- Drug makers in Africa largest economy have capitulated to huge production costs that left these companies with low profit margins. This also affected the returns to shareholders.

- The companies under our analysis are: GlaxoSmithKline Nigeria Plc, Fidson Nigeria Plc, May and Baker Nigeria Plc and PharmaDeko Nigeria Plc.

- The cumulative net income of the four firms that have released half year results showed net income fell by 29.23 percent to N792.26 million from N1.11 billion the previous year.

- Analysis of the books of the firms showed the bottom lines took a hit from weak sales. Cumulative sales were up by a mere 1.68 percent to N23.72 billion in June 2015 as against N24.12 billion last year.

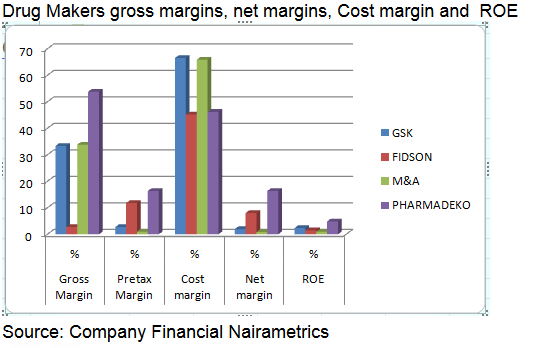

- These firms had huge production and operating costs wipe out most of sales leaving a very low profit margin. The average net margin of 6.81 percent is abysmally poor.

No Bumper Dividend for Shareholders as ROE weak

- The shareholders of the four drug makers may have earnings eroded as these companies were unable to utilize shareholders resources in generating higher profits as return on equity (ROE) were below the 5 percent thresh hold.

- GSK’s recorded a return on average equity (ROE) of 2.37 percent, Fidson’s ROE was 1.50 percent while May and Baker and PharmaDeko recorded ROE of 0.96 percent and 4.84 percent respectively.

Macroeconomic headwinds are crimping Drug maker’s growth

- The industry is facing the conundrum of economic doldrums bedevilling most firms in Africa largest oil producer.

Nairametrics observes that right from the announcement of the first devaluation by the Central Bank of Nigeria (CBN), most Pharma stocks were in negative. It should be noted that most firms import their raw materials into the country.

- GSK share price felt the heat immediately after the second devaluation as share price stood at N33.60 in February this year, from N52.79 as at September 2014.

- The last time Fidson share price hit a high point was September 2014 (N3.69) and it nosedived in February 2015 (N2.88).

- May and Baker’s highest rise was in August of 2014 when it stood at N1.96. The stock is trading at N1.40 on the exchange.

- Shrivelling consumer wallets caused by the fuel hike and rising transportation combined with high unemployment means people no longer buy drugs as they used to, culminating in weak demand for the firms products.

- The huge costs incurred on diesel oil, an expansive source of energy to power plants at factories contributed to drug makers rising production costs.

- Drug makers are also finding difficult to move goods to the north of the country as insurgency in that region heightens.