There are several reasons why retail investors loathe investing in the Nigerian stock market. One that cannot be quickly brushed aside is the spate of losses dished out consistently by some quoted companies. Truth be told, some companies deliberately report losses to avoid taxes or do so because they are investing in sales and promotions, capex etc. However, we know some who are loss making due to massive inefficiencies or incompetence.

Despite posting repeated losses, they continue to operate as a going concern. To make it worse, some of these companies had their IPO years ago when they debuted in the stock market.

At Nairametrics, we refer to these companies as “SLM or ‘Specialized Loss Making” Companies. We had wanted to start profiling some of them in the second half of this year, however we could not resist writing about Japaul.

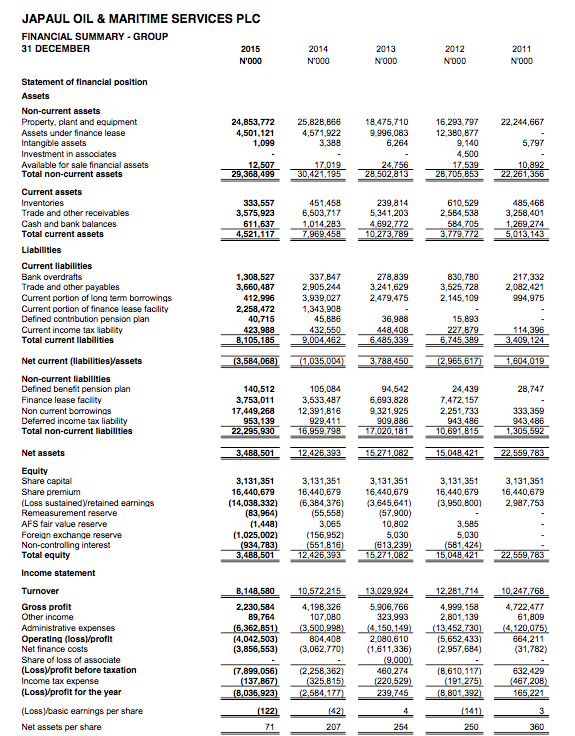

Japaul just released its 2016 Q1 results where it reported a pre-tax loss of N1.2 billion up from N438 million same period last year. Just three months earlier, its 2015 FY results, it reported a loss after tax of N8 billion!! For a retail investor new to this market, this result will be viewed as shocking. However, if you’ve been in this market for long, you’d understand that this is quite normal.

Japual Plc is a stark example of what you refer to as a company that specializes in posting losses. The company has reported losses after tax for 3 years out of the last 5 years culminating in a total loss of over N14 billion only. The losses have now resulted in accumulated losses of N15 billion (as at March 2016) making it nearly impossible for the company to pay dividends in the nearest future. In fact, if the company continues on its current loss trajectory it could end up having negative equity rendering it technically insolvent.

Back in 2013 Japaul revealed plans to acquire 50 vessels optimistic that it will provide growth for the company.

“The operating environment is so good that if we have 50 vessels today, the market will absorb them because the Nigerian content policy has created an enabling environment for all local maritime companies to do well. It is evident therefore that there is no limit to our growth despite all the challenges we have been facing,”

Two years later what we have seen is a loss after tax of over N10 billion.

Why the losses?

The reason for this is not far-fetched as the company has two major problems. It has a high operating cost and sells to people who hardly pay back.

Japaul spends about N1 operating expenses for every N1 of revenue it earns. In addition to that it also spends another 43 kobo in interest payments to banks. Also for every N1 sales it makes it spends another 20 kobo of it from its debtors and losses a further 30 kobo to exchange rate fluctuations. The shareholders of the company are basically paying the price for a board and management that is likely not interested in providing any returns on investments. Experience suggests companies that post frequent losses, fail to pay dividends but remain in operations as a going concern are probably doing one thing right. The management of the company is collecting their salaries, earnings their bonuses and probably involved in both supplies and service provision for the company.

As a public company, Japaul surely has enough corporate governance codes that precludes such practices. But what do we know?

This company should be thoroughly investigated by the regulatory authorities such as the Nigeria Stock Exchange (NSE) the Securities and Exchange Commission (SEC) and the Financial Reporting Council of Nigeria. Companies that had consecutively made losses for five years should be not be allowed by law to raise funds in the stock market.

Mogbe! To buy shares now dey fear me o. Nairametrics, what can I do to my Japaul Oil shares? I bought their IPO not knowing they were 419

Please who protects the share holders in Nigeria?? This looks like a rip-off between management and some directors! Nairametrics please do the profiling – AIT/RT Briscoe/Lasaco etc.