The recent results of insurance firms quoted on the floor of the exchange shows some are on the verge of collapse.

This has translated into their abysmally low or stagnant share price.

It is generally accepted financial practice that investors are attracted to a company because there is the possibility the share price will spike hence a higher return on investment or capital gains is expected.

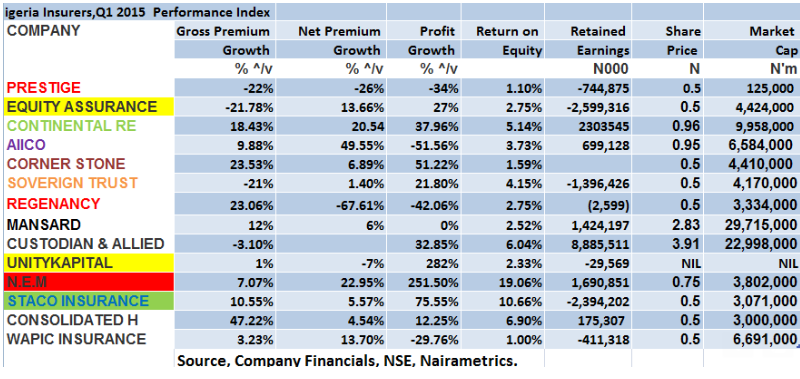

Of the 14 insurers under our analysis, 8 have share price of N0.50, while 3 have share price above N0.50 but less than N1. In short, none have share price exceeding N5.

The share price of companies like Equity Assurance, Staco Insurance, Consolidated Hallmark Insurance have remained stagnant since 2011 while Sovereign Trust and Cornerstone Stone last rose since 2013.

The N102.15 cumulative market capitalization of the 14 insurers is less than the N265.14 billion market cap of Tier 2 lender, Stanbic IBTC.

Recurring loses a threat to Insurers going concern

The recurring losses of some insurance firms as evidenced by their negative retained earnings threatens dividend paying abilities, is denting their share price and threatens going concern.

Companies like Wapic, Equity, Sovereign Trust, UnityKapital, Staco and Wapic have incurred more losses than profits since their existence.

It is not a good sign and also an indication that these firms are bankrupt, since it implies long term series of losses.

For the first three months through March 2015, Aiico Insurance net income dipped by 51.56 percent to N443.04 million from N914.93 million the previous year. Cornerstone Stone’s net income fell 51.22 percent, Regency dropped 42.06 percent and Wapic dipped 29.76 percent. Mansard, the largest insurer by market value recorded no growth in profit.

Abysmal contribution to GDP, calls for mergers and acquisitions

In the last rebased GDP estimate, the insurance sector contributed less than 1 percent to the economy of $510 billion (80.22 trillion), this lags Telecoms and information technology’s contribution of 8.68 percent to the economy.

While total premium as at the end of 2014 hit N302.50 billion, the faltering performance of some firms makes the N5 trillion gross premium targets (over 10 years) set by regulators insurmountable.

The regulator said insurers should achieve the target in 10 years. Nigeria’s premium to gross domestic product of 0.4 percent is poor when compared with 1.1 per cent in Ghana; three per cent in Kenya; and for the BRICS (Brazil 4.0 per cent; Russia 1.3 per cent; India 4.0 per cent; China 3.0 per cent; and South 15 percent).

A scheme of mergers and acquisitions (M &A) will help reshape the Nigerian insurance industry since there are too many weak ones anyway. M&A can generate cost efficiency through economies of scale, can enhance the revenue through gain in market share, and can even generate tax gains and reduce costs of capital. It worked out in the banking sector, so why won’t it work for the insurance sector.

“We expect the small players to shore up their capital base or embark on mergers and acquisitions (M&A) to be able to compete with big players.

This will enable them benefit immensely from the great potential as insurance penetration (premiums earned/GDP) of 0.57 percent compared with the average of 3.38 percent for African peers portends a great prospect in this industry,” said Kayode Omosebi an equity analyst with UBA capital Plc a Lagos based investment bank.

Fig 1