PZ Nigeria Plc announced it proposed a dividend payment of 20 kobo per share payable to shareholders who own shares in the company as at March 30, 2015. Does this announcement suddenly make the shares attractive? We will utilize a simple dividend valuation model in deciding.

Dividend Yield – PZ closed trading Monday at N24.43 relatively unmoved from its previous close. At 20kobo per share the interim dividend presents a dividend yield of 0.86%. PZ already paid a dividend of 61kobo this financial year taking the total to about 81kobo. Nevertheless, the current price of N24.43 makes this dividend inconsequential in our opinion. To think you’d even get better return if you place your cash in a savings deposits shows how poor the dividend is compared to its underlying price.

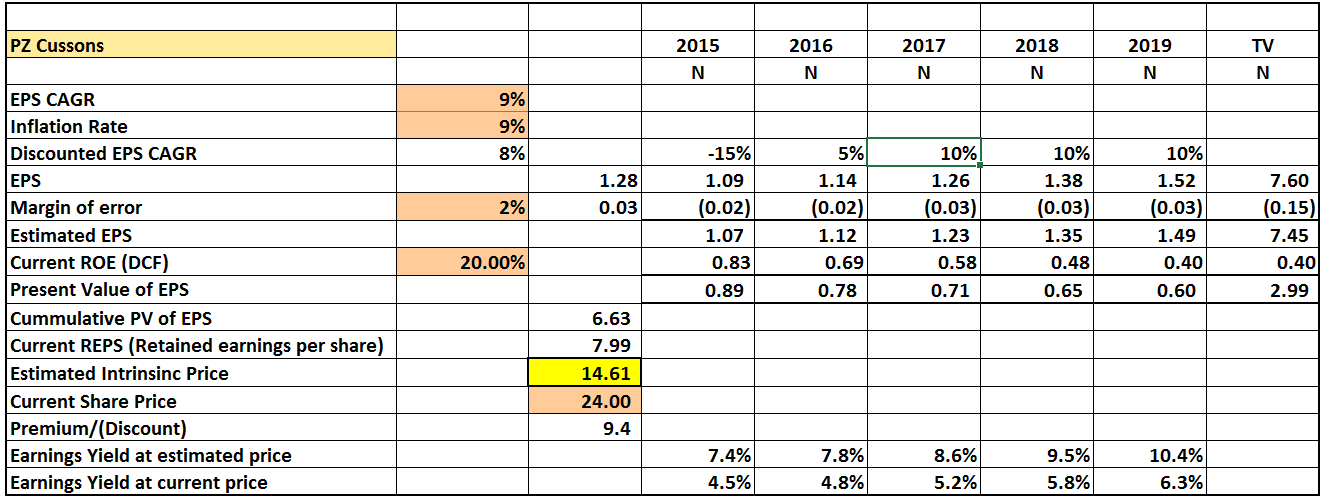

Equity Valuation

Buy sell or hold – PZ has been reporting lower margins for the last 11 quarters except one. We also project earnings per share will be at least 15% lower than what was reported the year before. We value PZ Cussons Nigeria at between N14 and N16 based on its fundamentals (see valuation above). The last time the share price was anywhere this low was in November when the Nigerian stocks crashed. The stock recovered remarkably and hit N33 before the year ended. PZ is a stock that attracts foreign investors and as such it has a potential to gain momentum once the elections are over. However, we base our buy, sell or hold decisions on company fundamentals and as such do not see much value in the stock at this price.

Decision

Sell

Buy under N17

Disclosure – The author(s) of this article does not own shares in PZ Cussons Nigeria Plc and does not plan to buy shares in PZ in the next one week. The author of this article wrote it themselves, and did not write this article on behalf of PZ Cussons Nigeria Plc, its associates or representatives. The article is purely their opinion.