“Nigeria has terminal illness’, ‘Does Chevron pay NDDC levy?’, ‘Godwin Obaseki & Gamaliel Onosode Oil field’, ‘NERC doesnt like NBET Prices?’ : Oil Gas and Power Round-up, July 18–22 2016.

Terminal Illness

The Niger Delta Avengers ventured eastward and damaged vital evacuation infrastructure at Qua Iboe Terminal. Exxon denied the attack as first but soon declared a force majeure on liftings from the terminal. First an accident weeks ago, now a sabotage by militants. Second major terminal targeted by NDA. One interesting thing about NDA is how sophisticated they have become. Instead of targeting disparate facilities and risking exposure, they calmly target key infrastructure that will seriously hurt production. Just one successful hit and every upstream activity shuts down. It’s like slashing someone’s wrist. Maximum damage.

Seems Exxon is still managing some production but time will tell if it can be sustained. Repair is also expected to take a minimum of a month to repair. Forcados has taken 6 months to repair. If this ‘terminal illnesses’ linger, I wager that this ‘technical recession’ we have staggered into might not be an easy fix. If you have been following this series, you will know by now that oil prices usually take a dip in the second half of the year — winter season. Low oil prices and low production and that forex shortages won’t disappear miraculously. I don’t think you should sell your dollars yet.

Banks with exposure to power and oil companies are also expected to suffer a little more. Loans sourced in foreign currency have practically doubled within a year on devaluation while revenue has dried up. Avengers are winning, let’s be a little bit humble.

Some cheering news from the President that he has started talking to the militants. What a climb-down? For a President whose economic recovery plan rests on oil, it’s important he negotiates his way through, for the good of all of us. If not, ladies and gentlemen, fasten your seat belts, we are about to experience some more turbulence.

Nigeria Rig Count and Job Losses

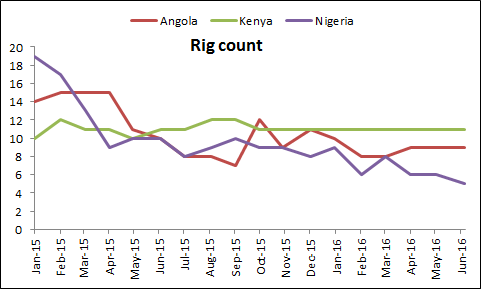

In January 2015, 19 rigs were operating in Nigeria. By June 2016, it has dropped to 5 rigs according to Baker Hughes Rig count data. This is a tragedy. An average rig has about 200–300 direct and indirect quality jobs attached to it. This implies that over 4000 jobs has been lost or idled in just over 16 months. Very easy to blame this on oil price but let’s take a look at what happened in other countries in Africa.

For the same period in Kenya rig count has remained rather stable because the country is a hotbed for exploration right now. Angola rig count dipped but is recovering faster. Why is CAPEX fleeing Nigeria faster than others? Why is it easier to dump Nigerian projects in the global portfolio for International Oil Companies? Oil prices might be down but our soft underbelly and unfriendly social, fiscal and funding issues may be hurting us more than we want to accept.

Note that I have intentionally not included Algeria’s rig count because it’s outsized. Algeria with 12 billion barrels (33% of our reserves) had 53 rigs in June 2016. That’s 7 times the number in Nigeria. We have work to do.

NDDC Levy is retrogressive

This week President Buhari took a good step by inaugurating a new NDDC board. The rotation principle in choosing the CEO was almost jettisoned with the appointment of the last acting CEO.

NDDC by the law is supposed to be funded by 3% of Oil Company’s budget. That is if the Chevron/NNPC budget for 2016 is $1 Billion, NDDC levy is supposed to be $30 Million. This means that even if Chevron/NNPC do not eventually fund the whole budget or are not able to complete all the projects in the budget it doesn’t matter, NDDC must still be paid its $30 Million. Another good example, if Pan Ocean Oil Corporation had a budget of $200 Million for 2016, it must pay NDDC a sum of $6 million. But Pan Ocean has not been able to produce any crude oil since February 15, 2016 when Niger Delta Avengers struck the Forcados terminal. How will it comply with the NDDC law?

It’s a regressive, royalty-esque levy. That’s why compliance has been poor. A more progressive option that considers probably profit or production during the fiscal year is more appropriate.

Sun Power

Last few months I have become more bullish about Solar energy. It’s now genuinely cheaper, industrial and abundant in Nigeria. Can be deployed very quickly too. What’s not to love? I want constant power by any legitimate means. No emotions. Coal, hydro, gas, nuclear and now solar. Anything to address our energy poverty.

Minister Fashola oversaw the formal signing of the solar power PPAs during the week and suggested Nigeria is targeting 30% renewable by 2030. Not a bad ambition. Probably mostly solar since its abundant here. Good thing about these PPAs is the pedigree of the companies that signed them up. Did a quick check and noticed come very solid partnerships, decent track record and robust plans. Pricing at US11.5¢/kWh seems steep for now but overall worldwide pricing is a trending down.

NERC does not like NBET prices?

NERC also announced a change in regulation during the week. Quite understated but significant for tariffs and power market going forward. My interpretation of this new directive is that NERC has decided that NBET cannot negotiate PPAs without a competitive bidding process. If this regulation has been effective before now, the latest round of solar power PPAs would have been bid for, not negotiated. This regulation should provide relief for those who argue that a more competitive procurement process would have reduced the price of the latest solar PPAs.

Society of Petroleum Engineers Conference

The annual conference of SPE starts with preliminary activities by 31st of July and ends on 4th August in Lagos. Yours truly will be delivering a technical paper on 3rd August. If you will be there, it would be nice to meet up.

Today’s Company Profile

As promised I would be profiling energy companies in Nigeria.

We start with Pillar Oil

· Co-owns and operates ‘marginal fields’ Umuseti/Igbuku field in Delta State.

· Production commenced in 2009.

· Seplat owns about 40% of field.

· Directors include the Onosodes (Late Gamaliel and Spencer — Managing Director).

· Production is over 2000 bopd.

· Godwin Obaseki currently contesting for Governorship in Edo State in a Director.

Follow Ade Damola on twitter for regular updates @Damoche