates and shared by some Nigerians.govt would have got them at least on laundry and receiving stolen money, and I think they all knows what they are doing,and you are saying Nigeria is in recession technically by the finance minister,even defrauding Nigerian govt and stealing govt fund is stealing technically.