A couple of very disturbing trends have been discovered in the end year 2015 financial statement of Afromedia Nigeria Plc following an analysis of their results by Nairametrics Research.

The foremost outdoor and advertisement company, which had revenues of only N407.01 million in the period under review, was however able to be extended an overdraft of N2.91 billion. To make matters worse, the overdraft was spent on huge administrative expenses of N1.63 billion, since the company’s sales could not cover costs.

According to note 25 accompanying the results the overdrafts were secured on the personal guarantee of the Managing Director of the company; Mr. Akin Olopade. Nairametrics believes this negates the principles of corporate governance and transparency.

Why should the managing director guarantee such a huge overdraft? Are the shareholders of the company aware of such copious and opaque transaction?

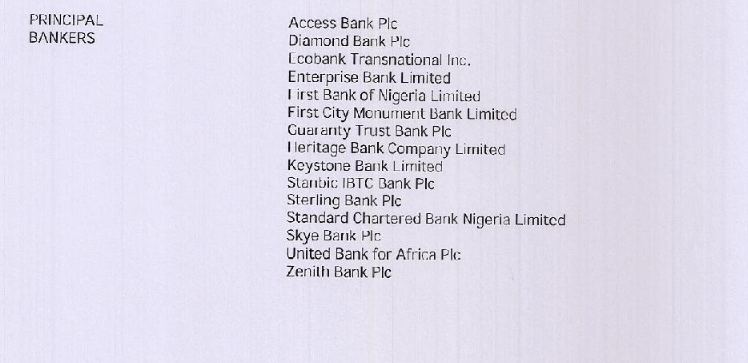

It would be interesting to know the banks that extended an overdraft equivalent to 7 times the revenue of Afromedia in the form of short term loan facilities.

We have attached the principal bankers to Afromedia in this report as obtained from the Audited Statement of the firm. The aforementioned financial shenanigans have made us in Nairametrics come to a logical conclusion that there are fundamental issues wrong with Afromedia Plc.

Afromedia is no stranger to accusations of fraud or scam within its confers as the managing director, Mr. Olopade, had earlier gotten the Economic Financial Crimes Commission (EFCC) to arrest Alhaji Mohammed Gobir, former director of the company for corporate fraud. Mr. Olopade had accused Gobir of collecting various amounts of money in a phony business deal.

Further analysis

- Further analysis of the financial statements of Afromedia showed the company has a negative working capital of N5.91 billion in 2015 from N4.09 billion the previous year.

- Negative working capital is when a company’s current liabilities exceed its current assets.

- Afromedia’s current ratio, a measure of working capital was 0.09 xs in 2015 as against 0.24 xs in 2014, which is below the industry standard of 2.1 xs.

- Negative working capital is usually seen as detrimental because it signifies additional capital that will be required to run the business after closing.

- Analysts prefer to see a working capital ratio of 1 to 1.5 times, which means there is at least one N1 of current assets for every naira of current liabilities.

Afromedia’s inability to meet short term obligations and demands threatens its existence as a going concern, a situation that signals the company may no longer be able to convert liquid assets to cash to cover payables.

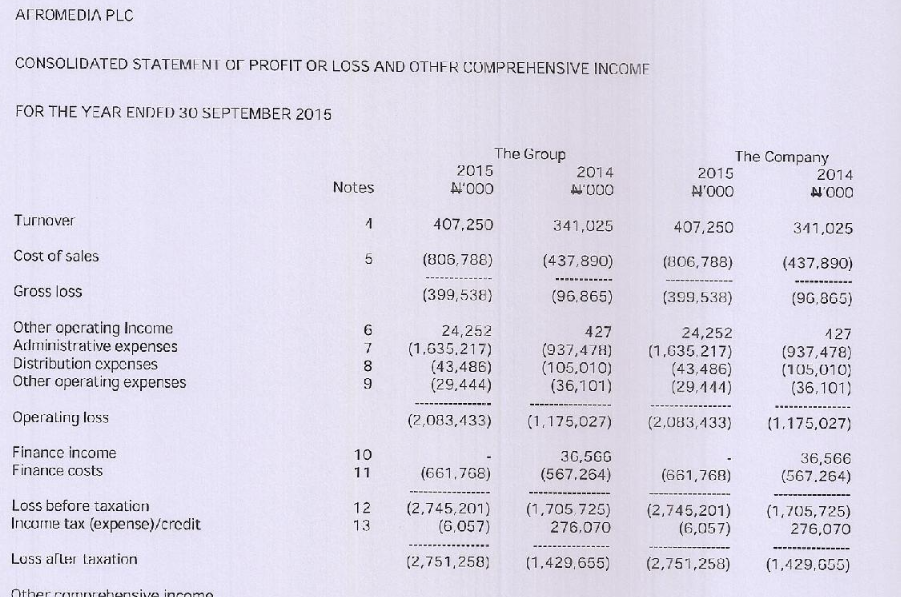

The company’s loss of N2.75 billion in its September 30, 2015 financial statement and negative working capital left the external auditors with no choice than to issue a qualified and stigmatized opinion on the company’s financial statement.

“These conditions indicate the existence of material of material uncertainties which may cast doubt on the Group’s ability to continue as a going concern and, therefore, that it may be unable to realise assets and discharge its liabilities in the normal course of business,” said Ernst and Young the external auditors of Afromedia.

Fig 1: Afromedia Plc Bankers

Fig 2: Snapshot of Afromedia Plc 2015 FY results

With that value of overdraft how come their “Finance Cost” didn’t skyrocket? Just wondering.

The overdraft facility as at Full Year (FY) September 2014 was N2.28 billion.

This increased by N631 million to N2.91 billion as at FY September 2015.

Finance costs increased to N661.7 million in FY 2015 from N567.2 million in FY 2014.

This is an increase of N94.5 million or 16.6 percent.

More scandalously however only the FY 2015 finance costs (N661.7 m) swallowed up all of Afromedia’s revenues for the period of N407.2 million.

What has the overdraft figures been in the last five years?

Thieves!