Just six months ago this stock was priced at about N23 and a year ago it was just N19. Today the stock is up 73% and priced at about N31 per share. I have been pissed with myself since I turned my searchlight on this stock and can’t imagine how I missed out on this golden opportunity to own not only one of the best performers of the banking industry in terms of capital appreciation but also one of the best in terms of fundamentals. [upme_private]

That stock is StanbicIBTC and it is currently not included in my portfolio. Enough of the crying over spilt milk and straight to the tough talk. What makes this stock really thick and could there still be an opportunity in there somehow?

Fundamentals

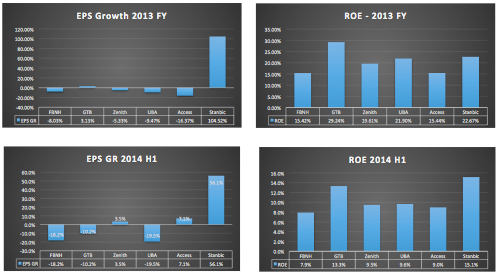

StanbicIBTC is designated a Tier 2 bank which lies outside the categories of the big five such as Zenith, GTB,FBNH, UBA and Access Bank. However, the 2013 FY results and the 2014 half year results suggest the company may have provided better value for shareholders. A look at the chart below highlights two key metrics – EPS and ROE (earnings per share and return on equity)

In period where banks have been posting lower profitability growth year on year, Stanbic IBTC has posted strong growth in Net Interest Income boosted by some aggressive lending. The bank as at 2013 had lent out about 75% of its deposits compared to an averaged 61% with none getting over 70%. This is also same for 2014 as the bank maintained its above 70% loan to deposit ratio. As at June 2014 StanbicIBTC was already posting EPS growth rate of 56% and a return on equity of 15% also. This scores above the Tier 1 Banks as the chart above depicts.

One bad spot to their results though is their personal banking division which posted a N6billion loss last year doubling the N3billion loss posted in 2012. The second half of this year showed cost to income ratio for the personal banking division was 96% compared to 126% same period 2013. So even though it might break-even at the best the loss won’t be as bad as 2013.

Capital Appreciation

Stanbic IBTC like I mentioned has been one of the best performers this year having returned over 70% in the last one year. The banking index has this year only returned a negative 6% this year to date. According to Bloomberg data the stock P.E ratio is 17x way higher than a banking Index that has most stocks trading under 10x earnings multiples. The earnings multiple might look high based on last year’s earnings per share however Bloomberg data also projects its future earnings per share at N2.5 which will place future earnings per share at N12x (certainly within buyable territory).

Valuation vs Pricing

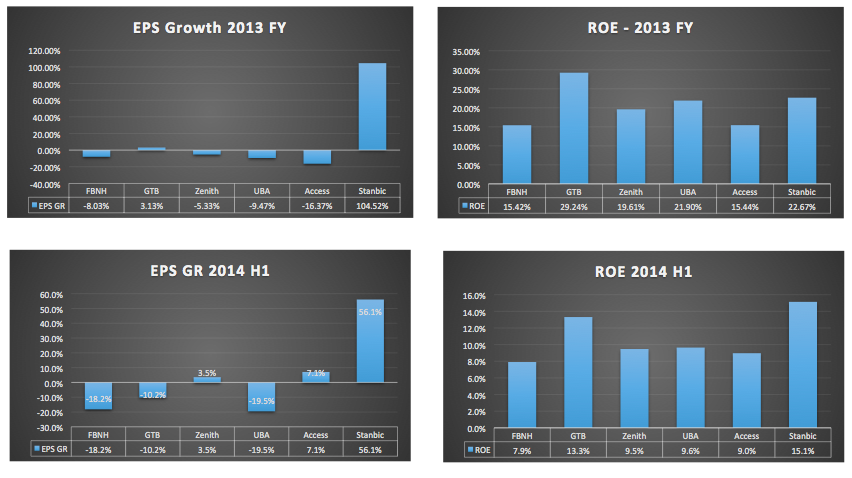

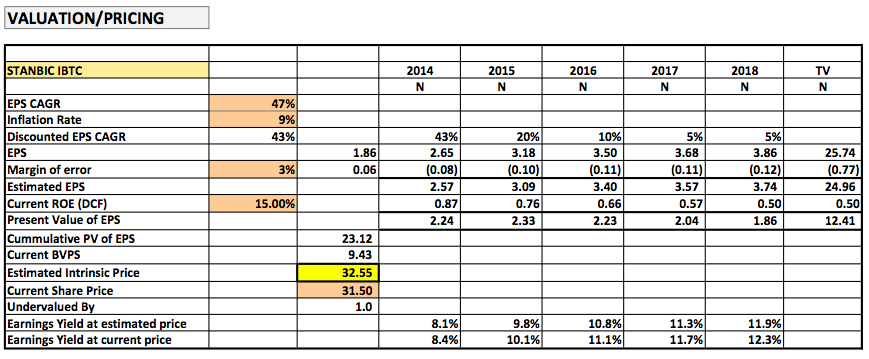

I believe Stanbic is priced just about right based on its future discounted earnings per share as the spreadsheet below suggest

A dividend yield approach, which the quite often knee jerk market uses a lot, could place the value much higher. Gross dividend yield was 3.75% this year. If its earnings per share rises as expected to N2.5 and it pays 43% of that like it did in 2013/2014 its dividend could at least be N1.2. Stanbic already declared an interim dividend of N1.1 and paid it in August. Therefore, if we use a conservative total dividend of N1.2 the yield on this current price becomes 3.8%. Add another dividend payment by mid 2015 and you are looking at a value probably exceeding N40.

Buy or Hold

A missed opportunity remains missed if you decide to ignore future potential for growth. Stanbic IBTC is a bank with a sound management and enjoys immense economic capital from its association with Standard Bank of South Africa. It’s ground operations may not be the most efficient (as buttressed by its relatively high cost to income ratio) but it ability to innovate with bankable financial services products should give it some earnings sustainability. Add to its strong subsidiaries (pension, asset management, capital, trustees etc) which have all been posting profits the bank appears a good investment.

Opinion: Buy ( if you are willing to keep for 1 to two years)

[/upme_private]