When China does bad, everybody pays for it. Including your economy and your stock market.

Yesterday saw some of the most nerve wrenching price swings in global stock markets, and the events from what has been dubbed the “Black Monday” cannot be unconnected from what is happening in China. Rather, it is a rippling effect that starts right from the world’s second largest economy.

Since China unexpectedly devalued the Yuan on Aug. 11, more than $5 trillion has been wiped off from the value of global equities.

The transmission point between the roil in the Chinese markets, and the quake in the global equities market is suspected to be the Yuan devaluation.

As a manufacturing and export powerhouse competing with other manufacturing and export regions in the world, the weakening of the Yuan by China undermines the competitiveness of “export-exposed” economies and companies from the US and other parts of Asia.

The weakening of the currency has an immensely adverse effect on the earnings potential of these other companies. The effect is rather worse in the US, against which the Yuan is directly devalued (Chinese Yuan Vs. USD). One effect of this is that corporate earnings of US companies could start to weaken, as their products become more expensive compared to products from China, causing demand for them to shift.

The devaluation of the Yuan ensures that the US Dollar will remain strong, expensive, and hence US products will be price-noncompetitive in the export market.

This causes a slow-down in their earnings momentum, and, coupled with the expensive prices of US securities caused by the strong dollar, the sell-off show started in earnest.

On the global scale, this could have also applied to other export exposed companies in other regions.

Tim Cook tries to rescues Apple from its plunge…

In an extraordinary event, Apple CEO Tim Cook had to email Jim Cramer of CNBC’s Mad Money to reassure investors that Apple’s sales was still doing well in China, as its stock tumbled into a bear market before paring losses.

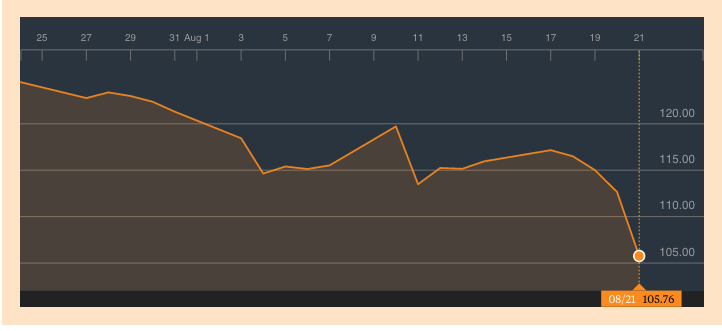

1-month chart of Apple share price

1-month chart of Apple share price

With this new dark cloud hanging over US corporates, it is no wonder that a sell-off has been sparked, because near term earnings could be immediately affected by the aforementioned factor.

China also has a hand in the renewed crude oil rout…

This strength in the US Dollar, (further prompted by the Yuan devaluation), is also partly responsible for the rout in the commodities market, most especially oil.

An inverse relationship seems to exist between the “trade-weighted” dollar and commodity prices. The stronger the trade-weighted dollar, the weaker the price of commodities, because commodities are priced in Dollars, and a strong Dollar makes them expensive, hence the fall in their demand.

And supply is still not yielding. Brent crude has fallen below $45 for the first time in more than 6 years. With this new low in the commodity market, new worries about deflation could arise.

Because of all this, the anticipated Fed rate hike, which was tipped for September could now be set for postponement until 2016, according to analysts, including some from Credit Suisse Group.

![[CONTAGION] How China is tipping the world back into recession](https://nairametrics.com/wp-content/uploads/2015/08/China-Sell-off.jpg)