Commentary

Following a lackluster trading week, the equities market ended the week lower with no major themes. Thin volumes and bearish sentiments remained firmly in place. The week however ended with MSCI announcing that it would consider excluding Nigeria from its frontier market index. This decision is on the back of foreign exchange controls imposed by the central bank. The index provider expects to have a decision on or before April 29 and It is estimated that we could see outflows of c.$500mn if it reaches a decision exclude Nigeria from its Index. To put it in perspective, it took the market c.40 trading session to hit $500mn in transaction value in 2016.

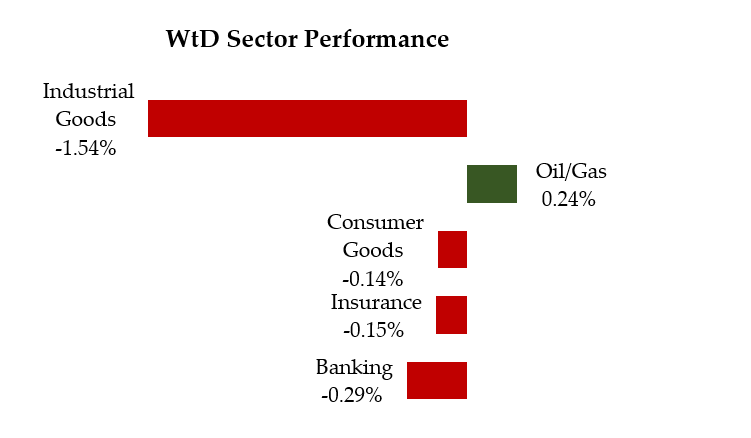

The All-Share Index dipped by 0.70% WoW to close at 25,328.04pts, with the market recording losses across all sectors safe for the Oils which were up 24bps. The Industrials were the most down (154bps) on declines in ASHAKACEM, PORTPAINT & CCNN. Otherwise, they were fairly flat, with the Banks, Insurance & Consumers down by 29bps, 15bps and 14bps respectively.

Participation in the market continued to trend lower, with a total market turnover of 1.11bn shares valued at N6.20bn compared with the 1.26bn shares valued at N6.43bn that traded in the previous week. The week saw transaction values within the N0.89bn – N1.65bn range, with a daily average of N1.24bn which was 23% lower than the N1.61bn that was recorded in the previous week. The activity was mainly in GUARANTY on the back of cross trades in the name. Trading in the name accounted for a little over a tenth and a third of total market volumes and transaction value respectively. Outside of this, activity levels were sharply down with the likes of NESTLE, ZENITH, NB & UNILEVER seeing a bit of the action.

Market Snapshot

- All-Share Index: 25,328.07pts

- Market Cap (NGN): N71tn

- Market Cap (USD): $44.23bn

- Total Volumes Traded: 11bn

- Total Value Traded (NGN): N20bn

- Daily Average Value Traded – WtD: N24bn

- Daily Average Value Traded – YtD: N29bn

- Advance/Decline Ratio: 27/40

Sector Performance:

Market Screeners:

- Top Risers:

ETRANZACT (+26.97%; N3.39); TIGERBRANDS (+11.76%; N2.47) & FCMB (+10.10%; N0.98)

- Top Decliners:

ASHAKACEM (-14.21%; N19.56); PORTPAINT (-14.06%; N2.75) & CCNN (-13.95%; N7.03)

- Top by Volumes Traded:

GUARANTY (130.85mn); FCMB (115.85mn) & EQUITYASUR (115.78mn)

- Top by Value Traded:

GUARANTY (N1.85bn); NESTLE (N0.51bn) & ZENITHBANK (N0.45bn)