Operators of high investment yielding scheme, MMM have in the last few days come under significant pressures from the media, social media and even Legislators. This is also coming on the heels of several allegations which suggest that the scheme bares all the hallmark of a Ponzi and could indeed be one.

As expected, the operators of the scheme are fighting back. They have also put out their own propaganda machine which they hope will convince those looking to join to do so without a bother. They have even gone as far as claiming that it has been approved by the CBN.

The operators of the scheme are not alone at this. “Investors” (sorry, we’ll have to use that word) in the scheme are also doggedly defending the scheme and are not afraid to attack anyone who dares calls it a ponzi or predicts its well…. inevitable fall. Their defensive posture is unprecedented as typically ponzi scheme operators hardly get heard let alone institute a propaganda machine. A mathematical theory proposed by Mike McDougall, CEO of the Actuarial Society of South Africa could explain why MMM operators are in a frenzy.

Here is how he described MMM and why it is destined to fail

“It can be stated with absolute certainty that these schemes will eventually collapse, leaving many people financially destitute, while only the founders and a few early participants make considerable gains,” he said.

“There are essentially two reasons for this. Firstly, if a scheme is paying out more than is being earned, it will run out of money. Secondly, such schemes need continuing growth in new members to sustain payments to existing members, and the reality is that they will ultimately run out of new investors,” he said.

“The only uncertainty is when the collapse will happen, which depends on how quickly the fund is growing and how much bigger the declared yields are than the actual investment earnings on the funds invested.”

South African website, Fin 24 also puts it into better perspective.

Example of scheme

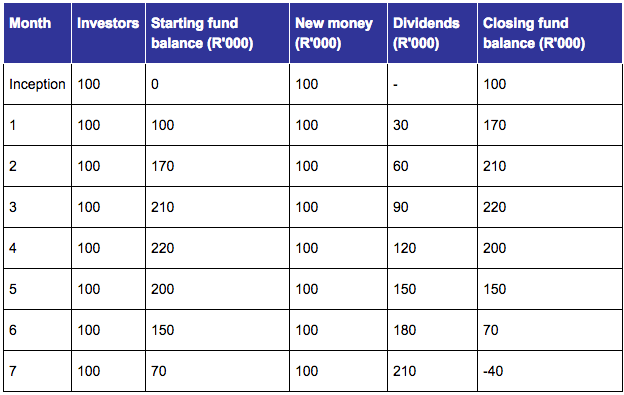

To demonstrate, McDougall points to the simple example of a scheme that begins with 100 members who each invest R1 000 with a promised return of 30% per month. Every month 100 additional members join the scheme and each invests the same amount until the scheme collapses. Members receive their first payment the month after they make their investment.

In this example, the scheme begins with 100 members and total funds of R100 000. In the second month, there are 200 members and the fund closes with R170 000 after paying dividends of R30 000 to the founding members.

The total dividends paid rapidly escalate each month as the membership base increases, until the scheme reaches its seventh month. In its seventh month, the scheme begins with R70 000 and receives an additional R100 000 from new investors. However, the scheme must now pay total dividends of R210 000 to its numerous members, leaving it in debt of R40 000. Instead of R300 each investor only gets R243 and the scheme collapses.

The above table probably explains why MMM fans, investors and operators are pushing back. The scheme requires more people to join for them to be able to continue to share money at these exorbitant interest rates, of course without creating value. The Investors column in the table above needs to increase in numbers and go beyond 7 months (or indeed infinite) to sustain the payouts. We all know nothing is infinite, especially with high yielding investments. It should plateau at some point.

Another reason too is the fact that most of the investors need to wait a few more days or weeks to get their money out, so the more bad publicity the scheme gets, the higher the risk of not being able to pull their money out.

It doesn’t end there too. A common feature of MMM is that most of the investors are returnee investors, that is those who have invested before and then decide to reinvest the profits. These guys make up a significant portion of the scheme and could decide not to reinvest thus jeopardizing the very survival of the scheme. What about those who just joined? Well the first in first out approach applies here. They’ll have to wait a bit longer to get their money our. But with the air of negativity around the scheme ratcheting up, there might be no new investors from where they can get money to pay them from.

This all doesn’t bode well for the operators of the scheme who really need to attract newer recruits and hope that older recruits continue to have faith in the scheme. Now that the EFCC and NASS is getting involved, a simple instruction to shut down the website of the operators could be all it will take for the cookie to crumble.

We do not wish for people to loose their hard earned money and hope that somehow this all ends well. For now, all we can say is best of luck.

What is TBC or THE BILLION COIN. it is an crypto

currency or internet currency/money use to buy any

product or services to co member of TBC or to the

TBC community around the world. The value of TBC

is increasing everyday from 1-5%, it never goes

down because its value is based on the number of

new verified members.. and the number of member

always goes up it never goes down..

if you buy 100 TBC today after 1 year your 100 TBC

is already worth 1 million or more.

if you buy 50 TBC today in 1 year and 6 months it

is already worth 1 million or more.

if you buy 25 TBC today after 2 years it is already

worth 1 million or more.

if you buy 10 TBC after 3 years it is already worth 1

million or more..

if you buy 1 TBC today after 5 years it is already

worth million or more.

We offering a discount price

N10,000 ($40) PER COIN

for Enquiry

Whatsapp 08165396851

or call

08137889490

Wow, Suddenly, the Nigerian Govt, Legislators now care about Nigerians. Where was CBN when people lost their money when Savannah bank’s bubble *burst*???

Where was the Govt and what did they do when the *stock market’s* bubble burst in 2008/2009??

Or did the stock market and banks despite being regulated stop them from going burst??

There are no guarantees with MMM and that’s why participants are advised to use their spare money…

And wow…there are also no *guarantees in life*

These people will stop at nothing to leave MMM alone and mind their businesses. Tell me, which pyramid or ponzi is worse than the entity called Nigeria where 1% of the population owns 99% of the nation’s wealth? What difference exists between traders and speculators in the Nigerian capital market and MMM? You have the organised criminals of men in black who sits behind the scene with insider info and manipulates the market to their own wicked advantages. What value has been created in the process of speculating and manipulating stock prices to make millions? What you guys failed to realise is that the MMM model is somewhat different from that of a bank or any investment scheme. A bank lends out money for 1 month and collects 30% interest, gives the owner of the money just 5% and pockets the remaining 25% for its directors and capitalist owners. MMM came and said such a system is unfair to the owner of the money. MMM eliminates the intermediary bank and connects the lender directly with the borrower. That’s the simple ideology. Though in MMM, no lender and no borrower. There’s a caveat for participation : only with spare money and what you can afford to lose. So every participant is warned that mmm is a mutual financial aid community and I’m sure If you are in this country, you will know that many lives have been touched since the advent of this scheme.