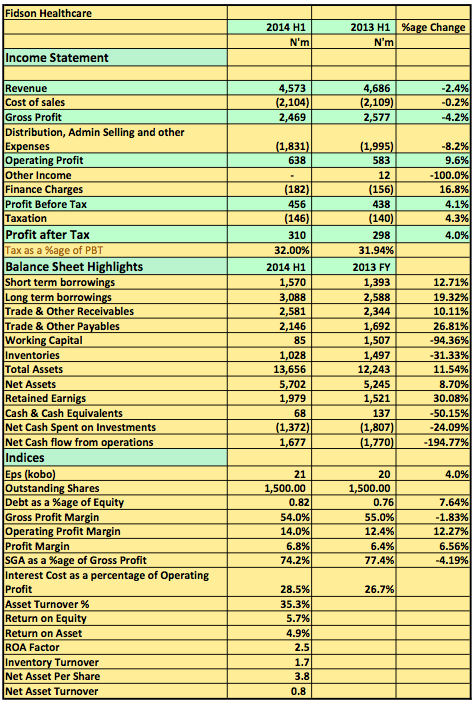

Fidson reported a 2.4% drop in first half revenues to N4.5billion compared to N4.8billion in the same period last year. Operating profit before other income also rose 9.6% year on year to N638million on the back of lower than compared cost of sales and operating expenses.

The company closed the period with a pre-tax profit of N456million compared to N438million posted a year earlier. Earnings per share was 21kobo compared to 20 kobo posted a year ago. Fidson debts increased to N4.5billion from the N3.9billion brought forward from 2013.

..