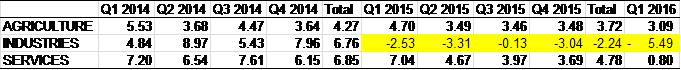

Nigeria will slip into a full-blown recession by the end June 2016 if the economy records another negative GDP growth rate for the second quarter of 2016. Arguments could be made that since 2015, the country had slipped into a dollar recession or technical recession in some of its key segments such as manufacturing (see table below). The industrial segment is deeply into a recession already despite being the focus of the current exchange rate policy (before the flexible rate policy was adopted).

To some extent, arguments could also be made that the typical economic realities that characterize a recession are already apparent in the country; for example companies shutting down, massive job losses and significant currency pressure. The recent Unemployment Report by the National Bureau of Statistics showed that over 500,000 people lost their jobs in the first three months of this year. The Naira traded at N323 to a dollar, 62% higher than the official exchange rate of N199.

However, if the country is officially declared to be in a recession, it could get much worse. Nigeria’s ability to secure international lending carries a much higher risk premium. This is important as we look to fund our N6.06 trillion budget while producing about half of our usual oil output at current oil prices. Considering that depending just on local markets for borrowing could also crowd out corporate borrowing because of the higher interest rates that would be demanded for their risk profiles, then we would have no choice but to borrow from international sources.

So I am wondering if we can avert this crisis in just one month. Is it too late? Can the government do anything in June to ensure that the economy records even a 0.01% growth in Q2? Here are some random ideas:

- The government has to print some Naira sufficient to do the following:

- Pay outstanding debts to contractors on major infrastructure projects in construction, agriculture etc that can create jobs

- Pay outstanding MDA and Security forces debts to power distribution companies

- Pay salaries to workers enabling some spending power return to the public and by extension the FMCG sectors, which rely on the industrial and manufacturing sectors.

- Commission new projects that will hire more people – housing and road projects are typically the target here.

It’s important to remember that the timeline here is one month, so what happens afterward?

Note that these expenditures are already contained in the budget so we’re not going outside the budget here. What I am advocating is reducing the portion we need to go and borrow. The process of borrowing will also take time which we don’t have if we wish to avoid slipping into a recession.

Subsequently, we can seek some international lending at slightly better rates if we do not slip into a recession. We can also borrow from the local markets.

However, most importantly, we need to carry out major structural reforms on our economy to ensure we move away from oil as the main source of foreign exchange, government revenue, exports and even jobs/business for the economy.

These are my thoughts. I’ll be happy to hear yours.

Your analyses as projected are quite reasonable and laudable. I still uphold the belief that much of the theories could be averted to realities if special considerations are allowed to play into the economy. The experiment being projected with the Chinese may prove to be logical and economically viable. If the Chinese are truly sincere in the implementation of the agreement, the approach may prove to be significantly helpful by thwarting the effect of recession in the country. You have made some recommendations which I personally consider workable and bankable. What the Nigeria situation needs right now is immediate correction and adjustment to the economy. Massive development in the areas of road construction, large scale agricultural development, housing estates, etc. These innovations, no doubt, would help to create substantial jobs for our youths and equally enhance the position of the economy. It is never too late for the Federal Government to approach friendly countries who are willing to make soft loans available for the anticipated development of the economy. African Development Bank and some other private institutions should rally round Nigeria because when the goings was good, Nigeria has always been there to help. I trust nature, it will never allow Nigeria to go into recession! Our people are hard working and ready to face the reality of life. Conclusively, it may appear the economy is bad, but barring economic polity, the prevailing economic condition will evince a brighter future for Nigeria. A nation that is not readily prepared to face challenges such as this will surely fail! Nigeria will not fail because of the readiness of the populace to always face challenges such as this and move the country forward. Let us all learn to be optimistic in all our endeavors.